Deposit interest rates in August witnessed an upward trend, with an increase of 0.6 percentage points for 6-month terms and 0.4-0.61 percentage points for 12-month terms since the April lows. Among state-owned commercial banks, Agribank made adjustments with an increase of 0.2 to 0.3 percentage points, while the rest remained unchanged. Large commercial banks followed suit with a 0.6 percentage point hike for 6-month terms and a 0.4 percentage point bump for 12-month terms. Meanwhile, medium and small-sized commercial banks saw more significant increases of approximately 0.6 percentage points for both terms.

This upward trend in deposit interest rates continued for most banks in August, albeit with some divergence as a few banks opted to lower their rates amidst slower-than-expected credit disbursement.

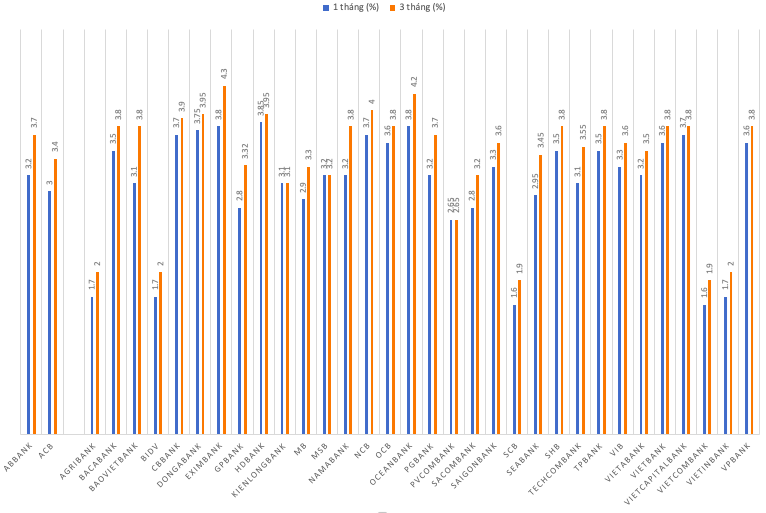

The highest savings interest rate for September 2024 with a 1-month term was offered by HDBank at 3.85%. This rate reflected an increase of 0.8 percentage points compared to the end of August for this particular term.

Closely following HDBank were OceanBank and Eximbank, offering an interest rate of 3.8% per annum for 1-month term deposits.

Several other banks also offered competitive interest rates for the 1-month term, including DongABank at 3.75% per annum, and NCB, VietCapitalBank, and CBBank, all at 3.7% per annum.

For the 3-month term, the highest interest rate in September 2024 was 4.3% per annum, offered by Eximbank. OceanBank took second place with an interest rate of 4.2% per annum, while the National Citizen Bank (NCB) offered an interest rate of 4% per annum for the same term.

DongABank and HDBank offered the third-highest interest rate in the market for the 3-month term, both at 3.95%.

It’s worth noting that some commercial banks are gradually approaching the ceiling interest rate set by the State Bank of Vietnam for terms under 6 months, which is currently at 4.75% per annum.

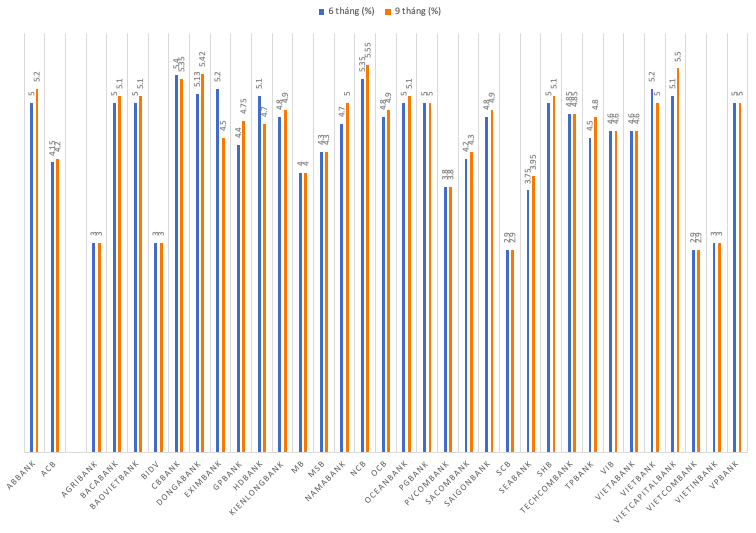

For the 6-month term, the highest interest rate in September 2024 was offered by CBBank at 5.4% per annum, closely followed by NCB at 5.35% per annum.

