The dividend payment date is expected to fall on 30/09/2024.

The 2023 dividend payout marks a return for RYG after a two-year hiatus in 2021-2022, during which profits were retained for reinvestment. Most recently, the company distributed dividends in 2020 at a rate of 78.77% in shares.

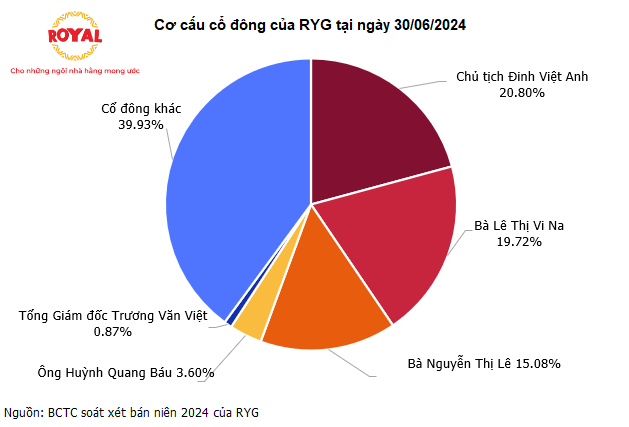

Among RYG’s major shareholders, Mr. Dinh Viet Anh, Chairman of the Board of Directors, tops the list with a 20.8% ownership stake. He will receive 9.4 billion VND in the upcoming dividend payout. Following him, Le Thi Vi Na, with a 19.72% stake, will receive 8.9 billion VND, and Nguyen Thi Le, with a 15.08% stake, will receive 6.8 billion VND.

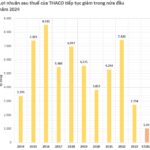

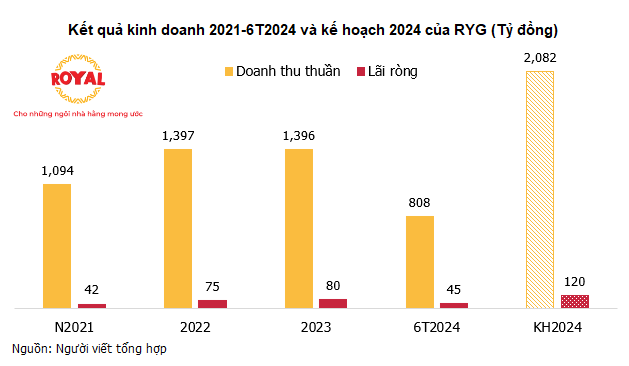

In terms of business performance, over the last four years (2020-2023), RYG’s revenue grew from 993 billion VND to 1,395 billion VND, while net profit increased from 30 billion VND to 101 billion VND.

In the first half of 2024, RYG recorded gross revenue of over 808 billion VND, a 44% increase compared to the same period last year. However, the faster growth of cost of goods sold compared to revenue narrowed the gross profit margin from 21% in the previous year to 18%.

A bright spot was the improvement in financial activities, generating revenue of more than 7 billion VND, nearly double that of the previous period. Additionally, the company recognized a profit of nearly 9 billion VND from its joint ventures and associates, while none was recorded in the same period last year.

After deducting expenses, RYG’s net profit exceeded 45 billion VND, a 77% increase compared to the first half of 2023.

For the full year 2024, the owner of the Royal tile brand targets gross revenue of 2,082 billion VND and net profit of 120 billion VND, representing increases of over 42% and 19%, respectively, compared to 2023. After six months, the company has achieved 39% of its revenue target and 37.5% of its profit target.

Chairman of the Hoang Gia Ceramic Tile brand discusses the Fourth Revolution in the ceramic industry

As of June 30, 2024, RYG’s total assets amounted to approximately 1,946 billion VND, including nearly 72 billion VND in bank deposits. In terms of capital structure, the company reported payables of nearly 1,171 billion VND, including financial borrowings of nearly 759 billion VND, resulting in a debt-to-equity ratio of almost 98%.

|

On May 21, the Ho Chi Minh City Stock Exchange (HOSE) received a listing registration dossier for 45 million RYG shares, equivalent to a charter capital of 450 billion VND. Previously, on October 16, 2023, the company successfully conducted an IPO of 9 million shares at a price of 15,000 VND/share, raising 135 billion VND. |