The term “unicorn” is reserved for startups that achieve a valuation of $1 billion or more, a milestone that many aspiring businesses dream of reaching. This valuation signifies a company’s potential, indicating robust growth prospects, abundant capital, and opportunities for international expansion.

However, attaining unicorn status is not a guarantee of success. Vietnam has witnessed its share of unicorns stumbling and faltering. Notably, in 2023, three prominent unicorns bid farewell after encountering setbacks in their ventures.

As Unicorns Stumble:

The year 2023 proved to be a challenging one for startups globally, and Vietnam was no exception. Zoomcar, an Indian car rental startup, fired the opening shot. Founded in 2013, Zoomcar entered the Vietnamese market in early 2022 with ambitious plans to conquer the country’s 100 million population.

Zoomcar was the first to exit Vietnam in a string of unicorn exits over the past year.

|

Initially, Zoomcar offered aggressive promotions and discounts while providing convenient services such as free car delivery, no deposit requirements, and no retention of physical copies of personal documents. By January 2023, Zoomcar boasted over 100,000 users and engaged more than 3,000 car owners as partners.

However, just four months later, the Indian unicorn abruptly announced its cessation of operations in Vietnam, effective May 24, 2023. The company cited “challenging market conditions in the overall business landscape and the self-drive car rental segment, which are expected to remain complex in the foreseeable future.”

Following Zoomcar’s exit, Atome, a “Buy Now, Pay Later” unicorn from Singapore, also bid farewell to the Vietnamese market after just one year of operation. Despite enlisting 100 partners during its short tenure, Atome decided to withdraw due to limited contributions from its Vietnamese branch.

Towards the end of 2023, another unicorn, Baemin, a food delivery platform from South Korea, departed, leaving a trail of disappointment. Baemin’s parent company, Delivery Hero, announced that Baemin would cease operations in Vietnam from midnight on December 8, 2023, attributing the decision to the challenging global economic climate and fierce local market competition.

Most recently, Gojek, an Indonesian ride-hailing, delivery, and food delivery super-app, joined the exodus, discontinuing its services in the 100-million population market from September 16, 2024.

Baemin and Gojek have both bid farewell to the Vietnamese market. Source: Internet

|

The End of the First Competition Era between Grab and Gojek?

Both Grab and Gojek went public relatively recently. While Grab listed in the US in 2021, Gojek chose to IPO on its home turf in Indonesia in 2022.

Prior to its IPO, GoTo, Gojek’s parent group, merged with Tokopedia, a Indonesian e-commerce unicorn. However, Jon Russell from Asia Tech Review suggests that Gojek’s performance failed to live up to expectations, reflecting poorly on their choices regarding competition, narrative delivery, and spending.

Vietnam was initially a logical choice for Gojek’s expansion into Southeast Asia. With a population of 100 million, over 50% of whom are under 30, the country presented an attractive market for the company, which entered Vietnam in August 2018 under the name GoViet. Additionally, Gojek aimed to fill the void left by Uber and enhance its appeal to investors.

GoTo considered Vietnam as the first step in Gojek’s regional expansion beyond Indonesia, including Singapore, Thailand, and the Philippines. However, Gojek has now withdrawn from all those markets except Singapore, where it remains profitable. Given the unpredictable nature of the ride-hailing industry, even this foothold may not be secure in the long term.

Gojek’s expansion plans had been showing signs of trouble for some time. In July 2021, AirAsia acquired GET, Gojek’s Thailand ride-hailing business, for $50 million. In the Philippines, Gojek never gained a foothold as it was unable to obtain the necessary licenses. Coins.ph, a fintech startup Gojek acquired for nearly $100 million in 2019, also failed to deliver returns and was sold to a company operated by the former CEO of Binance two years later.

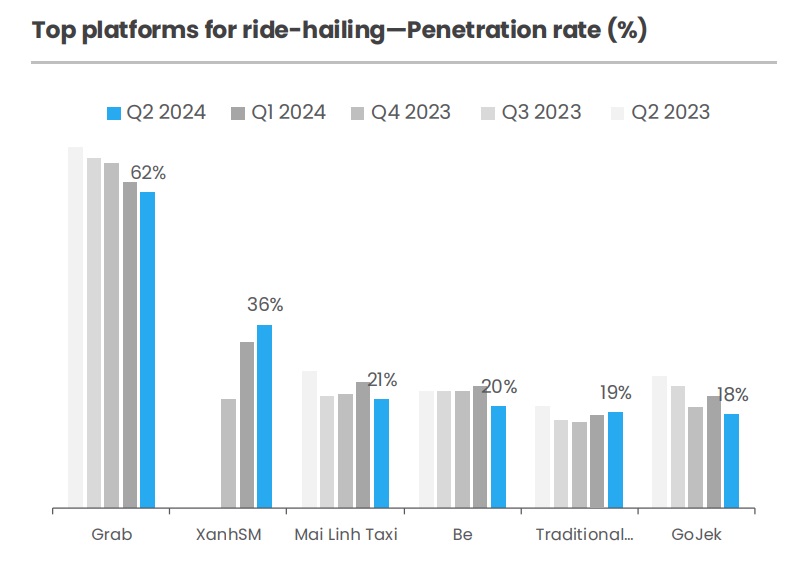

Returning to Vietnam, Gojek initially posed a strong challenge to Grab, despite the latter’s claims that its rival was spending heavily on discounts and promotions to attract users. There was some truth to this, as evidenced by Gojek’s fourth-place ranking in the market, trailing Grab, Be, and newer players like Xanh SM and traditional taxi companies.

