STOCK MARKET REVIEW FOR WEEK 04-06/09/2024

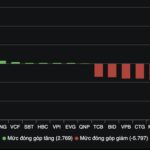

During the week of September 4-6, 2024, the VN-Index rebounded and recovered timely in the last trading session, thereby reducing the adjustment pressure from previous sessions.

On the other hand, trading volume has remained below the 20-week average since June 2024. This needs to be addressed in the coming period for index improvement.

Currently, the index remains above the Middle Bollinger Band. If it continues to hold above this level, the situation may not be too pessimistic.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

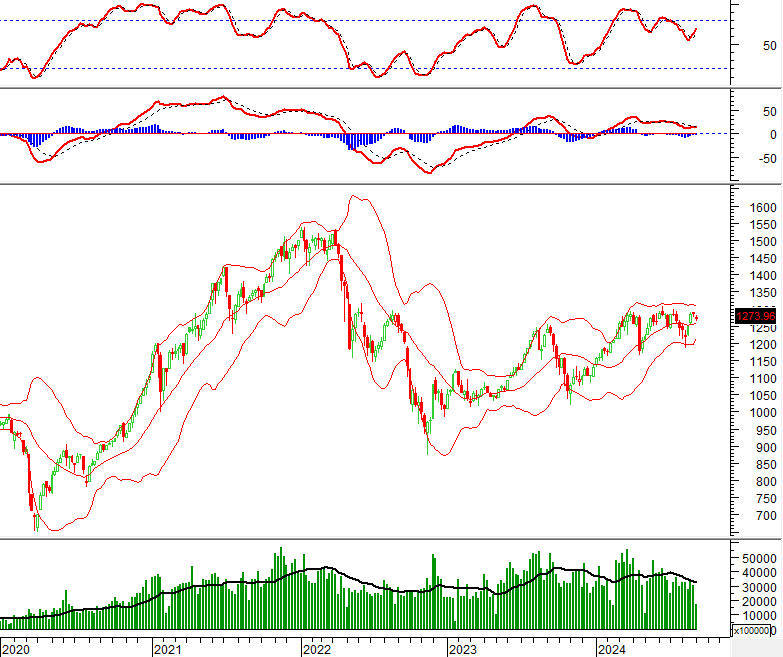

VN-Index – Bollinger Bands narrowing

On September 6, 2024, the VN-Index slightly increased with declining trading volume, remaining below the 20-session average, indicating investors’ cautious sentiment.

Additionally, the VN-Index is still ranging and sitting above the Middle Band, while the Bollinger Bands are narrowing (Bollinger Squeeze), and the ADX indicator continues to fall below 20. This suggests that the market is likely to experience more consolidation and volatility in the upcoming sessions.

The index is approaching the group of the 50-day and 100-day SMA, which should provide strong support for the VN-Index as the corrective phase persists.

HNX-Index – Stochastic Oscillator falls out of overbought territory

On September 6, 2024, the HNX-Index witnessed a slight decrease and formed a Three Black Candles pattern, dropping below the 200-day SMA, indicating a less optimistic outlook.

Currently, a Death Cross between the 50-day and 100-day SMA has reappeared, while the Stochastic Oscillator has triggered a sell signal and fallen out of the overbought region, adding to the pessimistic sentiment.

Money Flow Analysis

Smart Money Flow Variation: The Negative Volume Index of the VN-Index crossed above the 20-day EMA. If this state persists in the next session, the risk of a sudden downturn (thrust down) will diminish.

Technical Analysis Department, Vietstock Consulting