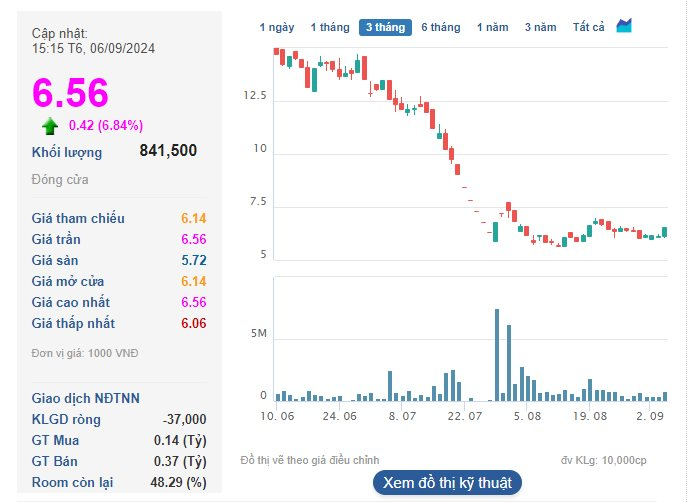

On September 6, QCG shares closed at 6,560 VND per share, up 6.84% from the previous session, with a trading volume of 841,500 units – doubling the previous session’s volume.

Over the past 10 trading sessions, QCG shares have been through a series of alternating increases and decreases, with the downward trend dominating with 7 out of 10 sessions ending in losses.

However, QCG shares traded around the reference threshold during the morning session of September 6. At the beginning of the afternoon session, this stock attracted strong investment cash flow, and at around 1:30 pm, QCG shares surged to the ceiling price and maintained this level until the end of the session.

QCG shares unexpectedly surged in the September 6 session. (Source: Cafef)

In the first half of 2024, Quoc Cuong Gia Lai experienced significant changes. On July 19, Ms. Nguyen Thi Nhu Loan, the former legal representative and General Director of the company, was prosecuted and temporarily detained in relation to the case of violations in the use of public land at 39-39B Ben Van Don, District 4, Ho Chi Minh City.

Subsequently, in late July 2024, Mr. Nguyen Quoc Cuong (aka Cuong “Dollar”) returned to Quoc Cuong Gia Lai, assuming the position of legal representative and General Director of the company, replacing his mother.

Recently, Mr. Cuong “Dollar” announced that Quoc Cuong Gia Lai is planning to sell valuable assets to ensure the repayment of a debt of 2,882 billion VND to Ms. Truong My Lan in relation to the case at Van Thinh Phat Group, involving the Phuoc Kien project (Nha Be district, Ho Chi Minh City).

Along with the leadership change, the market price of QCG shares has also fluctuated during this period. In mid-July 2024, the share price of QCG plummeted to its lowest level in the past year, erasing nearly two-thirds of its value compared to its peak in April.

In terms of business performance, in the first 6 months of 2024, Quoc Cuong Gia Lai recorded sales revenue of 65.2 billion VND, a decrease of two-thirds compared to the same period last year. As a result, the company reported a post-tax loss of 16.6 billion VND, an increase of nearly 3 billion VND compared to the same period in 2023.

In the consolidated financial statements, Quoc Cuong Gia Lai explained that this was due to the difficulties in the real estate market, the dry season leading to insufficient water for power generation, and the fact that rubber trees were only exploited from the end of May, resulting in low revenue…

