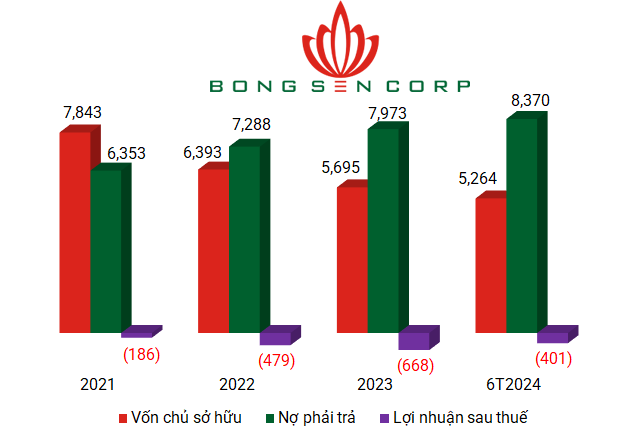

As of late June 2024, Bong Sen Joint Stock Company’s equity capital stood at over VND 5,200 billion, an almost 8% decrease compared to the beginning of the year. Payable debt at the end of the period was nearly VND 8,400 billion, a 5% increase. Bond debt remained unchanged over the past six months at VND 4,800 billion. The after-tax profit ratio on equity capital (ROE) was negative 8%.

The 2024 semi-annual business results extended Bong Sen’s streak of losses since 2021, with cumulative losses now exceeding VND 1,700 billion.

|

Financial statements and business performance of Bong Sen from 2021 to present (unit: billion VND)

Source: Author’s compilation

|

The company’s only outstanding bond issue is valued at VND 4,800 billion (face value) and was issued on October 15, 2021, with a 10.5% interest rate and a five-year maturity until October 2026. The proceeds were intended for investment in the project at 152 Tran Phu, Ward 4, District 5, Ho Chi Minh City.

According to the report, the company has only made interest payments for three periods in January, April, and July 2022 before their accounts were frozen due to an investigation related to Van Thinh Phat Group. As of December 31, 2023, the accrued interest payable exceeded VND 1,000 billion, with penalty interest amounting to VND 911 billion. “The company has paid interest to bondholders for three periods. Subsequently, the unit with which we cooperated on the investment did not fulfill their commitments, leading to the interruption in interest payment,” said the Chairman of the Extraordinary General Meeting of Shareholders in 2023, as quoted by the Bong Sen leadership, adding that the company is one of the 762 companies associated with Van Thinh Phat according to investigative documents.

Bong Sen operates in the hospitality, culinary, and tourism industries. Information from their website reveals that they own and manage a range of prominent restaurants and hotels in Ho Chi Minh City’s center, including Palace Saigon Hotel, Bong Sen Saigon Hotel, Bong Sen Annex Hotel, Calibre Restaurant, Bier Garden, Buffet Ganh Bong Sen, and the vegetarian restaurants Co Noi Vegetarian and Co Noi Buffet.