Hung Thinh Phat Reports Continued Losses

The Hanoi Stock Exchange (HNX) has recently published a document from Hung Thinh Phat Development and Investment Joint Stock Company (Hung Thinh Phat) detailing its financial situation for the first half of 2024.

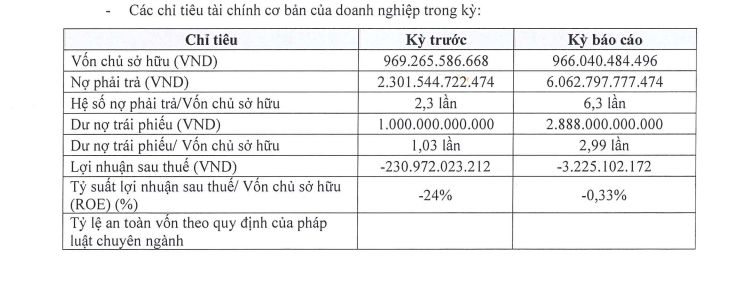

For the six-month period, Hung Thinh Phat reported a loss with a negative after-tax profit of 3.2 billion VND. However, this figure shows significant improvement compared to the loss of nearly 231 billion VND in the same period last year.

Owner’s equity decreased slightly by over 3 billion VND, reaching 966 billion VND. On the other hand, payables saw a sharp increase from 2,301 billion VND to nearly 6,063 billion VND; this includes a rise in bond debt from 1,000 billion VND to 2,888 billion VND.

Source: HNX

This bond debt originates from the HTPCH2327001 bond series issued on December 31, 2023, with a face value of 100 million VND per bond and an issuance value of 2,888 billion VND.

With a four-year term, this bond series will mature on December 31, 2027.

Despite being a relatively new and low-key company in the market, Hung Thinh Phat has surprised many by successfully raising 2,888 billion VND through bond issuance.

According to our sources, on December 31, 2023 (the same date as the issuance of the HTPCH2327001 bond series), the company entered into a secured transaction with HDBank (Ho Chi Minh City Development Joint Stock Commercial Bank).

Hung Thinh Phat used the entire balance and asset rights arising from the Specialized Collection Account for managing capital mobilization from disbursement/L/C/bond issuance, opened at HDBank, including: Account number 059 704 070 015 xxx (at HDBank Thu Duc Branch – Dong Sai Gon Transaction Office); all other payment accounts of the Guarantor at HDBank (if any); and All rights arising from the Investment Cooperation Contract No. 01/2023 between Dai Nam Company Limited and Hung Thinh Phat as collateral at HDBank.

In addition to the above bond series, on July 17, 2024, Hung Thinh Phat successfully raised 412 billion VND from the bond series with the code HTPCH2428001. This bond series has a four-year term, maturing on July 17, 2028, and an interest rate of 12% per annum.

Relationship with Danh Khoi Group

Hung Thinh Phat was established on October 13, 2021, with its head office located at 119 Truong Van Bang, Thanh My Loi Ward, Thu Duc City, Ho Chi Minh City.

Its initial chartered capital was 30 billion VND, with two contributing members: Lam Ky Dieu (70%) and Nguyen Van Ngoc (30%).

At that time, Mr. Lam Ky Dieu (born in 1974) held the positions of Chairman of the Members’ Council, General Director, and Legal Representative of the company.

In November 2022, Nguyen Van Ngoc transferred his 30% contribution to Nguyen Thi Le Thuy.

By December 2023, Hung Thinh Phat’s chartered capital had increased to 940 billion VND. The ownership structure changed with Lam Ky Dieu holding 2.23%, Nguyen Thi Le Thuy 0.96%, Nguyen Dinh Ngoc 45.74%, Le Khoi 4.26%, and Nguyen Thi Anh Thu 46.81%.

Just a month later, in January 2024, Hung Thinh Phat further increased its capital to 1,200 billion VND. The shareholder structure at this time was not disclosed.

According to the latest changes registered in April 2024, the company’s legal representative is now General Director Nguyen Dinh Ngoc (born in 1974).

Notably, in addition to Hung Thinh Phat, Mr. Ngoc also serves as the legal representative of two other entities: EDEN Non Nuoc Investment Company Limited and ADK Real Estate Joint Stock Company.

ADK Real Estate was established in December 2020 with a chartered capital of 510 billion VND. The founding shareholders included Chairman of the Board of Directors Nguyen Dinh Ngoc (96.9%), Danh Khoi Holdings Joint Stock Company (3%), and Nguyen Dinh Dung (0.1%).

In January 2021, the company increased its capital to 530 billion VND, but the shareholder structure was not disclosed.

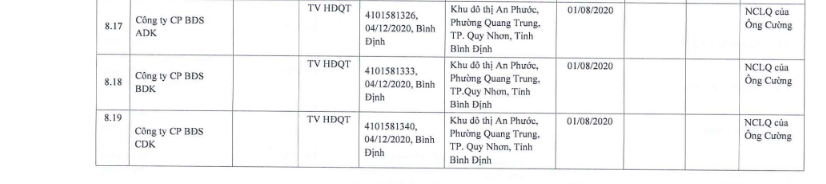

According to the semi-annual governance report of 2024 of NRC – Danh Khoi Group Joint Stock Company (HNX: NRC), Mr. Nguyen Huy Cuong, General Director of Danh Khoi Group, is a member of the Board of Directors of ADK Real Estate.

Mr. Nguyen Huy Cuong, General Director of Danh Khoi Group, is a member of the Board of Directors of ADK Real Estate and GDK Real Estate. Source: NRC’s Semi-annual Governance Report 2024.

The connection between ADK Real Estate and Danh Khoi Group doesn’t end there. Ms. Nguyen Thi Anh Thu, a shareholder holding 46.81% of ADK Real Estate (as registered in December 2023), is the Chairwoman of the Members’ Council and legal representative of GDK Real Estate Limited Liability Company.

GDK Real Estate is also related to Danh Khoi Group, as Mr. Nguyen Huy Cuong, General Director of NRC, is a member of the Board of Directors of GDK Real Estate.

Bach Hien

“Eurowindow Holdings Reports Six-Month Profit Quadruples, Liabilities Exceed Equity”

Eurowindow Holding, a member of the prestigious Eurowindow Group, has announced impressive financial results for the first half of 2024. The company reported a remarkable after-tax profit of 96.6 billion VND, more than quadrupling its earnings from the same period last year. This achievement is even more impressive considering Eurowindow Holding’s payable debt, which has increased to over 8.8 trillion VND, surpassing its owner’s equity by 1.1 times.