Source: General Statistics Office

|

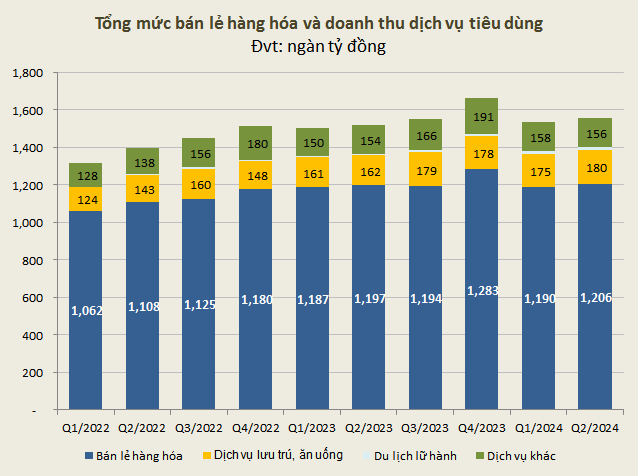

According to the General Statistics Office, macroeconomic indicators for Q2 2024 showed growth compared to the same period in 2023. Q2 2024 GDP increased by 6.93%; industrial production index rose by 8.55%; retail sales of goods and services increased by 8.8%; and total export turnover grew by 12.5%. Inflation remained stable, with the average CPI in Q2 2024 rising by 4.39% compared to the previous year.

As a result, Vietnam’s macroeconomic performance in Q2 and the first half of 2024 continued its positive trend. This created a favorable business environment for non-life insurance companies by strengthening confidence and stability in the market. When businesses and consumers feel more confident about the economic outlook, they tend to invest and spend more, stimulating the demand for insurance, thereby boosting the premium income of non-life insurance companies in Q2, improving from the previous quarter and the same period in 2023.

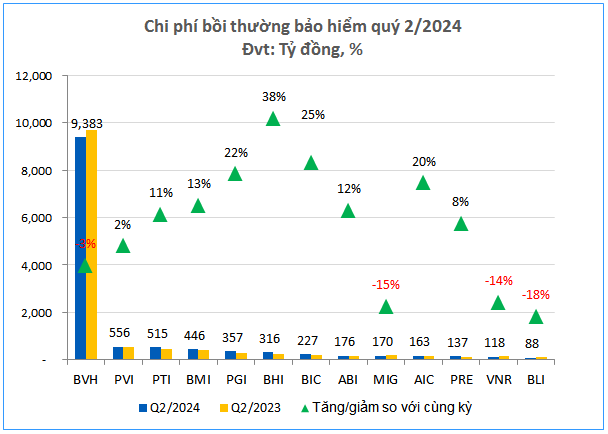

Claims expense pressure eases

In addition to improved premium income, stable insurance claims expenses reduced pressure on business costs, leading to gross profit growth in this sector.

