Vietnam Engine and Agricultural Machinery Corporation (VEAM, code: VEA) is known as the largest automotive company in Vietnam at the moment. Considering only the value on the stock exchange, VEAM’s market capitalization is over VND 58,300 billion, equivalent to nearly $2.4 billion. Notably, its main business of manufacturing and selling trucks is rather lackluster, and VEAM’s value lies primarily in its investments in well-known automotive brands.

Currently, VEAM holds 30% of Honda Vietnam, 20% of Toyota Vietnam, and 25% of Ford Vietnam. Through these investments, the company earns substantial profits by receiving a share of the associated companies’ profits, in addition to cash dividends of thousands of billions of VND each year.

In the first half of 2024 alone, VEAM’s revenue exceeded VND 1,900 billion, while its net profit nearly doubled to VND 3,258 billion. This was mainly due to profits from its joint ventures and associates, which contributed nearly VND 2,866 billion.

Additionally, according to the parent company’s financial statements, VEAM also received nearly VND 5,100 billion in dividends from Honda Vietnam in the first six months. In previous years, the dividend income from Honda, Toyota, and Ford also amounted to thousands of billions of VND.

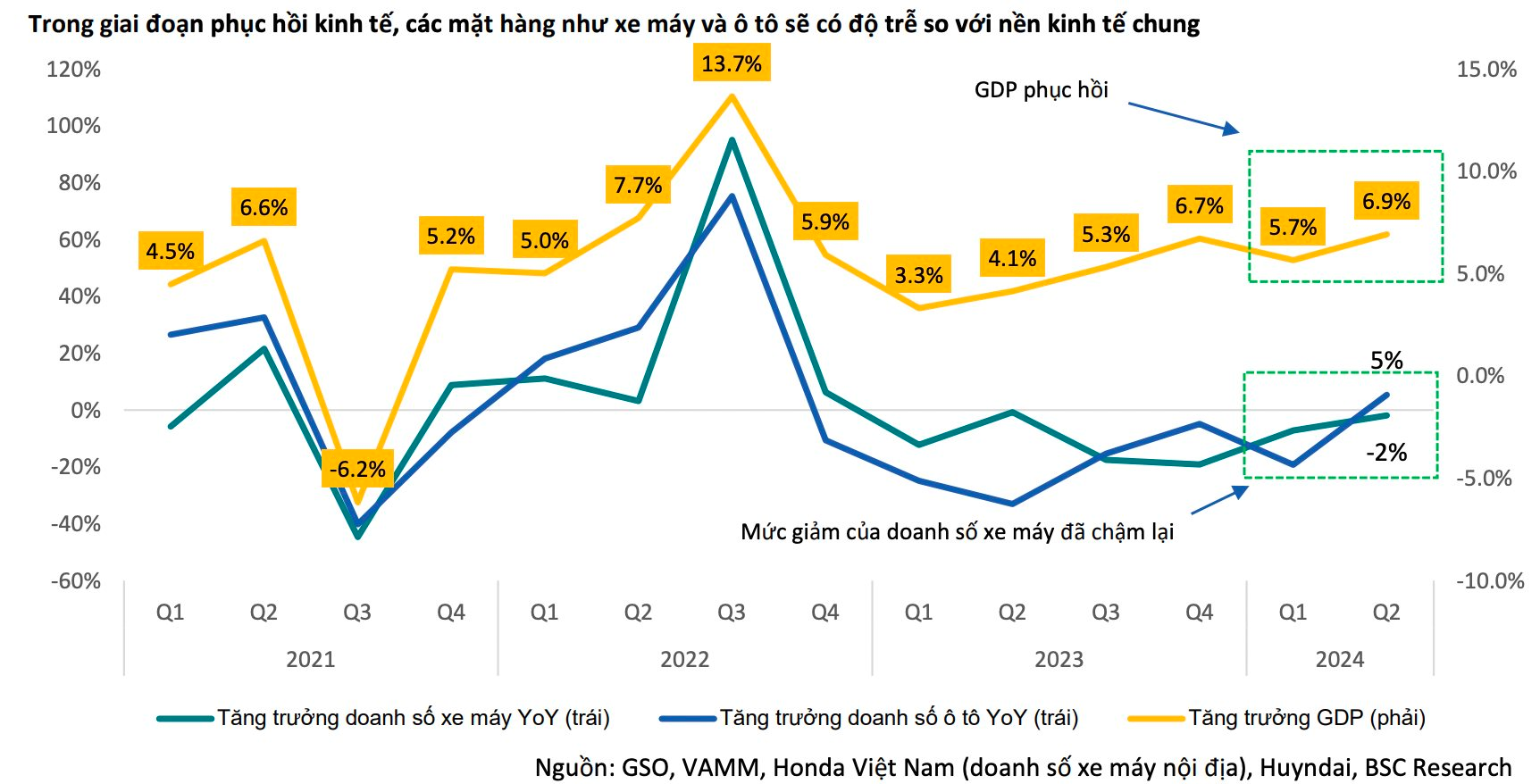

