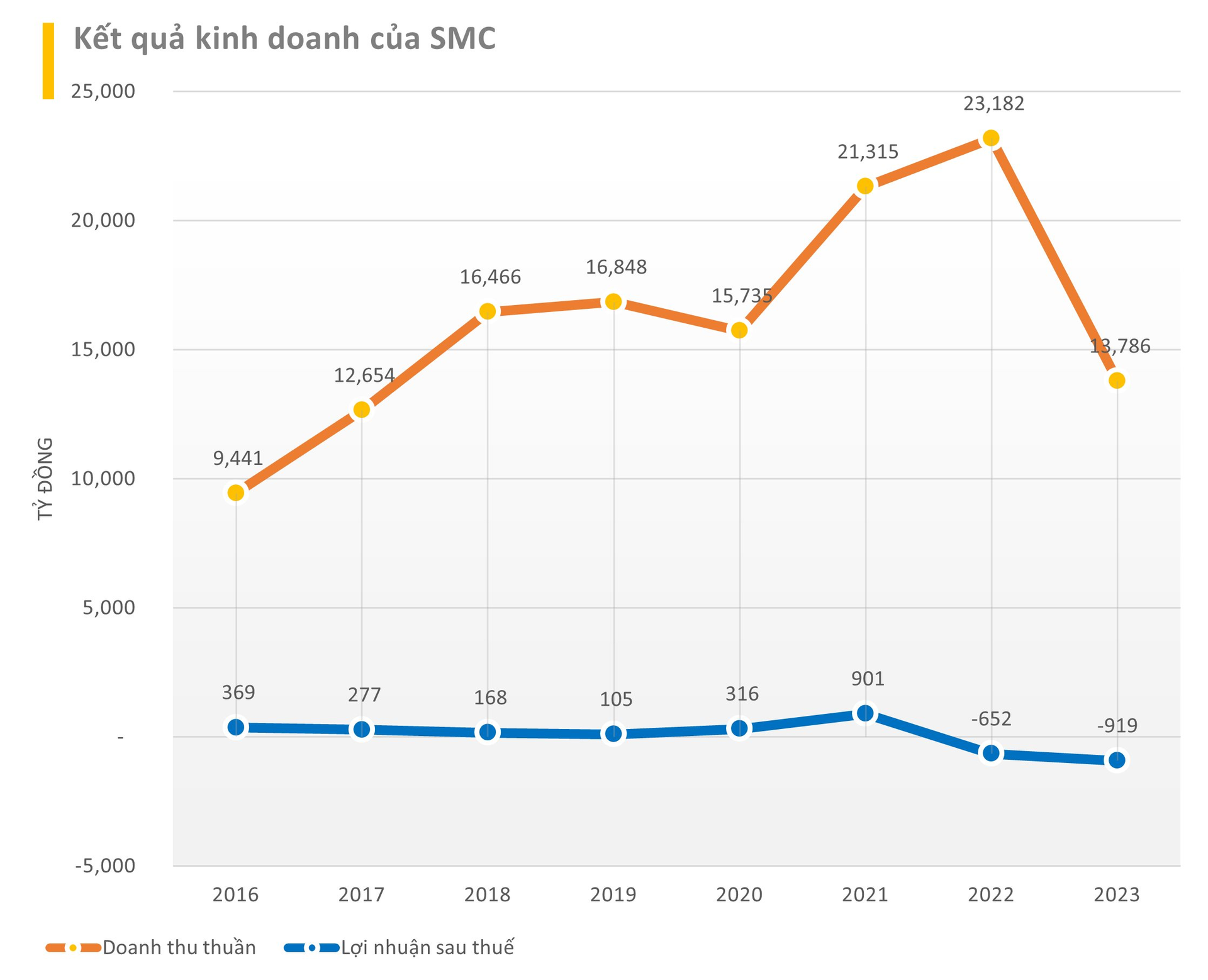

SMC Corporation (SMC) – a trading and investment joint stock company – has announced its consolidated financial statements for the fourth quarter of 2023. Unfavorable market conditions led to a 24% decrease in SMC’s revenue compared to the same period. Excluding cost of goods sold, SMC’s operating gross profit was only 49 billion VND, equivalent to a meager 1.5% margin (although it improved compared to the hundreds of billions loss in the same period last year).

