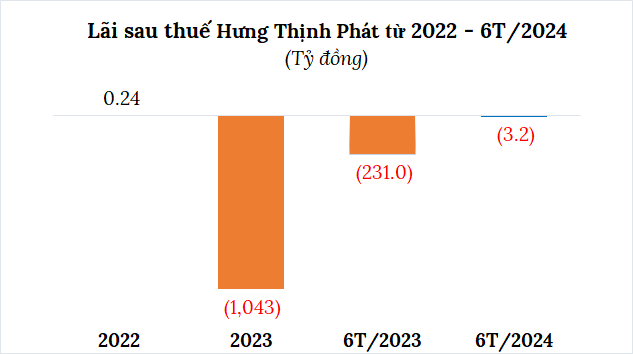

Hung Thinh Phat JSC announces its business results for the first half of 2024, continuing to incur a loss of over VND 3 billion (compared to a loss of nearly VND 231 billion in the same period last year). The company suffered its heaviest loss in 2023, with a loss of over VND 1,000 billion, while it made a meager profit of VND 240 million in 2022.

Source: Consolidated

|

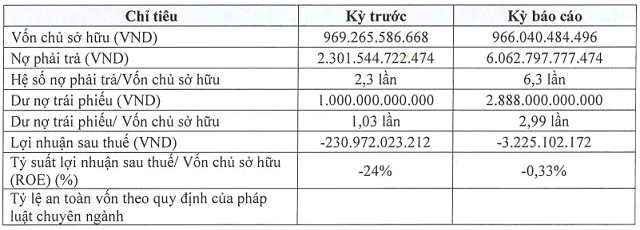

Hung Thinh Phat’s owner’s equity remains relatively unchanged from the same period in 2023, standing at VND 966 billion. Meanwhile, its liabilities have increased significantly, reaching VND 6,086 billion, over 2.7 times higher than the previous year and more than 6 times the owner’s equity. The outstanding bond debt stands at VND 2,888 billion, a 47% increase.

Source: Hung Thinh Phat

|

The significant increase in liabilities is attributed to the successful issuance of the HTPCH2327001 bond series at the end of 2023, valued at VND 2,888 billion, with a four-year term maturing on December 31, 2027, and an interest rate of 12% per annum.

In the first six months of this year, Hung Thinh Phat has paid nearly VND 173 billion in interest on this bond series.

In addition to the aforementioned bonds, the company has also recently issued the HTPCH2428001 bond series on July 17, valued at VND 412 billion and carrying an interest rate of 12%. These bonds are guaranteed by a payment guarantee from the Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank, HOSE: HDB). The registrar and depository for these bonds is HD Securities Joint Stock Company (HDBS).

With these two bond series, the total debt outstanding amounts to VND 3,300 billion.

Another bank-guaranteed bond series added to Hung Thinh Phat’s portfolio

Hung Thinh Phat was established in 2021, specializing in real estate and land-use right trading. Its initial chartered capital was VND 30 billion, with Mr. Lam Ky Dieu holding a 70% stake and Mr. Pham Van Ngoc holding the remaining 30%. Mr. Dieu also served as the Chairman and General Director.

In December 2023, the company transitioned into a joint-stock company, significantly increasing its chartered capital to VND 940 billion. Several new shareholders joined, including Ms. Nguyen Thi Anh Thu with a 46.81% stake, Mr. Nguyen Dinh Ngoc with 45.74%, and Mr. Le Khoi with 4.26%, while Mr. Dieu’s stake decreased to 2.23%.

According to HNX data, the company’s current chartered capital is VND 1,200 billion, with Mr. Nguyen Dinh Ngoc serving as the Chairman of the Board of Directors and legal representative.