As VEAM’s performance is closely linked to the performance of these automotive companies, its results are significantly influenced by the motorcycle and automobile markets, despite not being directly involved in their operations. In a recent report, BSC Securities assessed VEAM’s growth prospects for the last months of 2024 and into 2025 as positive, given the improving automotive market conditions.

Motorcycle exports and automobile sales are expected to recover strongly

BSC maintains its forecast that Honda Vietnam’s motorcycle export sales will reach 430,000 units in 2024, a 60% increase. Just in July, motorcycle export sales grew by 83% year-on-year, continuing the strong growth trend since the beginning of 2024. The domestic market also witnessed a good recovery, with sales in May, June, and July increasing by over 14% after 17 consecutive months of decline.

With improvements in people’s income and a time lag for non-essential products, BSC predicts that Honda’s domestic motorcycle sales in the second half of 2024 will grow by 3% compared to the first half, resulting in total sales of 1.94 million units for the full year, a 7% decrease.

Notably, important input costs such as steel, chips, and plastics have decreased rapidly, while product prices have only seen a slight decline. Additionally, the launch of new vehicle models has encouraged higher prices. As a result, profit per vehicle in the second quarter of 2024 increased significantly more than expected, and BSC forecasts a profit per vehicle of VND 6.7 million for the year, a slight increase of 2%.

