As of 2 pm, the VN-Index maintained a slight gain of over 5 points, crossing the 1,258 mark. Similar fluctuations were observed in the HNX and UPCoM. The modest trading volume indicated that the buying force to “catch the bottom” was not significant after the market had witnessed considerable declines in the past.

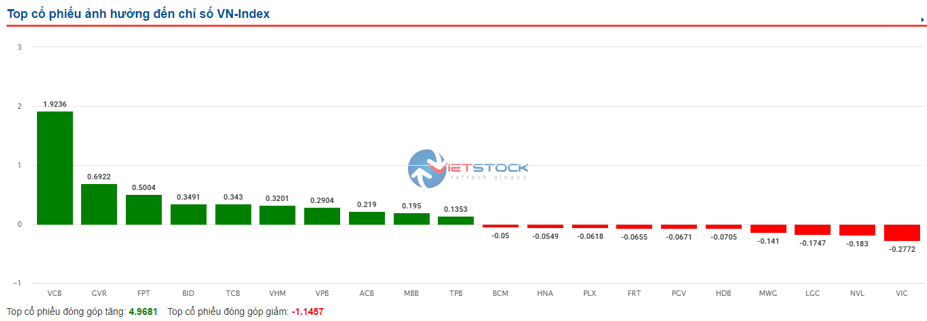

The green hue spread across various sectors and stocks, with 415 gainers versus 280 losers, while 909 stocks remained unchanged. However, the top 10 influential stocks significantly supported the VN-Index’s 5-point rise.

VCB took the lead, contributing over 1.9 points to the increase, followed by GVR with nearly 0.7 points, FPT with more than 0.5 points, and BID, TCB, and VHM, each adding over 0.3 points.

Source: VietstockFinance

|

AM Session: Mild Recovery, but Trading Volume Drops

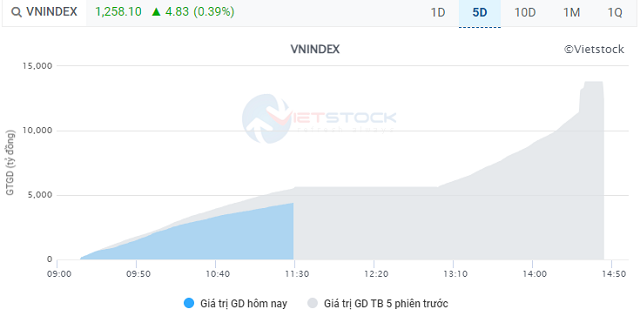

The VN-Index maintained its positive territory throughout the morning session, ending 4.83 points higher at 1,258.10. A similar scenario played out in the HNX and UPCoM, which rose 0.74 points to 232.2 and 0.23 points to 92.55, respectively. However, the trading volume weakened compared to the previous session and the five-day average.

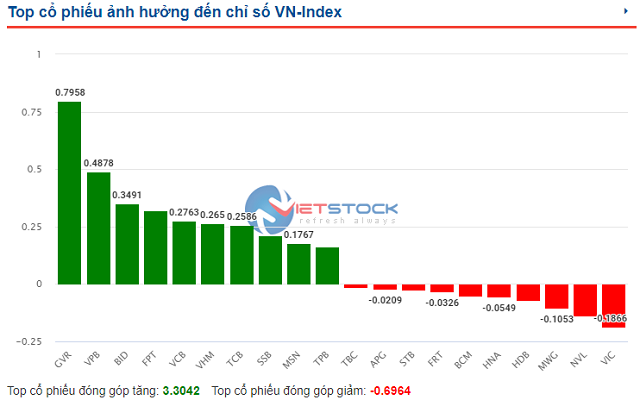

Several large-cap stocks positively contributed to the VN-Index’s gain, led by VCB, which added nearly 1.1 points, followed by GVR with almost 0.7 points and FPT with close to 0.4 points. In total, the top 10 stocks contributed approximately 3.4 points to the index’s increase.

In terms of sector performance, media and entertainment stocks continued to lead the gains, surging 10.61%, driven by VNZ’s 15% rally. The market also witnessed two other sectors climbing over 1%—telecommunications and transportation. On the downside, the semiconductor sector declined the most by 5.13% due to the pressure from VBH’s plunge.