Source: VietstockFinance

|

Source: VietstockFinance

|

Source: VietstockFinance

|

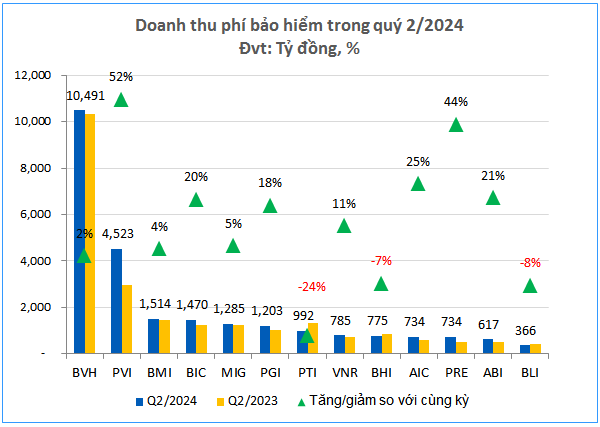

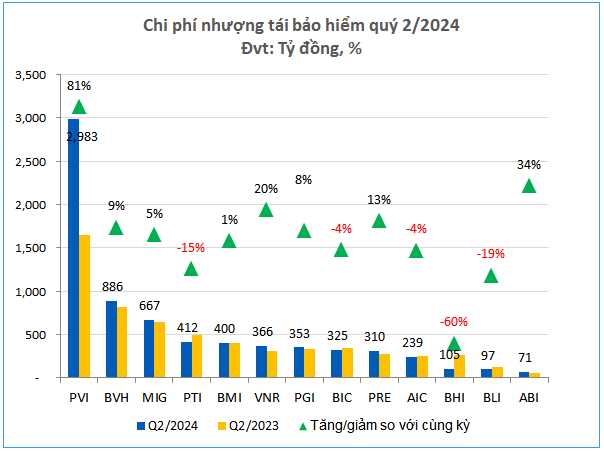

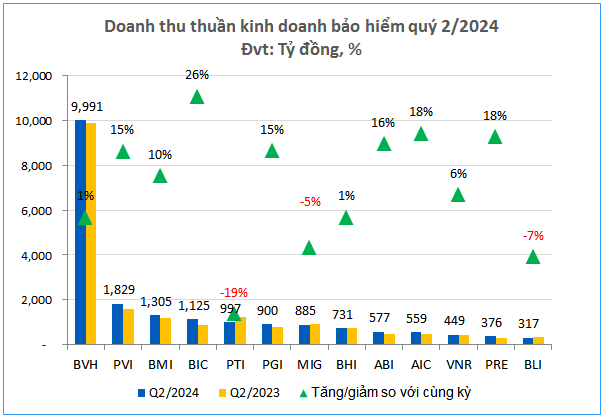

Statistics from VietstockFinance show that in Q2 2024, premium income of 13 non-life insurance companies listed on the stock exchange (HOSE, HNX, UPCoM) reached VND 25,489 billion, up 10% over the same period last year. On the other hand, reinsurance cession expenses increased by 22% to VND 7,214 billion, so net revenue from insurance business activities reached VND 20,041 billion, up 4%.

Source: VietstockFinance

|

Source: VietstockFinance

|

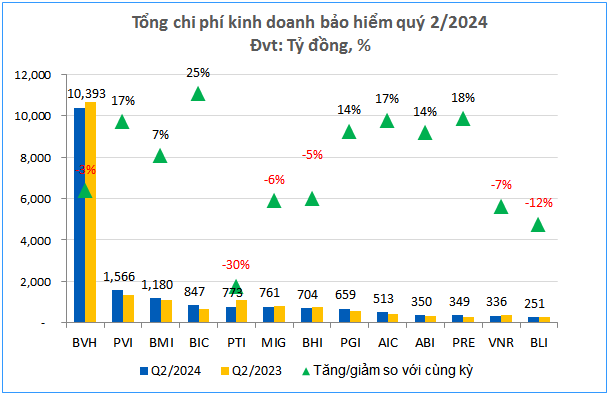

Meanwhile, insurance claims expenses of the companies reached VND 12,652 billion, VND 28 billion lower than the previous year, helping to narrow the scale of insurance business expenses compared to the same period to VND 18,682 billion.

Source: VietstockFinance

|

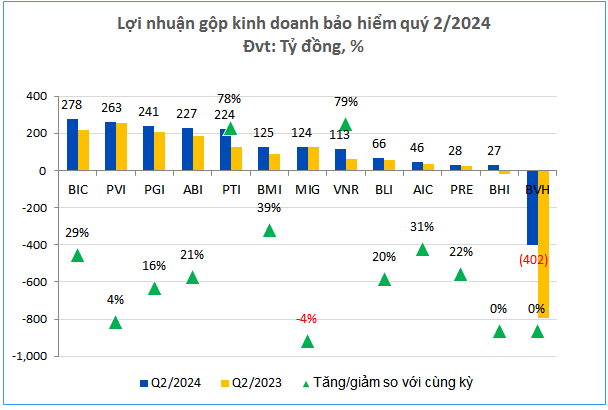

Thanks to improved net revenue and stable expenses, the total gross profit from insurance business activities in Q2 2024 was 2.4 times higher than the previous year, reaching VND 1,360 billion.

