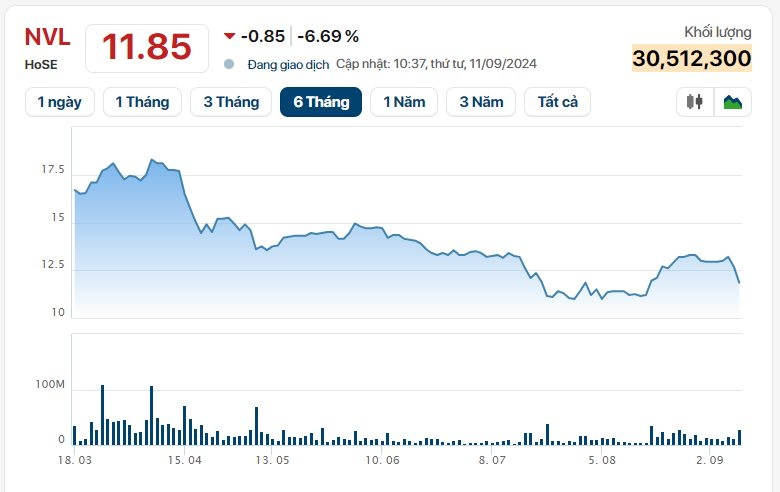

Novaland’s NVL stock has been added to the list of stocks ineligible for margin trading by the Ho Chi Minh City Stock Exchange due to a delay in publishing its semi-annual audited financial report for 2024. This triggered a negative response from investors, causing the stock price to plunge with a trading volume of over 30 million shares as of 10:35 am.

As a result, NVL’s market price dropped to 11,850 VND per share, a 30% decrease since the beginning of the year, leaving a market capitalization of approximately 23.1 trillion VND.

In recent times, Novaland has faced a string of unfavorable developments. The latest being a fine imposed by the State Securities Commission of Vietnam on its subsidiary, Nova Lucky Palace, for failing to disclose information as per regulations.

Specifically, Nova Lucky Palace was fined 92.5 million VND for not sending its semi-annual financial report for 2021 to the Hanoi Stock Exchange (HNX). Additionally, they were late in submitting other documents related to bond interest and principal payments for 2020 and the first half of 2021, as well as a report on the use of proceeds from bond issuances in the same period.

Nova Lucky Palace is a wholly-owned subsidiary of Novaland, established in 2014 with a chartered capital of 100 billion VND.

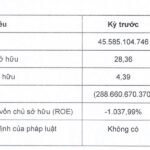

Furthermore, another Novaland subsidiary, Aqua City, reported a loss of over 100 billion VND in the first half of 2024, continuing its streak of losses since 2022, with accumulated losses reaching 600 billion VND.

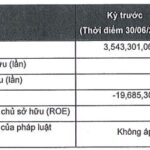

Aqua City, a 1,000-hectare smart city project with 752 housing units, has a shareholder equity of 1.03 trillion VND as of June 30, 2024. Its debt-to-equity ratio stands at 10.95 times, indicating approximately 11.3 trillion VND in liabilities. Of this, an estimated 2.4 trillion VND is in bond debt.

Aqua City has issued a total of eight bond lots worth 4.6 trillion VND, of which 2.4 trillion VND is still outstanding. Each bond lot carries an interest rate of 10% per annum.

Aqua City has faced challenges over the past two years. When Novaland took over the project, it had already received approvals for its master plan, detailed planning at a scale of 1/500, and land allocation and lease decisions. However, adjustments to the master plan of Bien Hoa city in July 2014 and the detailed planning of subdivision C4 in September 2016 were not aligned with the approved detailed planning at a scale of 1/500, leading to a halt in the project.

As of June 2024, Novaland provided an update on the project’s progress, stating that out of the nine subdivisions, six are awaiting new approvals from Bien Hoa city. The detailed planning at a scale of 1/5,000 for subdivision C4 is expected to be approved in August 2024, and the detailed planning at a scale of 1/500 will be adjusted in October before proceeding with other legal procedures.

“Struggling Cinema Chain: Galaxy Cinema’s Losses Continue in First Half of 2024, Leaving Only $77,000 in Shareholder Equity”

In the first half of 2024, Galaxy Entertainment and Education Joint Stock Company (Galaxy EE) continued to incur losses. However, what’s noteworthy is the company’s equity position.