The overall trading volume across the market was approximately VND 5.7 trillion, lower than the previous session and the five-day average.

|

Market trading volume dropped during the morning session of September 12

Source: VietstockFinance

|

Foreign investors net sold nearly VND 214 billion, focusing on VPB (over VND 38 billion), VCI (nearly VND 33 billion), MWG (over VND 24 billion), and HPG (more than VND 23 billion). On the buying side, DCM, FPT, CTG, and VHM received attention but couldn’t offset the selling pressure.

10:40 AM: Continuous Fluctuations to Maintain Positive Territory

The market started the morning session on a smooth note, entering a period of continuous fluctuations but generally retaining its positive bias. As of 10:30 AM, the VN-Index climbed 5.59 points to 1,258.86, while the HNX and UPCoM rose 1.16 points to 232.61 and 0.34 points to 92.66, respectively.

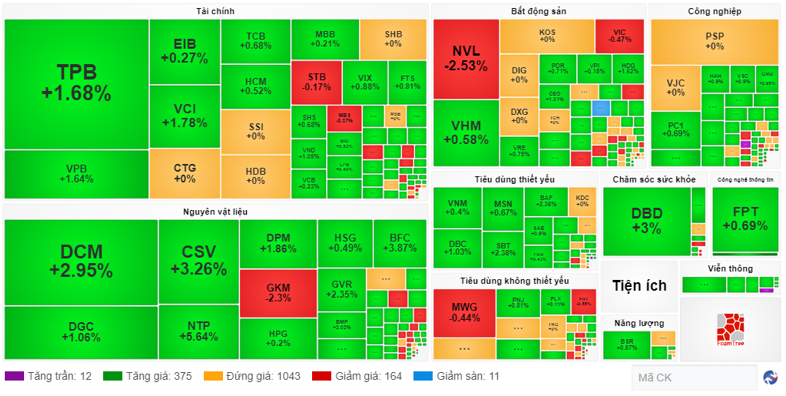

The market breadth witnessed 387 advancing stocks, including 12 at their ceiling prices, against 175 declining stocks, of which 11 hit their floor prices. The remaining 1,043 stocks were unchanged.

Source: VietstockFinance

|

The trading volume across the three exchanges stood at VND 3,774 billion, slightly lower than the previous session. Stocks from sectors with significant weightings in the market, such as financials and real estate, mostly exhibited positive dynamics. Financial stocks like TPB (+1.68%), VPB (+1.64%), and VCI (+1.78%) performed well, while real estate stocks mostly edged higher.

Additionally, the materials sector attracted cash flow, with NTP surging 5.64%, CSV climbing 3.26%, BFC rising 3.87%, DCM gaining 2.95%, GVR advancing 2.35%, and DPM increasing 1.86%.

Among these stocks, GVR also led in terms of point contributions to the VN-Index, adding nearly 0.8 points. VPB and BID followed closely, contributing almost 0.5 points and nearly 0.4 points, respectively.

Source: VietstockFinance

|

Foreign investors were net sellers for nearly VND 97 billion. The selling pressure was distributed across stocks, with VPB recording nearly VND 25 billion, NVL over VND 18 billion, MWG approximately VND 16 billion, and VCI nearly VND 15 billion. On the buying side, foreign investors concentrated their purchases on DCM (nearly VND 22 billion), CTG (over VND 16 billion), and TPB (around VND 14 billion).

Market Open: Mild Recovery, VNZ Continues to Surge

After a series of sharp declines, the VN-Index rebounded 5.09 points to 1,258.36 at the opening of the September 12 session. Simultaneously, the HNX and UPCoM also entered positive territory, rising 1.05 points to 232.5 and 0.12 points to 92.44, respectively.

Previously, US stocks advanced in a volatile session as investors assessed what the latest US inflation data meant for the Fed’s policy path. Tech stocks led the recovery from intraday lows.

In the Vietnamese market, most sectors started the morning session in the green, with media and entertainment leading the gains, surging 10.54%. VNZ continued its rally, hitting the upper limit with a 15% jump. The food and staples retailing sector and telecommunications sector both climbed over 1%.

Only two sectors traded in negative territory—household durables and personal products, and diversified services—but their declines were marginal, almost unchanged from the reference price.

Huy Khai