|

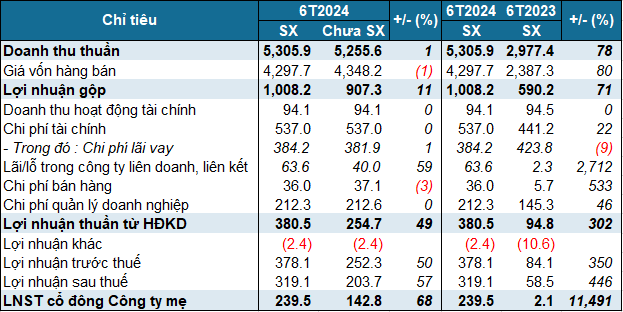

Financial Results of PC1 Before and After the 2024 Semi-Annual Review

Unit: Billion VND

Source: VietstockFinance

|

According to PC1, the reclassification of retrospective adjustment items on the reviewed financial statements for the first six months of 2024, relating to 2023, resulted in a decrease in 2023 profit and an increase in profit for the first half of 2024.

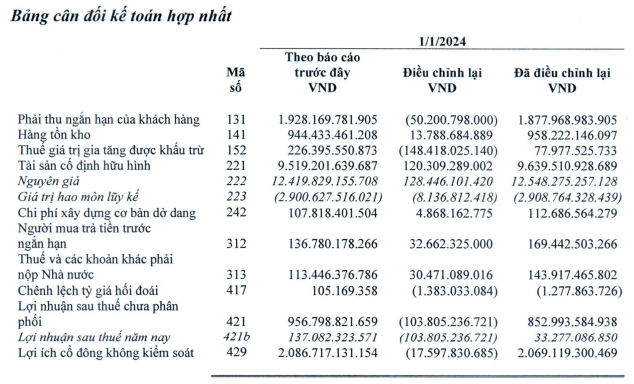

On the consolidated financial statements for the first six months of 2024, the Company made adjustments to the comparative data as of January 1, 2024, as the management realized that the previously issued consolidated financial statements needed adjustments in terms of calculation, tax accounting, and revenue recognition at two subsidiaries.

Source: PC1

|

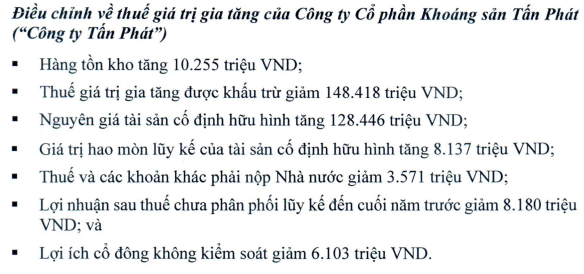

Specifically, during the preparation of the consolidated financial statements for the first six months of 2024, PC1 made adjustments to the Value-Added Tax (VAT) of Tan Phat Mineral JSC. After reviewing and recalculating the ratio of the value of mineral resources plus energy costs to the total production cost of exported products (CPTNNL ratio), it was found to be over 51% for 2023, contrary to the previous assumption of below 51%.

As a result, PC1 made adjustments to the comparative data as of January 1, 2024, including increases in inventory and fixed asset depreciation, and decreases in VAT payable, state tax, and undistributed post-tax profits by the end of 2023, as well as a reduction in non-controlling interests.

Source: PC1

|

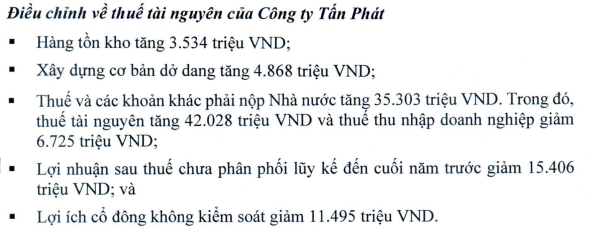

Additionally, PC1 made adjustments to the mineral tax of Tan Phat Mineral JSC by reassessing this tax based on the customs value of exported mineral resources, excluding export tax and transportation costs. This resulted in an additional tax liability of approximately 41 billion VND for 2023.

Consequently, the comparative data as of January 1, 2024, was adjusted, leading to increases in inventory and construction in progress, and a decrease in corporate income tax. This also resulted in a reduction in undistributed post-tax profits by the end of 2023 and a decrease in non-controlling interests.

Source: PC1

|

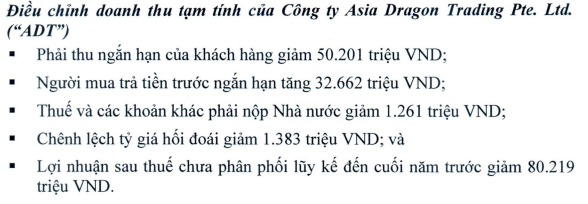

Finally, there was an adjustment to the provisional revenue of Asia Dragon Trading Ptd. Ltd. (ADT). When preparing the consolidated financial statements for the period ending December 31, 2023, PC1 had not made adjustments to the provisional revenue that ADT recognized based on the actual selling price of two batches of products sold in September and December.

At the time of preparing the consolidated financial statements for the first six months of 2024, PC1 recalculated and adjusted the revenue related to these two batches, attributing it to the correct reporting period in 2023. This led to changes in the comparative data as of January 1, 2024, including decreases in accounts receivable, state tax, and foreign exchange differences, and an increase in advances from customers, ultimately resulting in a decrease in undistributed post-tax profits by the end of 2023.

Source: PC1

|

Aside from these retrospective adjustments, PC1 also changed the method of allocating the asset right to exploit the project at the associated company, shifting from straight-line depreciation to allocation based on revenue or area sold. The company stated that this change better reflects the economic benefits that the asset brings to the company and increases profit in the reviewed financial statements.

On the other hand, PC1 updated the provisional revenue of the batch sold in June 2024, which had not been settled by June 30, 2024, based on information updated from the time of issuing the unreviewed financial statements to the time of issuing the reviewed financial statements.

Bank Records Impressive Growth: BVH Reaps 1,059 Billion VND in 6-Month Profit, a 9% Surge

In the first half of 2024, Bao Viet Holdings (HOSE: BVH) recorded an impressive performance with after-tax profit reaching 1,059 billion VND, marking a 9.4% increase compared to the same period last year. Demonstrating its strong financial standing, BVH is set to allocate over 745 billion VND for cash dividend payments to shareholders as planned.