On September 9, the BCM Board of Directors approved the capital contribution in the form of purchasing over 1.93 million shares of Becamex – Binh Phuoc Technical Infrastructure Development JSC at a price of VND 10,000/share, equivalent to a purchase value of over VND 19 billion.

The capital contribution will be made within 30 days from September 9. If successful, BCM’s ownership in Becamex – Binh Phuoc is expected to remain unchanged at over 40%.

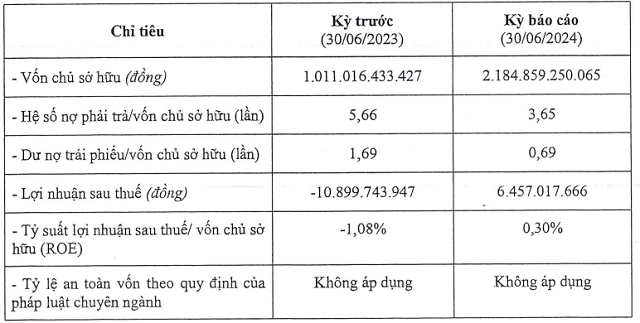

In terms of business operations, Becamex – Binh Phuoc reported a profit of over VND 6 billion in the first half of 2024 (compared to a loss of nearly VND 11 billion in the same period last year).

Notably, Becamex – Binh Phuoc’s equity nearly doubled from the previous year to nearly VND 2,185 billion. Total liabilities stood at VND 7,975 billion, an increase of 39%, including approximately VND 1,500 billion in bond debt, a decrease of 12%.

Source: Becamex – Binh Phuoc

|

Turning back to BCM, this industrial giant from Binh Duong also recently announced that it had spent VND 400 billion to repurchase before the due date of the VND 2,000 billion bond, code BCMH2025002, issued on August 31, 2020, with a term of 5 years and maturing on August 31, 2025.

Having previously repurchased VND 800 billion, and with the recent repurchase, the remaining value of this bond is VND 800 billion.

Interestingly, BCM repurchased the bonds ahead of schedule despite successfully raising an additional VND 1,000 billion from bond issuance in August.

With the recent repurchase of VND 400 billion in bonds, BCM’s total bond debt now stands at over VND 12,800 billion.

BCM raises an additional VND 1,000 billion from bond issuance in August

The $40 Billion Bond Burden: Is Saigon Capital Thriving or Just Surviving?

Despite a notable improvement in financial performance compared to the previous year, Saigon Capital’s net profit for the first half of the year remains modest in comparison to the company’s total capital of nearly VND 5,000 billion.