Source: VietstockFinance

|

Source: VietstockFinance

|

Source: VietstockFinance

|

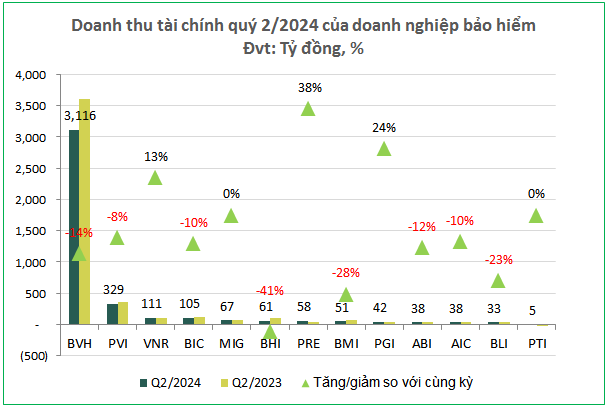

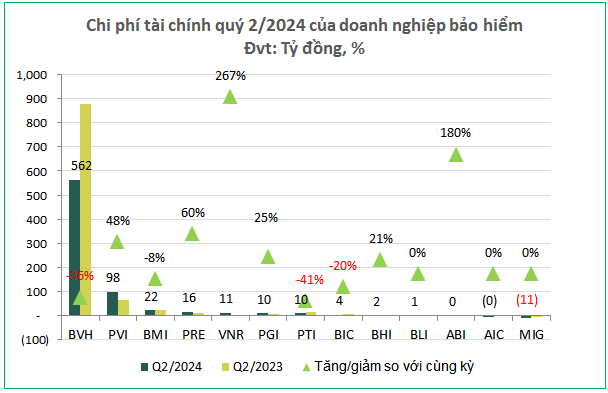

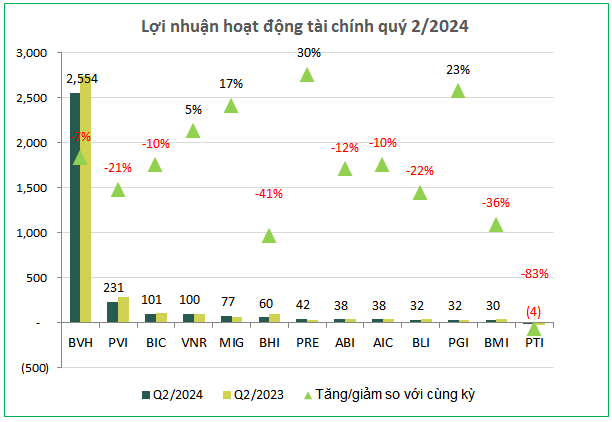

While the insurance sector prospered, financial activities somewhat declined, with profits falling by 8% over the same period to VND 3,331 billion as financial expenses (down 29%) decreased faster than revenue (down 12%).

