In a strategic investment move, DSD‘s largest shareholder, Mr. Pham Phuong Long, acquired 10.5 million shares of Suoi Doi in a private sale.

The shares are subject to a three-year lock-up period from the completion of the offering. Following this transaction, DSD‘s charter capital increased to 471 billion VND, equivalent to 47.1 million shares.

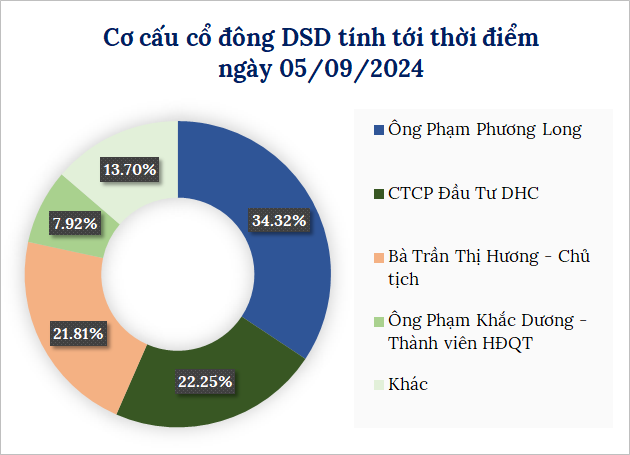

At a purchase price of 20,000 VND per share (equal to the market price on September 11), Mr. Long invested 210 billion VND to increase his ownership from over 5.6 million shares (15.48%) to nearly 16.2 million shares (34.32%), thus becoming DSD‘s largest shareholder.

Mr. Long first became a major shareholder of DSD on April 17, 2023, when he purchased an additional 5.5 million shares, increasing his stake from 0.46% to 15.48%. Prior to this recent private purchase of 10.5 million shares, he further solidified his position.

In addition to Mr. Long, there are three other major shareholders: Ms. Tran Thi Huong, Chairwoman, who owns 21.81%; Mr. Pham Khac Duong, Board member and Director of the Company, with a 7.92% stake; and DHC Investment Joint Stock Company, holding 22.25%.

Source: VietstockFinance

|

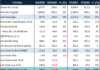

The concentrated ownership has resulted in low liquidity for DSD shares. Since May 22, 2024, there have been 78 sessions without any trading activity. On September 11, the closing price of DSD shares remained unchanged at 20,000 VND per share, up 15% since the beginning of the year, with an average liquidity of just 1 share per session.

| Price Movement of DSD Shares Since the Beginning of 2024 |

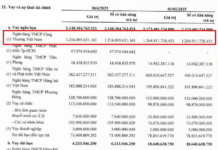

In terms of business performance, in the first six months of 2024, DSD recorded over 88 billion VND in net revenue, a 5% increase year-on-year, while its after-tax profit surpassed 10 billion VND, a 2.5-fold rise compared to the same period last year.

With a target of 190 billion VND in revenue and over 12 billion VND in after-tax profit for the full year 2024, DSD has already achieved 46% and 82% of these goals, respectively.

“Will Credit Growth Reach the 15% Target in 2024?”

On September 7, at the regular Government press conference for August 2024, Deputy Governor of the State Bank of Vietnam Dao Minh Tu expressed his views on the possibility of achieving the 15% credit growth target for the year.

“Tasco Auto Invests in Strategic Subsidiary Takeovers and Increased Holdings in High-Performing Subsidiaries”

Tasco Auto, a leading automotive distributor in Vietnam, has unveiled its strategic investment plan. The company aims to transform select associated businesses into subsidiaries and increase its stake in high-performing ones. This move underscores Tasco Auto’s commitment to fortify its core business and investment prowess, solidifying its position as a powerhouse in the Vietnamese automotive landscape.