In particular, Phong Liệu failed to disclose information within the prescribed time frame to the Hanoi Stock Exchange (HNX). The documents in question include financial statements, reports on the use of capital from bond issuances, and payments of interest and principal for the years 2021, the first half of 2022, and the full year 2022.

Additionally, Phong Liệu delayed the disclosure of reports on the issuer’s commitment fulfillment to bondholders for 2022, the audited semi-annual report for 2023 on the use of proceeds from bond issuances, and the repurchase results of PLWCH2135001 bonds (across five batches). The company also failed to timely disclose its 2023 financial statements.

Phong Liệu’s offenses were aggravated by their history of administrative violations. However, the company’s sincere remorse was considered a mitigating factor. Ultimately, the SBSV imposed a fine of 60 million dong, without any supplementary penalties or remedial measures.

Phong Liệu Wind Power JSC is known for its investment in the Phong Liệu Wind Power Plant project in Tan Thanh and Huong Tan communes, Huong Hoa district, Quang Tri province. The construction of the plant commenced in late 2019, alongside two other wind power plant projects: Phong Huy, developed by Phong Huy Wind Power JSC, and Phong Nguyen, by Phong Nguyen Wind Power JSC. All three projects have an installed capacity of 48MW and a total investment of 1,600 billion dong.

Established on August 15, 2019, Phong Liệu primarily operates in the electricity production industry and is headquartered in Xa Lang village, Da Krong commune, Da Krong district, Quang Tri province. The company’s initial chartered capital was 310 billion dong, with three founding shareholders: Mai Phong Investment JSC holding 99%, Da Krong Hydropower JSC, and Ms. Le Thi Ai Loan, each owning 1%. Mr. Vo Duy Tan served as both the Chairman of the Board of Directors and the Director of the Company.

Following several changes, as of December 2021, Phong Liệu’s chartered capital increased to 505 billion dong, while its ownership structure remains undisclosed.

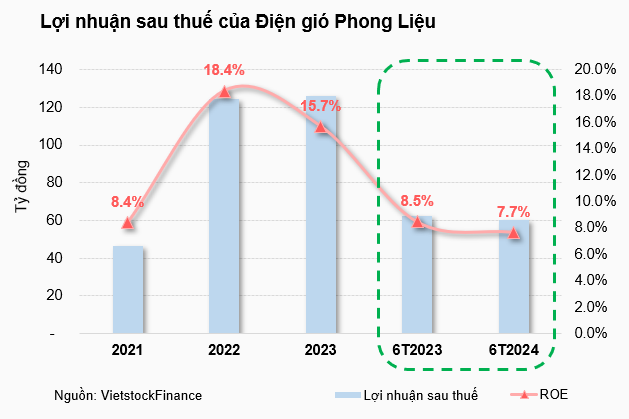

According to the periodic financial statements submitted to HNX, Phong Liệu recorded an after-tax profit of over 60 billion dong in the first half of 2024, a 4% decrease compared to the same period last year. This profit resulted in a decline in the company’s return on equity (ROE) from 8.5% in the previous year to 7.7%.

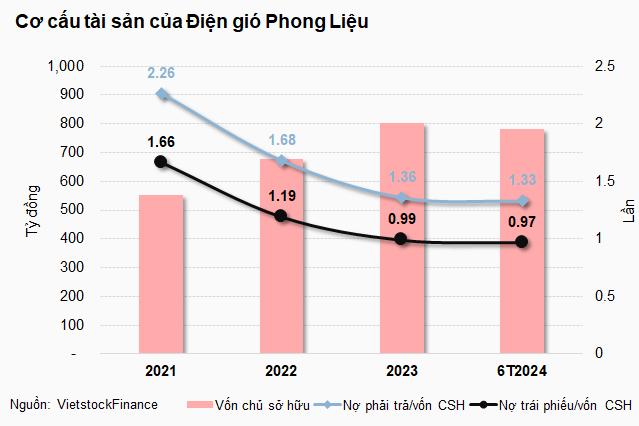

As of June 30, 2024, the company had nearly 1,040 billion dong in payables, a 5% decrease from the beginning of the year. Its debt-to-equity ratio stood at 1.33. Of the total payables, bond debt accounted for over 758 billion dong, a 4% decrease, resulting in a bond debt-to-equity ratio of 0.97.

Upon further investigation, it was found that the company has only one outstanding bond lot, PLWCH2135001, issued on June 18, 2021, and maturing on April 2, 2035. Military Commercial Joint Stock Bank (HOSE: MBB) serves as the bond registrar. This particular bond lot, for which Phong Liệu delayed reporting the repurchase results, contributed to the company’s violation and subsequent penalty.

With the issuance of 9,140 bonds, the company raised 914 billion dong at an annual interest rate of 8%, payable quarterly. The principal is due in a lump sum upon maturity. According to the latest update on HNX as of September 11, 7,610 bonds from this lot remain outstanding.

The Alluring August Affair: 43 Enterprises Embark on a Bond Odyssey, Raising a Whopping 38 Trillion VND

“The Vietnam Bond Market Association (VBMA) reported 43 private corporate bond issuances valued at VND 37,995 billion and 2 public issuances worth VND 11,000 billion in August 2024, based on data aggregated from HNX and SSC as of August 30, 2024.”

The Industrial Production Index in August 2024 Surges: A Robust 2.0% Month-Over-Month Increase.

Industrial production in August continued its positive growth trend, with an estimated increase of 2.0% compared to the previous month and a 9.5% rise from the same period last year. This marks a consistent upward trajectory, as the eight-month estimate for 2024 shows a solid 8.6% industrial production index growth year-on-year.

The New Bond Offering: Becamex IDC’s $211.5 Million Venture

Becamex IDC has successfully issued another bond offering, with the code BCMH2427003, raising VND 500 billion in capital. This 3-year bond issuance showcases the company’s continued financial strength and stability, reinforcing its position as a leading developer in the region.