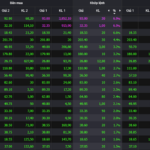

The Vietnamese stock market opened in the red, influenced by the poor performance of global stock markets. However, the decline was modest, fluctuating within a narrow range of 1,263 – 1,269 points.

At the close, the VN-Index fell 6.23 points to finish at 1,267 points. Trading volume decreased, with 433.9 million shares traded on the HOSE exchange.

The large-cap VN30 basket decreased by 8.24 points, closing at 1,307 points. Among these, only three codes increased in price: HPG (+0.8%), GAS (+0.7%), and SSB (+0.6%).

On the other hand, 23 codes closed in the red, including VIC (-2.1%), VHM (-2.1%), BVH (-1.8%), SSI (-1.5%), and others…

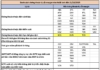

Market performance over time Source: Fireant

Foreign investors resumed net selling on the HOSE exchange, with a value of 484.3 billion VND. They heavily sold FPT (-108.9 billion VND), MSN (-78.9 billion VND), and HPG (-76.8 billion VND)… Conversely, they bought large quantities of DGW (+38 billion VND), TCB (+36 billion VND), and DBC (+25.9 billion VND)…

According to Dragon Vietnam Securities Company, the decreased trading volume compared to the previous session indicates low supply as the market approaches the support zone of 1,255 – 1,260 points. The current support candle signal may lead to a market recovery in the near term.

“It is anticipated that the market will once again test supply around the 1,280-point level. Therefore, investors can expect a short-term market recovery and prioritize stocks with stable performance that have attracted capital recently.

However, it is advisable to consider the recovery rhythm for short-term profit-taking or portfolio restructuring to minimize risks,” advised Rong Viet.

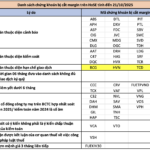

VCBS recommends that investors maintain their portfolio allocation with codes in the retail, securities, and banking sectors. They can also consider investing in the aforementioned sectors at discounted prices.