Source: VietstockFinance

|

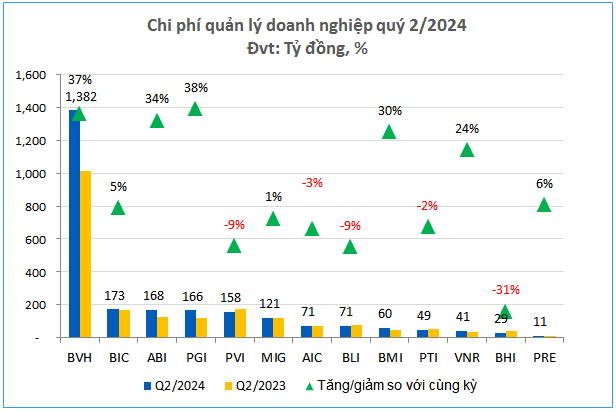

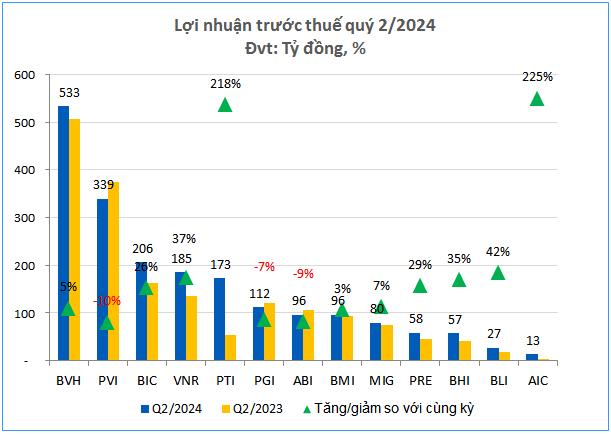

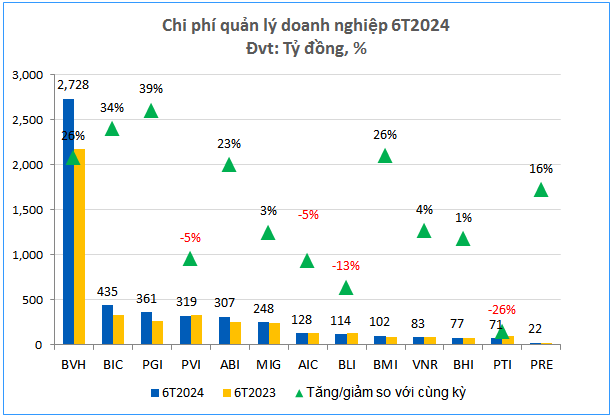

Although financial activities decreased in profit and business management expenses increased sharply (up 22% over the same period to VND 2,500 billion), the total pre-tax profit of non-life insurance companies still grew by 14%, reaching VND 1,975 billion, thanks to a strong push from the insurance business sector.

Source: VietstockFinance

|

Of these, except for PVI (down 10%), ABI (down 9%), and PGI (down 7%), which were the three companies with reduced profits, the remaining non-life insurance companies all achieved pre-tax profit growth compared to the same period.

Notably, although Total Air Insurance Joint Stock Company (AIC) had the most modest pre-tax profit among the non-life insurance companies, with just VND 13 billion, it achieved the highest profit growth rate in Q2 this year, tripling that of the same period. This result was due to a 31% increase in insurance business profit compared to the same period last year and a slight 2% decrease in business management expenses.

With pre-tax profit 3.2 times higher than the previous year, reaching VND 173 billion, Post Insurance Corporation (PTI) ranked second in the profit growth rate thanks to a more significant reduction in insurance business expenses than revenue.

Easily reaching the annual profit target?

Positive business results in Q2 helped improve the overall profit of non-life insurance companies in the first six months.

