In a surprising turn of events, the steel stock group witnessed a remarkable surge amidst a lackluster trading market right from the opening bell. An influx of capital rapidly drove up stock prices, with notable mentions including TIS (+9.52%) approaching the ceiling price, HSG (+4%), TVN (+4.4%), HPG (+2.4%), and TLH and NKG both gaining approximately 3% in value…

Steel stocks soared in unison following regulatory moves to investigate and implement anti-dumping measures for imported coated steel products. Specifically, the Ministry of Industry and Trade decided to initiate an anti-dumping investigation on certain hot-rolled steel (HRC) products originating from India and China on July 26. The investigation period for determining dumping acts and damages is from July 1, 2023, to June 30, 2024.

The deadline for issuing a final decision on the application of anti-dumping measures is one year from the date of the investigation decision (July 26, 2025). In special cases, this deadline can be extended, but the total investigation period must not exceed 18 months (by the first quarter of 2026 at the latest). In a recent report, Phu Hung Securities (PHS) anticipated that Vietnam would soon issue a decision to apply anti-dumping measures on HRC by the end of 2025 or, at the latest, in the first quarter of 2026.

On another positive note, steel consumption in the first seven months of 2024 showed significant improvement. According to the VSA, overall steel production reached nearly 17 million tons (+9.4% year-on-year). Steel consumption (including exports and domestic sales) reached 16.75 million tons (+14.3% year-on-year), with exports reaching 4.9 million tons, up 7% compared to the same period in 2023.

Breaking it down, according to VSA data, construction steel was the first bright spot, witnessing robust growth in production, consumption, and exports, increasing by approximately 9%, 13%, and 27%, respectively, compared to the same seven-month period last year. The coated steel segment also recorded impressive growth: production, consumption, and exports in the first seven months of this year increased by 29%, 35%, and 51% year-on-year, respectively. Cold-rolled steel (CRC) also saw strong consumption and export growth in the first seven months of 2024, with increases of about 40% and 13%, respectively, while production decreased by approximately 15% compared to the same period last year.

Additionally, the momentum for the steel group’s rally stems from expectations of a recovery in domestic consumption in the second half of 2024.

KBSV Securities anticipated that domestic consumption would begin to recover in the latter half of 2024, driven by a rebound in the residential real estate sector and an increase in the number of new licensed projects. In the medium and long term, the amended Real Estate Law, which took effect on August 1, 2024, is expected to indirectly stimulate domestic steel demand.

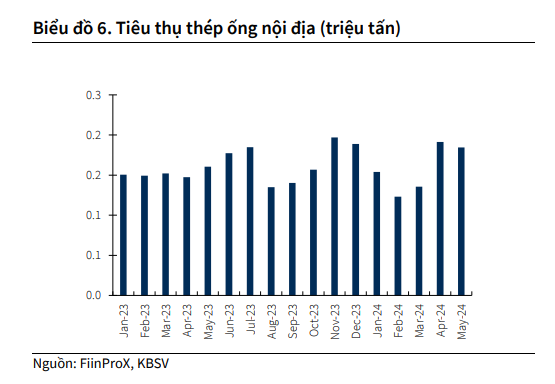

As of now, the recovery trend in the domestic market is evident, with steel pipe consumption in Q4-05/2024 reaching 191/184 thousand tons, up 26%/14% year-on-year (90% of steel pipe consumption comes from the domestic market). KBSV projected a 15%/8% year-on-year increase in consumption for the entire steel industry in 2024/2025.

Furthermore, KBSV believed that the competitiveness of domestic steel manufacturers would improve compared to the previous year due to the narrowing price gap between domestic and imported construction steel. Additionally, the decline in input costs in the first half of 2024 would provide room for manufacturers to adjust selling prices to ensure consumption volume.

FPT opens an office in Sweden, boosting growth in the Nordic market

The Heat is On: Vietnam’s Hot-Rolled Coil Steel Production Faces a Double Whammy

The domestic steel industry is facing a formidable challenge. Not only are they struggling to compete with the influx of cheap imported hot-rolled steel coils, but they are also now at risk of being investigated for dumping by their export markets. This puts them in a precarious position, as they navigate the delicate balance between staying competitive and avoiding potential trade sanctions.

The Steel Industry’s Challenge: Navigating the Threats of Imports

“The domestic steel industry is at a critical juncture. Without timely and adequate support, coupled with protective measures, the local market is at risk of falling into the hands of foreign producers. This is a crucial time to bolster our domestic steel sector and ensure its survival and prosperity in the face of global competition.”