In a recently announced plan, Vietnam’s leading beverage company, Sabeco (listed on the Ho Chi Minh Stock Exchange as SAB), intends to acquire over 37.8 million shares of Sabibeco (traded on the UPCoM Exchange as SBB), representing 43.2% of the latter’s total outstanding shares.

Currently, Sabeco directly holds nearly 14.4 million SBB shares (16.4%), and its related parties own over 5.5 million shares (6.3%), totaling almost 19.9 million shares (22.7%). With the proposed acquisition, Sabeco and its related parties aim to increase their collective ownership to over 57.7 million SBB shares, or 65.9% of the total, thus establishing Sabeco as the parent company of Sabibeco.

At a public offer price of 22,000 VND per share, Sabeco is expected to spend nearly 832 billion VND on this transaction, utilizing its own capital and other lawful sources. During the acquisition process, Sabeco may increase the offer price if necessary to ensure a successful outcome, in compliance with legal regulations and market conditions at the given time.

This M&A deal is set to commence in 2024 and will be completed within a minimum of 30 trading days and a maximum of 60 trading days from the start of the acceptance period specified in the public tender offer announcement.

It is important to note that Sabeco reserves the right to withdraw the tender offer if any of the following events occur: the number of SBB shares registered for sale does not reach the minimum threshold of 25.1 million shares (28.7%); SBB reduces its number of voting shares; SBB issues convertible bonds, bonds with warrants, or pre-emptive rights; or SBB sells assets valued at 35% or more of the total asset value based on the latest audited financial statements.

Recalling the events of February 2023, Sabeco’s Board of Directors approved the proposal to increase its ownership in Sabibeco and the Saigon Packaging Group Joint Stock Company. Following the completion of the necessary procedures, these two companies would become Sabeco’s subsidiaries.

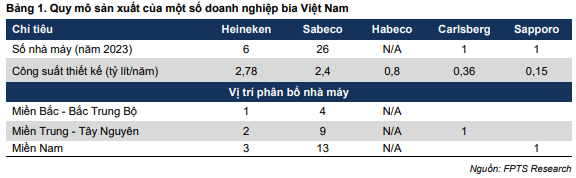

Sabibeco, formerly known as Saigon Beer Binh Tay Joint Stock Company, was established on November 25, 2005, with its first project being the Saigon Beer Binh Duong Brewery. According to Sabibeco’s website, the company operates six member factories with a total beer production capacity of 610 million liters per year.

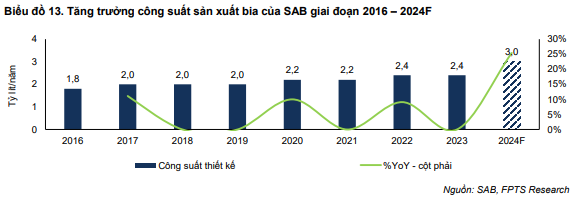

As highlighted in FPTS’s initial valuation report on SAB shares, upon the completion of this M&A transaction with Sabibeco, Sabeco’s total production capacity is expected to reach 3.01 billion liters of beer per year in 2024, reflecting a 25.4% increase from its current capacity, making it the largest beer producer in Vietnam.

Sabibeco is renowned for its Sagota beer brand, which encompasses a range of products such as draft beer, canned beer, fresh beer, and bottled beer. Additionally, they offer contract manufacturing services for popular beer brands like Saigon Special, Saigon Larger, Saigon 333 Export, and Saigon Export, as well as malt-based beverages in lemon and raspberry flavors.

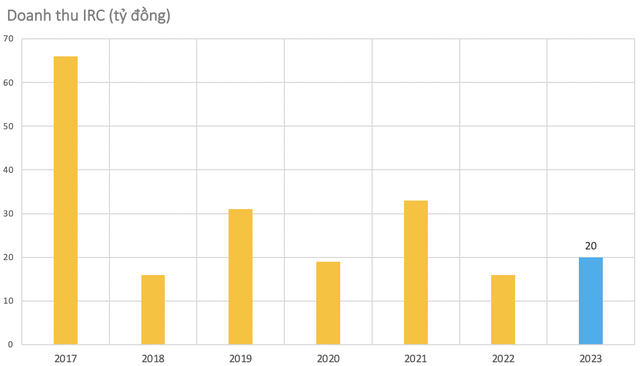

In the first quarter of 2024, Sabibeco reported impressive financial results, with net revenue surpassing 574 billion VND, marking a 48% increase compared to the same period last year. The company eliminated its below-cost selling practices, resulting in a gross profit of 19.5 billion VND, in contrast to a loss of nearly 500 million VND in the previous year’s first quarter.

A notable improvement was the significant reduction in financial expenses due to the reversal of allowance for impairment of trading securities and investment losses, totaling over 21 billion VND. However, the company’s overall performance was dragged down by a loss of nearly 29 billion VND from its joint venture and associate investments.

Consequently, Sabibeco recorded a net loss of approximately 17 billion VND for the quarter, an improvement from the 34 billion VND loss in the first quarter of 2023. The beer enterprise has incurred losses for four consecutive years from 2020 to 2023, with the peak loss reaching a record high of 108 billion VND in 2022. As of March 31, 2024, Sabibeco’s accumulated loss stood at nearly 9 billion VND.

Huy Khai

The “Capital” of Binh Duong Furniture Achieves Export Turnover of Over 4.2 Billion USD

Amid a surge in new orders, wood businesses in Binh Duong forecast a year of robust factory activity. This influx of orders presents a unique opportunity for these businesses to ramp up production and boost exports, capitalizing on favorable market conditions.

“Speaker of the House Trần Thanh Mẫn Embarks on an Official Visit to the Russian Federation”

Upon the invitation of Mr. Vyacheslav Victorovich Volodin, Chairman of the State Duma of the Federal Assembly of the Russian Federation, and Ms. Valentina Ivanovna Matvienko, Chairwoman of the Federation Council of the Federal Assembly of the Russian Federation, Mr. Tran Thanh Man, Chairman of the National Assembly of Vietnam, departed Hanoi on the morning of September 8, leading a high-level delegation on an official visit to the Russian Federation. The visit will also see Mr. Man co-chair the third meeting of the Vietnam-Russia Inter-Parliamentary Cooperation Committee from September 8 to 10, 2024.

The Central Bank Will Continue to Lower Lending Rates

The State Bank is implementing a range of solutions to boost credit growth, with a key focus on reducing lending rates.