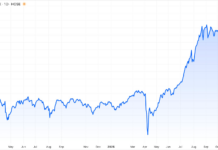

VN-Index Recovers at the End of the Session

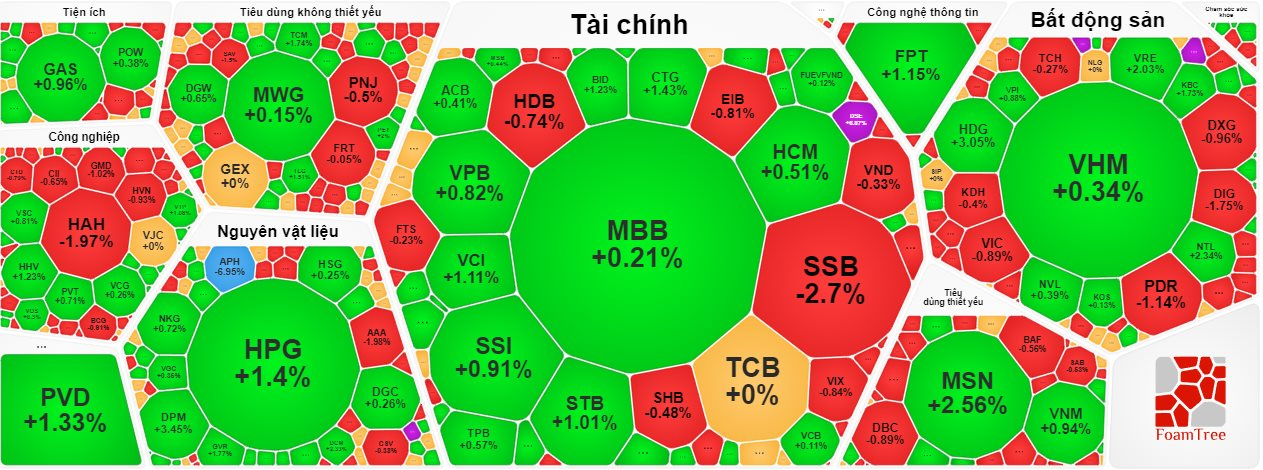

The stock market continued to face challenges, with the benchmark VN-Index trading below the reference threshold for most of the session. However, strong bottom-fishing in the last hour before the market closed helped the VN-Index recover, accumulating nearly 6 points.

The VN-Index closed September 6 at 1,273.96 points, up 5.75 points. Meanwhile, the HNX-Index decreased by 0.31 points to 234.65 points. Similarly, the UPCoM-Index fell by 0.1 points to 93.37 points.

Today’s market liquidity was low, with a total trading value of nearly 17,000 billion VND on all three exchanges. On the HoSE alone, liquidity reached nearly 15,500 billion VND.

VN-Index breaks losing streak, adding nearly 6 points.

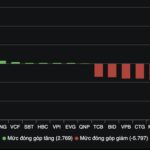

Investor cash flow unexpectedly surged into banking stocks in the late session, helping a series of stocks regain green. VAB of VietABank led the gainers with an increase of over 4%. This was followed by STB, BID, CTG, and ABB, which rose by more than 1%. Other stocks that recovered to positive territory before the market closed included VCB, VPB, LBP, ACB, MBB, TPB, NAB, PGB, BVB, KLB, and MSB.

In the real estate group, in addition to QCG, SGR of Saigon Real Estate also unexpectedly hit the ceiling price. Along with VHM of Vinhomes, many other blue-chip stocks in this group also increased in this session, including HDG (+3.05%), VRE (+2.03%), NTL (+2.34%), and KBC (+1.73%).

On the other hand, stocks such as DIG, VIC, PDR, DXG, TCH, and KDH fell into negative territory.

In the VN30 basket, in addition to bank stocks, some other stocks also recorded strong gains, positively contributing to the VN-Index. These included MSN, GVR, HPG, FPT, GAS, VNM, and PLX.

Conversely, VIC, SSB, HDB, SAB, and EIB were the biggest drags on the VN-Index in this session.

After two net selling sessions of around 700 billion VND each, foreign investors returned to net buying on the HoSE with a value of more than 230 billion VND.

FPT was the most purchased stock by foreign investors, with a value of nearly 200 billion VND. This was followed by CTG (102.29 billion VND), VNM (77.62 billion VND), and STB (54.17 billion VND).