A look inside Vĩnh Phú Paper’s packaging paper production line in Lai Uyên, Bàu Bàng. Source: PRT

|

The decision to cease operations was attributed to a range of issues, including inefficient business performance, a lack of orders, and high inventory levels coupled with high production costs. Environmental concerns, which have not been adequately addressed, further complicate the matter. “As a result, the Board of Directors deems it necessary to terminate the operations of Vĩnh Phú Paper,” the PRT resolution stated.

The timeline and procedures for liquidating contracts, settling debts, and handling labor contract obligations will follow the approved plan.

According to PRT’s report, Vĩnh Phú Paper had to temporarily halt its production as of March 15, 2023, due to the aforementioned reasons. The decision to dissolve the company was approved at the 2024 Annual General Meeting of Shareholders. In 2021, PRT also intended to divest its investments in its subsidiaries, including Vĩnh Phú Paper.

Established in 1979, Vĩnh Phú Paper initially specialized in paper production using local bamboo and rattan resources. In 1985, the PRT subsidiary transitioned to manufacturing packaging paper for industrial use, which it has continued to do until now. Headquartered in Lai Uyên Town, Bàu Bàng District, Bình Dương Province, Vĩnh Phú Paper had a charter capital of approximately VND 84 billion at the end of 2023, with PRT holding 100% ownership. The PRT Board of Directors member and General Director, Mr. Lê Trọng Nghĩa, also serves as the Chairman of the Member Council of this subsidiary.

In addition to Vĩnh Phú Paper, PRT has several other subsidiaries operating in diverse industries. These include Thuận An General Trading Company (62.68% owned by PRT), which engages in commercial activities; Palm Sông Bé Golf Course (100% owned) offering golf services; Quốc Tế Protrade (100% owned) specializing in industrial infrastructure; Cao Su Dầu Tiếng Việt Lào (51% owned) involved in rubber cultivation, exploitation, and processing; and KP Apparell Manufacturing Co., Ltd. (100% owned) manufacturing yarn, fabric, and garments. PRT also has stakes in seven associated companies.

Subsidiaries and associated companies of PRT. Source: PRT

|

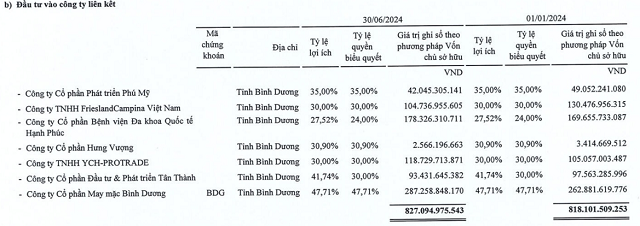

Ownership ratios of PRT’s associated companies. Source: PRT

|

In the first half of 2024, PRT’s business performance showed signs of improvement compared to the same period last year. The company recorded a 5% increase in revenue, amounting to VND 439 billion. Lower production costs led to a significant improvement in gross profit, which reached nearly VND 130 billion, mainly driven by the infrastructure business segment within the member unit. However, revenue from the sale of by-products and goods decreased significantly.

The company reported a net profit of VND 7.7 billion, a positive turnaround from the loss of VND 51 billion in the first half of the previous year, but still far from the peak of VND 223 billion in the same period in 2022. According to PRT, management expenses increased due to the provision of VND 8 billion in expected credit losses related to overdue receivables from Tân Thành Investment and Development Joint Stock Company (Tân Thành Company).

Similar to previous periods, the 2024 semi-annual audited financial statements of PRT continue to receive a qualified opinion from the auditor regarding various issues. These issues primarily relate to transactions that took place before the transition to the joint-stock company model in 2018 and the unapproved equitization settlement, as well as the investment in Tân Thành Company, an associated company in which PRT holds a 41.74% interest. This associated company is facing serious financial imbalances and legal issues, along with shareholder structure complications arising from two judgments of the Hanoi People’s Court and the Hanoi High Court.

In other news, the PRT Board of Directors has set October 3, 2024, as the record date for paying 2023 dividends at a rate of 3% (equivalent to VND 300/share). The company will spend VND 90 billion on this dividend payment, which will be sourced from post-tax profit accumulations up to December 31, 2022. The expected payment date is October 28, 2024.

| Financial results for the first half of 2024 of PRT for the period 2019-2024 |

|

|