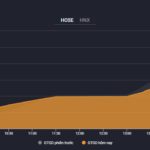

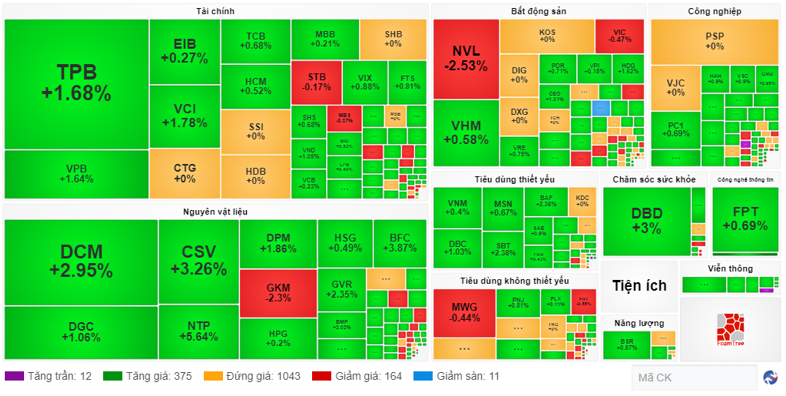

The market breadth saw 387 gainers with 12 stocks hitting the ceiling price, while there were 175 losers, including 11 stocks that dropped to the floor price. The remaining 1,043 stocks stayed flat.

Source: VietstockFinance

|

The liquidity of the 3 exchanges reached VND 3,774 billion, slightly lower than the previous session. Stocks from sectors with large market capitalization such as finance and real estate mostly witnessed positive movements. Financial stocks that gained notably included TPB up 1.68%, VPB up 1.64%, VCI up 1.78%, etc., while real estate stocks mostly rose slightly.

Additionally, the materials sector also attracted cash flow with NTP surging 5.64%, CSV up 3.26%, BFC climbing 3.87%, DCM rising 2.95%, GVR up 2.35%, DPM gaining 1.86%, etc.

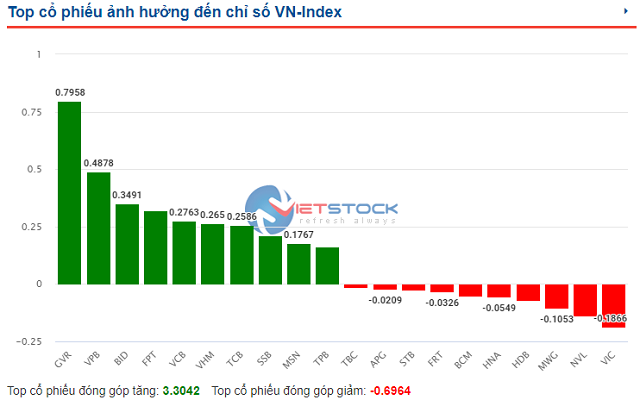

Among the aforementioned stocks, GVR also took the lead in terms of contribution to the VN-Index, with nearly 0.8 points. This was followed by VPB with nearly 0.5 points and BID with almost 0.4 points.

Source: VietstockFinance

|

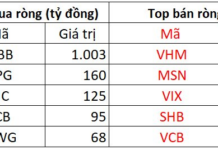

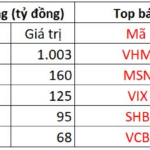

Foreign investors were net sellers to the tune of nearly VND 97 billion, with the selling pressure distributed across VPB at nearly VND 25 billion, NVL at over VND 18 billion, MWG at nearly VND 16 billion, VCI at almost VND 15 billion, HDB at approximately VND 13 billion, etc. On the other hand, foreign investors focused on net buying DCM at nearly VND 22 billion, CTG at over VND 16 billion, and TPB at around VND 14 billion.

Opening: Mild recovery, VNZ continues to surge to the ceiling price

After a series of sharp declines, the VN-Index started the trading session on September 12 with a recovery of 5.09 points to reach the 1,258.36 mark, while the green color also appeared on the HNX and UPCoM, increasing by 1.05 points to 232.5 and 0.12 points to 92.44, respectively.

Previously, US stocks had risen in a volatile session as investors weighed the latest US inflation data and its implications for the Fed’s policy stance. Tech stocks led the rebound from intraday lows.

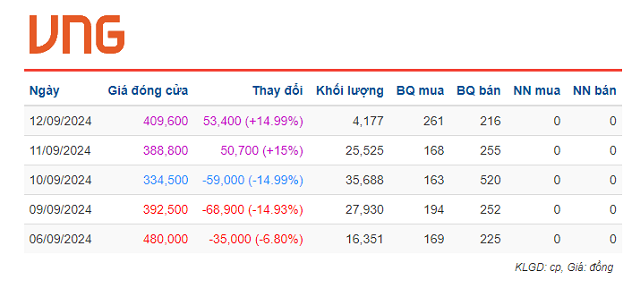

In the Vietnamese market, the morning session witnessed most industry groups in a positive state, with the media and entertainment sector leading the gains, surging by 10.54%. Within this sector, VNZ continued its upward momentum, soaring to the ceiling price with a 15% gain. This was followed by the food and staples retailing, and telecommunications services sectors, both climbing by over 1%.

Source: VietstockFinance

|

Only two sectors posted losses, namely household durables and personal products, and diversified consumer services. However, the losses were minimal, with both sectors hovering around the reference level.

The Most ‘Expensive’ Stock on the Stock Exchange Takes a Negative Turn

Today’s trading session (September 9) was relatively dull, with the value of stocks traded on the HoSE through matching orders hovering around VND 10 trillion, hitting a three-week low. Large-cap stocks were painted in red, and the market lacked driving force. The negative trend also continued for VNZ, the most expensive stock on the exchange, as shares of VNG Corporation continued to be heavily sold off.

The Stock Market is Primed for a New Uptrend; VN-Index Eyes 1,350 Points by Late 2024

According to Agriseco, the second half of this year will be pivotal for the new growth cycle leading up to 2025. With potential market upgrades on the horizon, this period is crucial for attracting foreign investment and setting the stage for a prosperous future.