VietBank and EximBank offered competitive rates of 5.2% per annum for the same term, while HDBank and VietCapitalBank both provided an interest rate of 5.1% per annum. DongABank slightly edged them with an interest rate of 5.13% per annum for the 6-month term.

VPBank, ABBank, BacABank, BaoVietBank, SHB, and OceanBank all offered an interest rate of 5% per annum for the 6-month term.

For the 9-month term, most banks offered interest rates that were 0.1 to 0.3 percentage points higher than the 6-month term. However, a few banks, such as HDBank, EximBank, and CBBank, went against the grain and offered slightly lower interest rates for the 9-month term compared to the 6-month term.

The highest interest rate for the 9-month term in September 2024 was offered by NCB at 5.55% per annum, followed by VietCapitalBank at 5.5% and DongABank at 5.42%. CBBank took the fifth spot with an interest rate of 5.35% per annum.

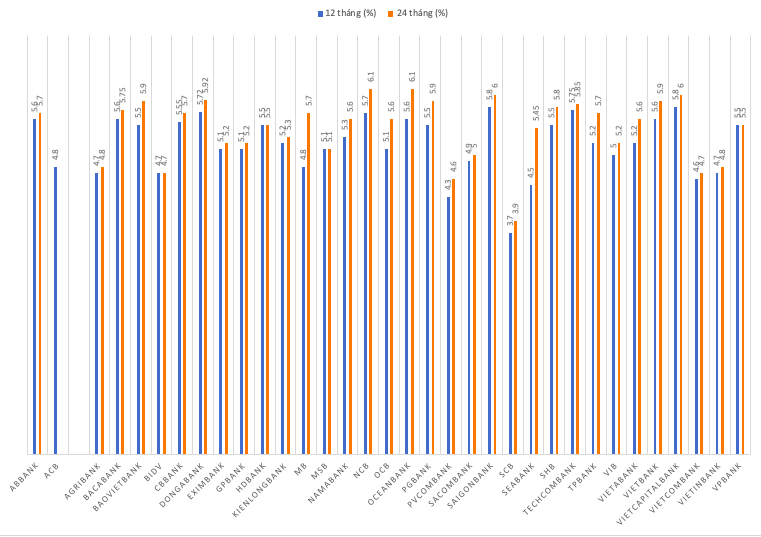

The 12-month term offered interest rates that were 0.4 to 1 percentage point higher than the 6-9 month terms.

VietCapitalBank and SaigonBank took the lead for the highest interest rate in September 2024 for the 12-month term, both offering a rate of 5.8% per annum. Techcombank followed closely with an interest rate of 5.75% per annum, while DongABank offered a rate of 5.72%.

For the 24-month term, NCB and OceanBank offered the highest interest rate of 6.1% per annum, while SaigonBank and VietCapitalBank provided a rate of 6% per annum.

It’s worth noting that customers who opt for online savings deposits often enjoy higher interest rates compared to counter deposits, with a difference ranging from 0.2 to 0.3 percentage points.

For non-term deposits, the interest rates currently range from 0.1% to 0.5% per annum. BacABank and NamABank offer an interest rate of 0.5% per annum for this type of deposit, while banks like MB, Vietcombank, and Viettinbank provide a lower rate of 0.1% per annum.

It’s important to note that the above-mentioned savings interest rates are for individual customers, with interest calculated at the end of the term and subject to change. Banks often have different interest rate policies tailored to various customer segments, depending on the deposit amount. Additionally, the actual deposit interest rates may vary depending on the capital balance of each bank branch…

The Fingerprint Conundrum: Navigating Biometrics Without a Chipped ID

For high-value transactions exceeding 10 million VND per transaction or a daily total of over 20 million VND (type C and D transactions), customers are required to authenticate themselves using biometric identification.