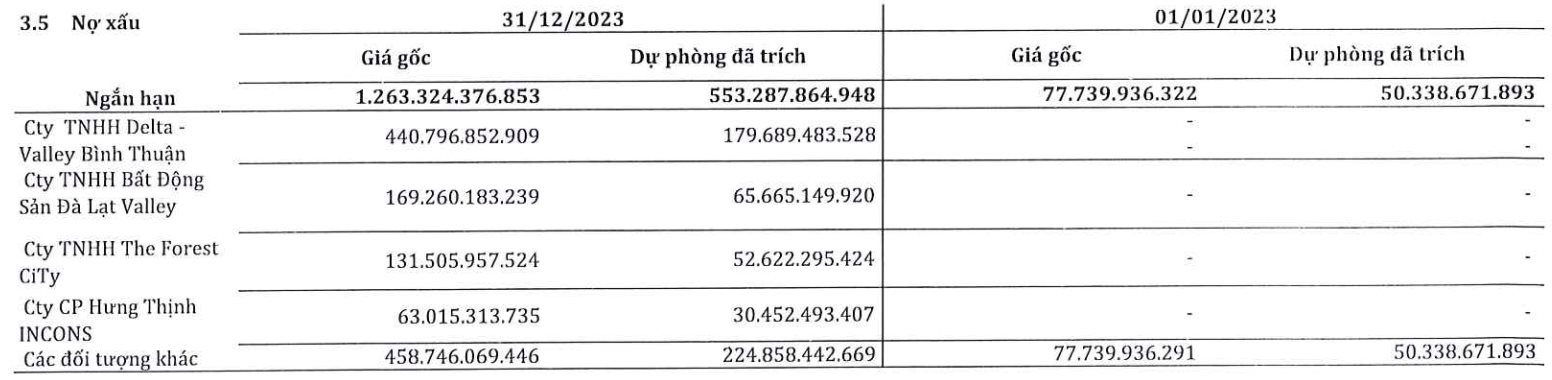

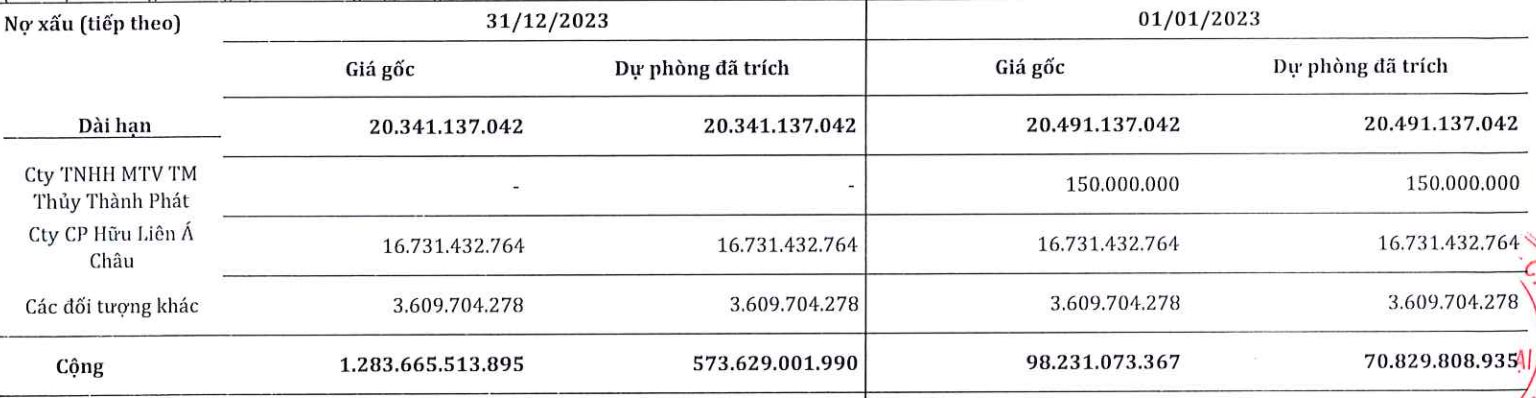

Notably, during this period, SMC also faced a bad debt amounting to 1,284 billion VND, with Novaland, a related partner, leading the chart with over 700 billion VND.

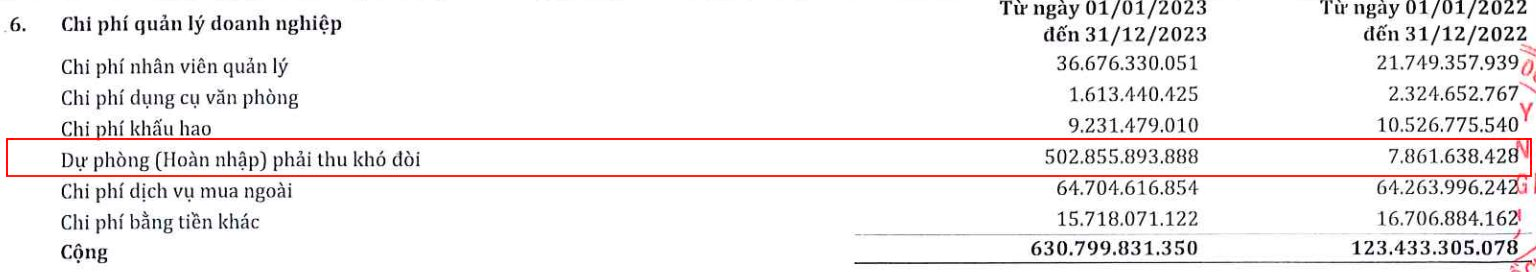

As of December 31, 2023, SMC had set aside more than 574 billion VND for this bad debt portfolio. As a result, the company recorded a loss of 333 billion VND in the fourth quarter.

Accumulated throughout 2023, SMC incurred a loss of 919 billion VND.

SMC’s leaders mentioned that the stagnation of the real estate market has caused difficulties for both real estate companies in general and construction companies, leading to a significant decline in revenue and cash flow. Consequently, SMC’s slow turnover of accounts receivable with major clients is prolonged throughout this year.

By the end of 2023, SMC had to increase provisions for doubtful accounts, resulting in ineffective after-tax profits.