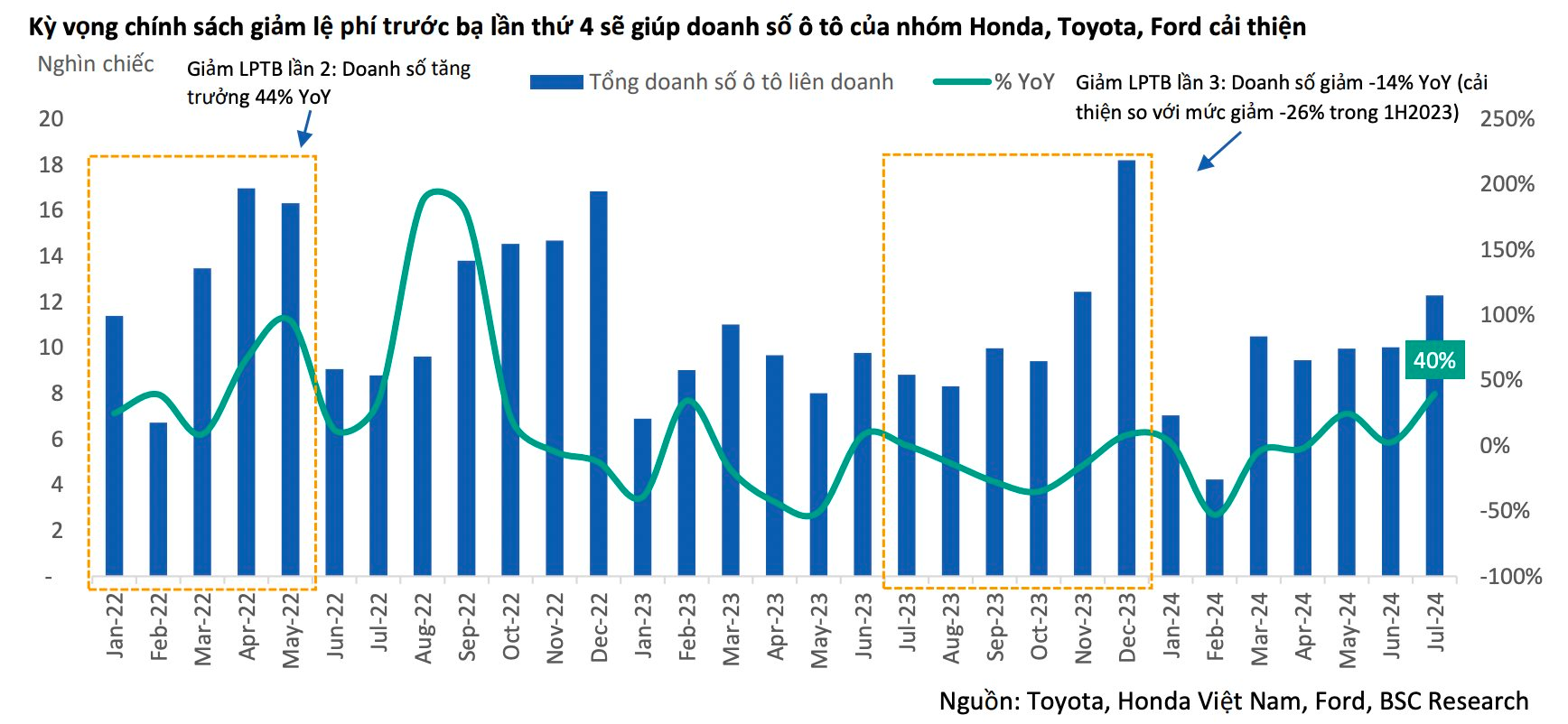

There are more positive signals in the automobile market, as car sales in the second half of 2024 are expected to continue growing by 5% year-on-year, thanks to a 50% reduction in registration fees effective from September 1, 2024, to November 30, 2024; Toyota regaining market share, and the economic recovery.

In July 2024, Toyota’s market share accelerated to 27%, and the improved supply of various models helped Toyota regain its sales momentum. Notably, BSC expects the fourth reduction in registration fees to boost car sales for Honda, Toyota, and Ford.

Sky-high cash dividends

From another perspective, one of the attractive factors of VEA stock that could draw investment is its dividend policy. Since 2018, the company has consistently maintained a double-digit dividend ratio, always in cash. For 2023, the company is awaiting approval from the Ministry of Industry and Trade for its profit distribution plan, which includes using VND 6,691 billion for dividends, equivalent to a ratio of 50.35% (VND 5,035 per share); the dividend yield is expected to be 11.3%, which is more attractive than bank savings rates.

In practice, the company typically uses almost all of its profits to pay cash dividends. Given the positive business outlook, BSC believes that VEA has the resources to maintain its attractive dividend policy in 2024-2025.

It is important to note that most of this money will go to the state-owned shareholder. Currently, the Ministry of Industry and Trade holds 88.47% of the capital in this automotive company.

In the market, VEA shares closed at VND 43,900 per share on September 9, an increase of 28% since the beginning of 2024.

The Auditors’ Report: Unraveling VEAM’s Web of Issues

At the reviewed consolidated financial statements for the first half of 2024, VEAM was subject to exceptions and notes by the auditing firm on a range of issues.