Source: VietstockFinance

|

Source: VietstockFinance

|

Source: VietstockFinance

|

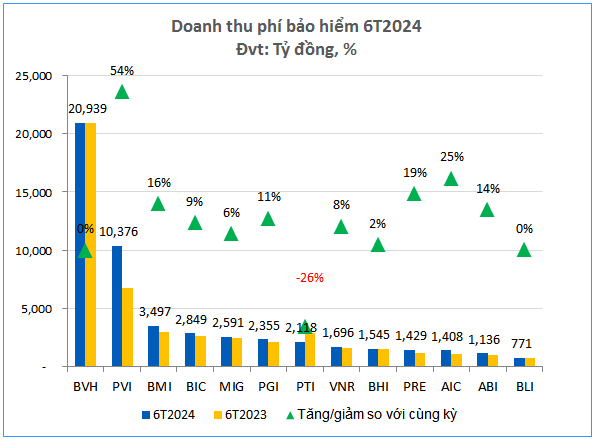

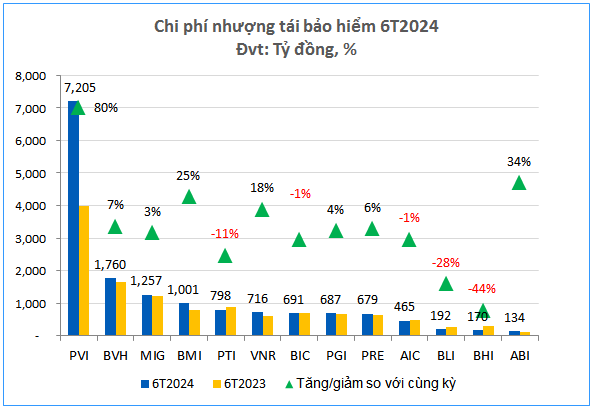

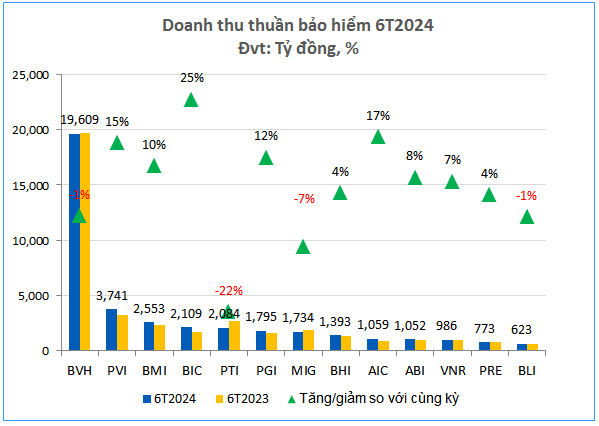

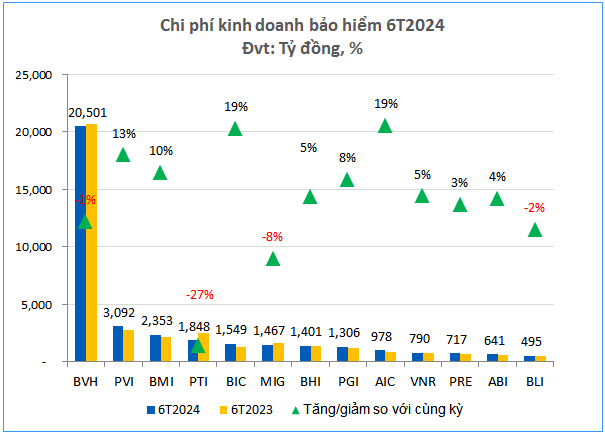

Specifically, in the first half of the year, the 13 non-life insurance companies on the stock exchange collected VND 52,710 billion in insurance premiums, 10% higher than the same period. However, net revenue reached VND 39,511 billion, a slight increase of 2%, as reinsurance cession expenses increased faster than revenue (up 28%).

Source: VietstockFinance

|

Source: VietstockFinance

|

Source: VietstockFinance

|

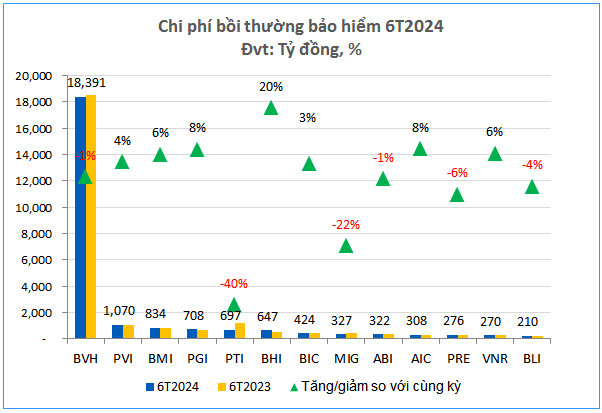

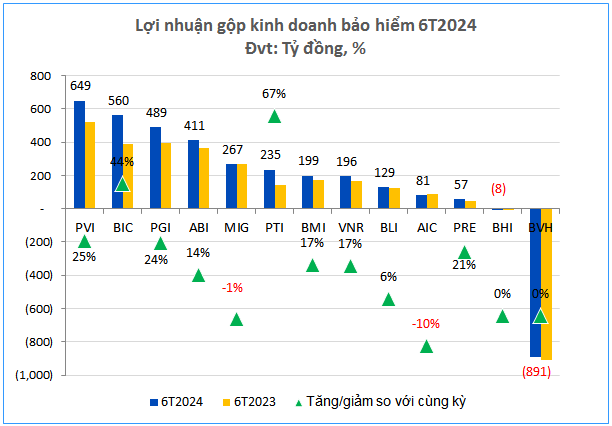

Nevertheless, gross profit from insurance business still increased by 35%, reaching VND 2,374 billion, thanks to a decrease in claims expenses (down 2% to VND 24,484 billion), reducing pressure on overall business expenses (approximately VND 37,137 billion, almost unchanged).

