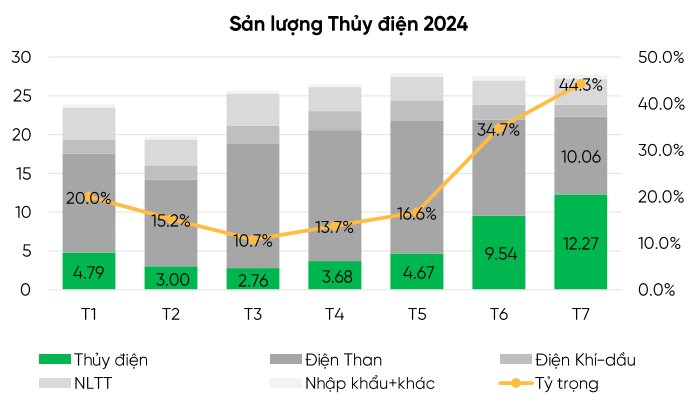

VPBank Securities (VPBankS) reports that La Nina is expected to be in full force from August to December 2024, with a 66%-74% likelihood of persisting until April next year. Precipitation levels from June to August 2024 are forecasted to be 15% to 30% higher than the multi-year average.

The VPBankS analysis team predicts that this will benefit hydroelectric power plants, which are expected to outperform their 2023 performance. Notably, in July, hydroelectric power generation reached 12.3 billion kwh, surpassing coal-fired power and accounting for 44.3% of total power output. The expected hydroelectric power output for 2024 is over 84 billion kwh, a 4% increase from the previous year.

Source: VPankS

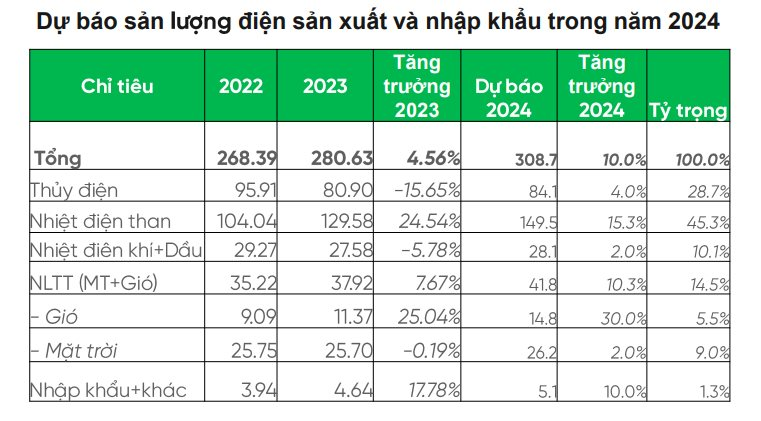

On another note, the Ministry of Industry and Trade/EVN has adjusted the electricity demand plan, increasing it by 1.25% compared to the initial plan. As a result, the total electricity demand is now estimated at 310.6 billion kwh, an almost 11% increase from the previous year. VPBankS remains optimistic about the power sector’s prospects in the coming months, anticipating a further rise in electricity demand. They predict a 10%-11% increase in electricity demand in 2024, driven by expectations of robust economic growth (6%-6.5%).

Additionally, the power sector’s growth prospects are bolstered by stable primary fuel prices in the second half of the year and the implementation of electricity pricing mechanisms for imported LNG power projects and renewable energy sources.

Source: VPankS

4 Power Stocks with Expected Growth

Based on the above analysis, the research team has identified four promising power stocks with expected growth in the last months of 2024: PC1, QTP, REE, and POW.

For PC1 Corporation (PC1), VPBankS offers an optimistic outlook on its electricity construction and industrial production recovery. The industrial real estate segment is also expected to perform well in the coming months. The securities firm forecasts a 27% and 75% year-on-year increase in revenue and pre-tax profit, respectively, for 2024.

Additionally, analysts predict that Quang Ninh Thermal Power (QTP) will achieve an electricity output of 7,750-7,780 kwh for the full year 2024. Consequently, revenue and profit are expected to reach VND 11,892 billion and VND 764 billion, respectively, equivalent to 99% and 118% of 2023 figures. Investment highlights include high electricity production, reduced production costs, and attractive cash dividends.

VPbankS also anticipates that the end of El Nino in the first half of the year will result in improved hydropower output for Refrigeration Electrical Engineering (REE) in the second half, especially with REE’s focus on the Central and Central Highlands regions. Moreover, the real estate sector is expected to compensate for any declines in hydropower. The Etown6 project is in its final stages and will be handed over to tenants in the second quarter of 2024, adding nearly 37,000 square meters of leasable office space.

Lastly, VPbankS believes that the Vung Ang plant’s S1 unit and the completion of maintenance on gas-fired power plants will boost PetroVietnam Power Corporation (POW)‘s performance in 2024. In the long term, the Nhon Trach 3 and 4 power projects are expected to contribute an additional 1,500 MW (+36% capacity) and 9,200 million kwh (+45% electricity output) from 2025 to 2026.

El Nino is a climate phenomenon characterized by the abnormal warming of sea surface temperatures in the equatorial Pacific, lasting from 8 to 12 months or longer. It typically occurs every three to four years and significantly influences weather patterns worldwide.

Conversely, La Nina is marked by abnormally cold sea surface temperatures in the same region. It has a similar or less frequent cycle than El Nino and often follows the latter’s weakening. La Nina typically forms between March and June and has the most significant impact from late in the year until February of the following year.

“ePortfolio: The Ultimate Investment Portfolio Product of 2024”

ePortfolio, a diverse and high-performing sample portfolio product, has been recognized by Global Banking & Finance Review as the “Best Sample Portfolio Product of 2024.” This prestigious award acknowledges the unique offering of ePortfolio, which stands out for its wide range of sample portfolios, superior performance, and unparalleled convenience for customers.

Beware of Inflation in 2024

According to a report from the General Statistics Office, the average inflation rate for the first two months of 2024 increased by 3.67% compared to the same period in 2023. This is a lower growth rate compared to the 4.6% figure from the previous year. However, upon closer examination of the factors influencing inflation in the first two months of this year, it is evident that food prices have made a significant contribution, with a 16.49% increase compared to the same period last year. The persistently high food prices may lead to a continued increase in inflation in the future.