Source: DecisionLab

|

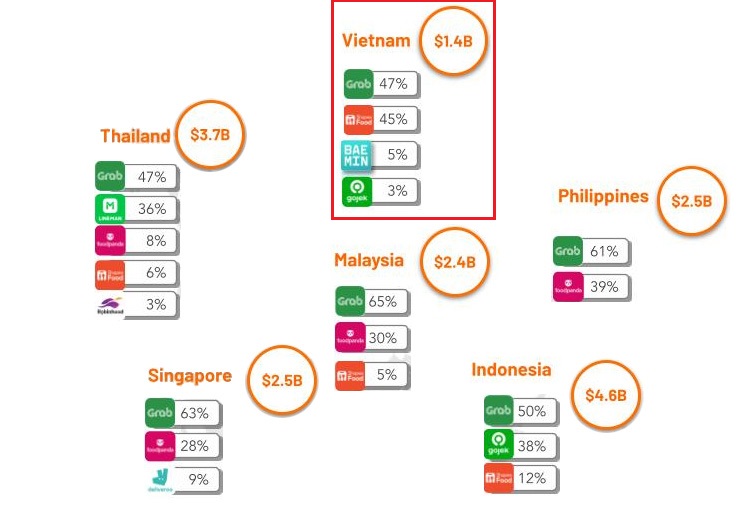

In the food delivery segment, Gojek faced similar challenges. According to Momentum Works’ 2023 statistics, Gojek held only 3% of the GMV (gross merchandise volume), even lagging behind Baemin. GoTo’s announcement of its exit from Vietnam confirmed the market’s insignificance, stating that the country accounted for just 1% of the group’s total transactions in Q2 2024, and the closure would have no material impact on the group’s financial position.

|

In the food delivery market share for 2023, Gojek even trailed behind Baemin, a unicorn that exited the previous year.

Source: Momentum Works

|

The “Money-Burning” Battle:

The landscape in 2018 was markedly different. Gojek was engaged in a fundraising battle with Grab, seeking to transition from its dominant position in Indonesia to competing in neighboring countries and filling the void left by Uber.

Gojek chose Vietnam as its springboard to challenge Grab’s market leadership. This was a sensible choice, as Gojek had encountered setbacks in Thailand and had not yet established a presence in the Philippines. In Vietnam, Gojek embarked on a strategy of promotions and fare discounts to gain market share, inadvertently forcing Grab to follow suit. Thus, a “money-burning” battle ensued, with the first to falter facing dire consequences.

Gojek entered Vietnam with high ambitions but ultimately stumbled and had to exit. Source: Asia Tech Review

|

From an investment perspective, Gojek’s spending initially yielded positive results. The potential for regional expansion helped the company attain unicorn status in 2016 and successfully raise $2 billion in 2019, achieving a valuation of approximately $9.5 billion. This influx of capital enabled Gojek to initiate various projects, ranging from entertainment to investments.

In an interview with Asia Tech Review, Gojek expressed its belief that challenging Grab in markets where it held dominance conveyed a positive message to investors and supported its position as a multi-market unicorn. However, as time passed, circumstances changed.

As a public company, Gojek had to shed excess weight and streamline its operations, akin to a spacecraft shedding unnecessary components after liftoff. In late 2023, Gojek sold its e-commerce arm, Tokopedia, to TikTok in a $1.5 billion deal. Subsequently, the company entered a phase of cost-cutting to pursue profitability.

Similarly, its rival, Grab, embarked on a path of financial prudence. Although both companies asserted their intention to achieve positive adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) in early 2024, Gojek faced a more challenging journey.

Indeed, “money-burning” battles rarely lead to sustainable success. Fierce competition in a market of 100 million people proved to be a formidable challenge for startups caught in this vortex. Niklas Östberg, co-founder and CEO of Delivery Hero, shared his perspective with Reuters in August 2023, expressing optimism about Asia but excluding Vietnam, where he believed the food delivery business would “never make money.” This assessment underscores the consequences of the “money-burning” tactics employed by these companies.

The battle between Grab and Gojek in Vietnam has come to an end, with Gojek faltering first. What the future holds for the ride-hailing market remains to be seen.

The End of the Road for the Toyota Yaris in Vietnam: The Declining Popularity of B-Segment Hatchbacks

The departure of the Toyota Yaris from the automotive scene has left a void in the B-segment hatchback market, with only the Suzuki Swift and Mazda2 remaining as key contenders.