Source: VietstockFinance

|

Source: VietstockFinance

|

Source: VietstockFinance

|

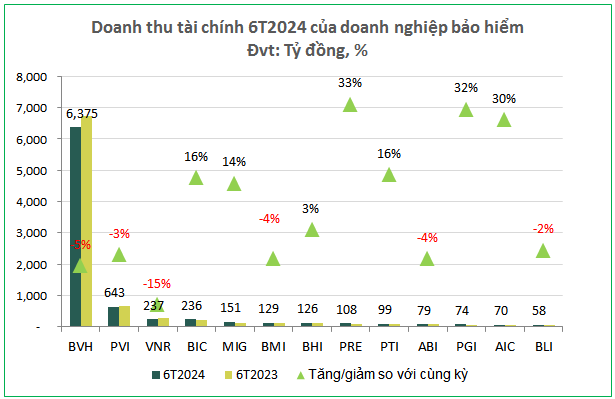

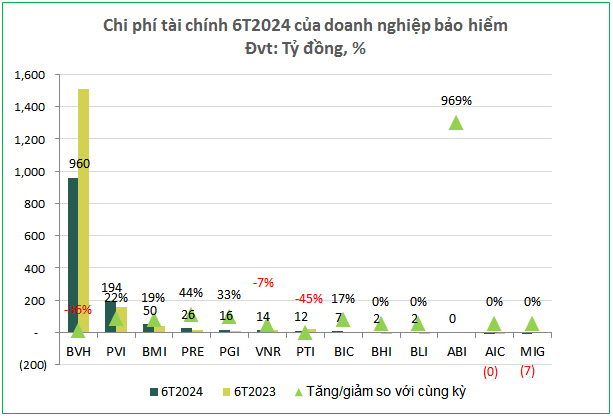

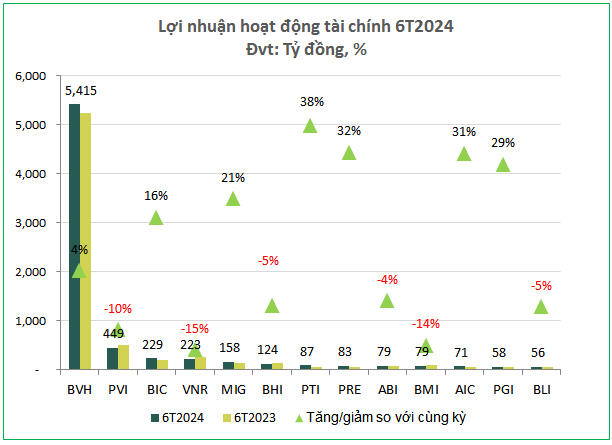

In addition to the improvement in insurance business profit, financial activity profit also increased slightly by 3%, reaching VND 7,111 billion, as financial expenses decreased more rapidly than revenue.

Source: VietstockFinance

|

Source: VietstockFinance

|

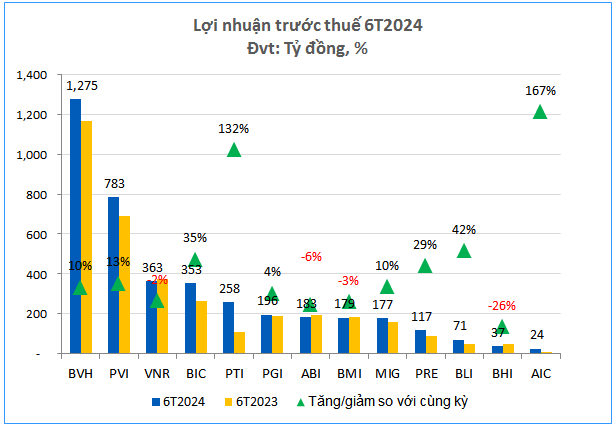

As a result, pre-tax profit in the first six months reached VND 4,016 billion, up 14%, while business management expenses increased by 19%, to VND 4,995 billion.

