The Vietnamese stock market experienced significant volatility during the September 10 session. The main index opened with a slight recovery and gain, but persistent selling pressure and weak demand caused it to plunge into negative territory in the latter half of the afternoon. The VN-Index closed 12.5 points lower at 1,255.23. Foreign investors continued their net selling spree, offloading approximately VND383 billion across all markets.

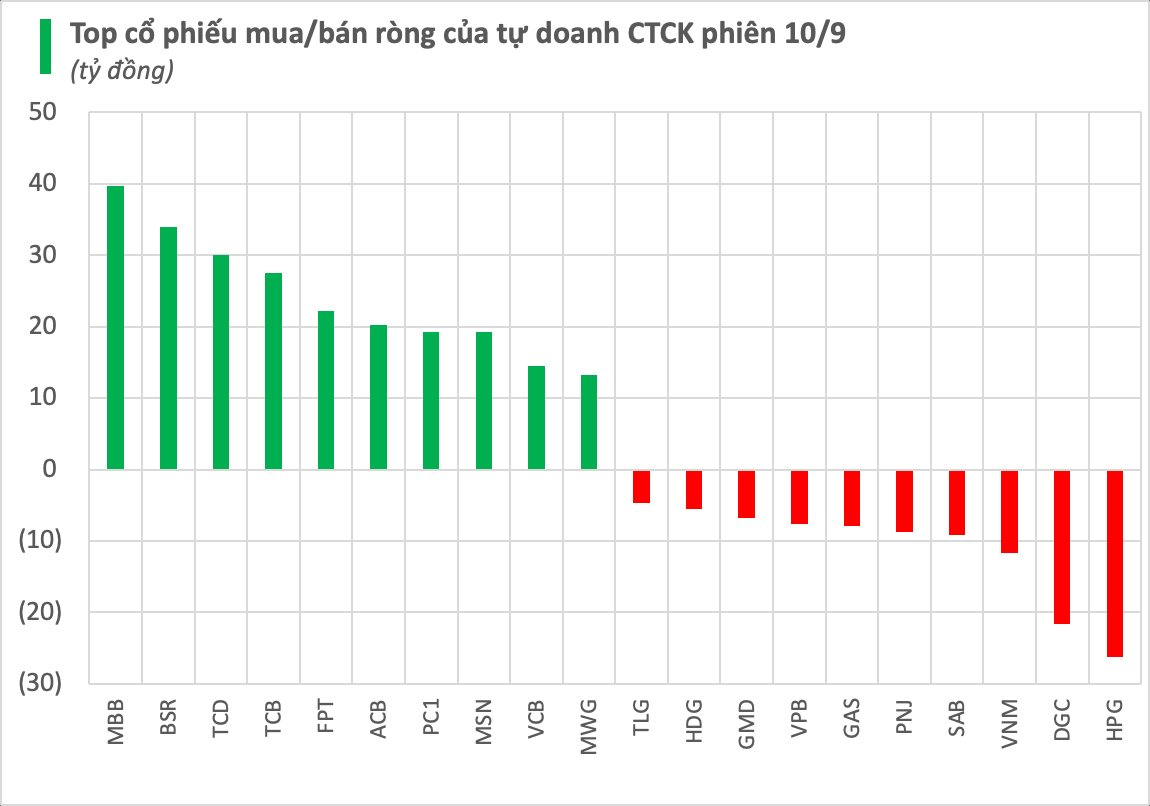

Brokerage firms’ proprietary trading activities resumed net buying, recording VND170 billion across the three exchanges.

On the HoSE, brokerage firms’ proprietary trading activities net bought VND138 billion, including VND118 billion on the matching order channel and VND19 billion on the negotiated deal channel.

Specifically, the most substantial net buying by brokerage firms was observed in MBB and TCD, with respective values of VND40 billion and VND30 billion. Additionally, stocks like TCB, FPT, ACB, and PC1 also witnessed net buying during the September 10 session.

In contrast, brokerage firms offloaded HPG and DGC the most, with respective net selling values of VND23 billion and VND22 billion. VNM, SAB, PNJ, and GAS were among the stocks that experienced net selling during today’s session.

On the HNX, brokerage firms’ proprietary trading activities net sold nearly VND3 billion, with the sole transaction occurring in PLC.

On the UPCoM, brokerage firms’ proprietary trading activities net bought VND35 billion, of which VND34 billion was in BSR, and a minor amount in BSA.

“DRH Holdings Stock (DRH) Plunges as Chairman Phan Tan Dat Faces Crisis”

After trading was suspended by HoSE, Chairman Phan Tan Dat’s DHR shares plummeted to the floor price, with a record-high trading volume.