The two “giants,” BVH and PVI, made the most significant contributions to the industry’s overall profit. Both leading companies achieved pre-tax profit increases of 10% and 13%, reaching VND 1,275 billion and VND 783 billion, respectively.

With a breakthrough in Q2, AIC (up 2.7 times) and PTI (up 2.3 times) continued to be the two companies with the fastest pre-tax profit growth rates in the first six months.

On the other hand, BHI (down 26%), ABI (down 6%), BMI (down 3%), and VNR (down 2%) were the four non-life insurance companies with decreasing half-year profits.

Source: VietstockFinance

|

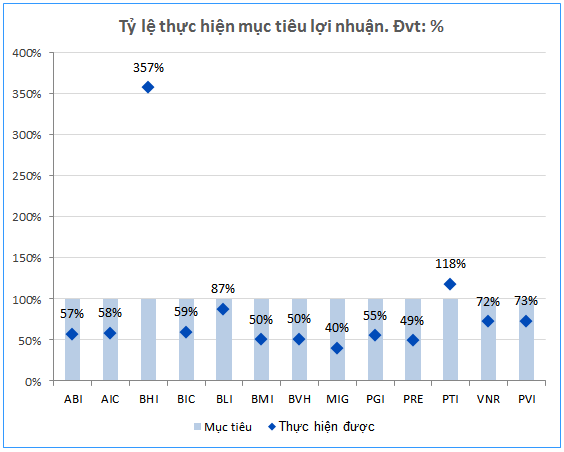

With positive profit growth in the first six months, the progress toward achieving the annual profit targets of the companies was also favorable, with the ratio of target completion mostly reaching 50% or more. This is against the backdrop of the 2024 profit plan being built at a higher level than the 2023 results.

Notably, the two companies that exceeded their annual profit targets in just six months were BHI (257% higher) and PTI (18% higher). BHI set a 31% increase in its 2024 profit target, while PTI expected a 31% decrease in 2024 profit compared to 2023.

Will non-life insurance profit growth be sustained in late 2024?

According to PVI, although there are challenges, the non-life insurance market in 2024 is expected to grow more positively than in 2023 due to the momentum from changes in institutions and new policies. However, this also poses challenges for insurance companies in complying with the new regulations.

The company also expects Vietnam’s economic recovery to accelerate in 2024, positively affecting the recovery of the non-life insurance industry. The main supporting factors come from stronger production and export activities, improved domestic consumption, a revival in private investment, and a warming real estate market.

PTI also forecasts that domestic consumption will improve significantly in 2024, and Vietnam’s retail sales are expected to grow by about 9.5-10% year-on-year in 2024 (up 8.6% in 2023 compared to 2022). The State Bank of Vietnam will continue to maintain a loose monetary policy to support economic recovery, inflation will be controlled, and the USD/VND exchange rate is likely to be less volatile in 2024.

Khang Di

The “Capital” of Binh Duong Furniture Achieves Export Turnover of Over 4.2 Billion USD

Amid a surge in new orders, wood businesses in Binh Duong forecast a year of robust factory activity. This influx of orders presents a unique opportunity for these businesses to ramp up production and boost exports, capitalizing on favorable market conditions.

“Speaker of the House Trần Thanh Mẫn Embarks on an Official Visit to the Russian Federation”

Upon the invitation of Mr. Vyacheslav Victorovich Volodin, Chairman of the State Duma of the Federal Assembly of the Russian Federation, and Ms. Valentina Ivanovna Matvienko, Chairwoman of the Federation Council of the Federal Assembly of the Russian Federation, Mr. Tran Thanh Man, Chairman of the National Assembly of Vietnam, departed Hanoi on the morning of September 8, leading a high-level delegation on an official visit to the Russian Federation. The visit will also see Mr. Man co-chair the third meeting of the Vietnam-Russia Inter-Parliamentary Cooperation Committee from September 8 to 10, 2024.