Closing the 12/09 trading session, the VN-Index closed at 1,256.35 points, up 3.08 points. During the session, the gain was pushed up to more than 7 points at some point. The green also appeared on HNX and UPCoM, with respective increases of 0.45 points to 231.90 and 0.4 points to 92.73.

|

Source: VietstockFinance

|

The market breadth was positive with 428 gainers, including 23 stocks hitting the ceiling price, while there were 281 losers, including 24 stocks falling to the floor price.

Notably, the top 10 stocks with a positive impact on the VN-Index brought in nearly 4.4 points, higher than the index’s gain. VCB took the lead with 1.5 points, followed by FPT with 0.6 points, VPB with 0.5 points,…

| Top stocks influencing the VN-Index |

Joining the green spread in the market, 14 sectors advanced, overwhelming 9 declining sectors, while the food and staples retailing sector traded sideways.

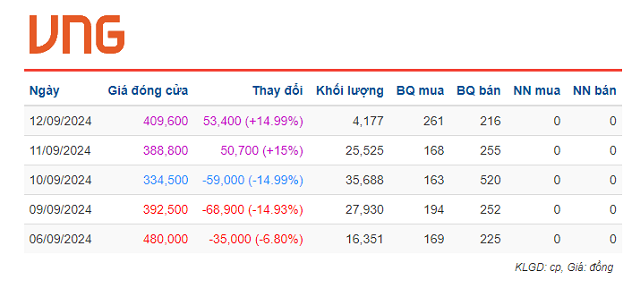

In the list of gainers, media and entertainment took the lead with a rise of up to 10.76%, mainly contributed by VNZ surging 15% and CAB increasing by 6.8%. Following were 3 sectors climbing over 1%, including telecommunications, software, and household and personal products.

In the losers’ list, most declines were not too strong, with only 2 sectors falling over 1% – healthcare and semiconductors.

The market liquidity was quite low, indicating that buying force had not really returned strongly. The total trading value on the 3 exchanges was less than VND12 trillion. Meanwhile, foreign investors’ trading size decreased, with a net sell value of over VND286 billion.

Net selling pressure was seen in many stocks, focusing on MWG with more than VND49 billion, VPB and VCI with over VND47 billion. Conversely, net buying was concentrated in FPT with over VND58 billion.

| Foreign investors’ net trading value by stock as of 12/09/2024 |

14:00: Green Spread, Pillar Stocks Create Highlight

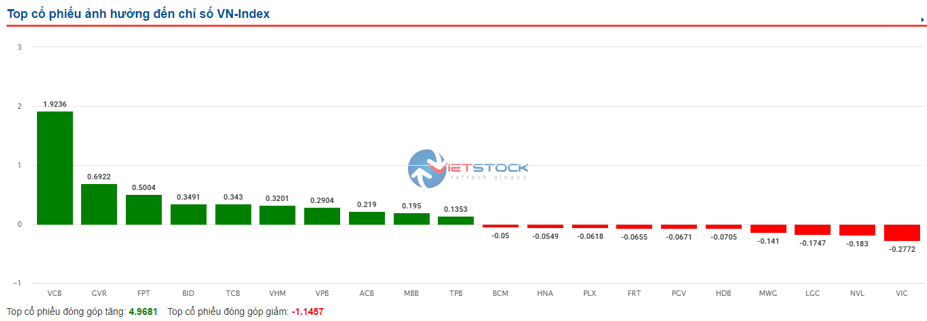

VN-Index continued to maintain its green status in the afternoon session with a spread presence in many industry groups, with the main contribution coming from pillar stocks with a large contribution to the overall gain.

As of 14:00, VN-Index still maintained a slight increase of over 5 points to stay above 1,258. Similar fluctuations also occurred on HNX and UPCoM. Liquidity remained low, indicating that the “bottom-fishing” force after the market had dropped significantly in the past time was not large.

It is easy to see the green spread to many industry groups and stocks, with 415 gainers while only 280 losers, and the remaining 909 stocks were stagnant. However, in the 5-point gain of VN-Index, there was a great contribution of nearly 5 points from the top 10 stocks with a positive impact.

Leading the list was VCB, which brought in more than 1.9 points, followed by GVR with nearly 0.7 points, FPT with more than 0.5 points, and BID, TCB, and VHM, which all contributed more than 0.3 points.

Source: VietstockFinance

|

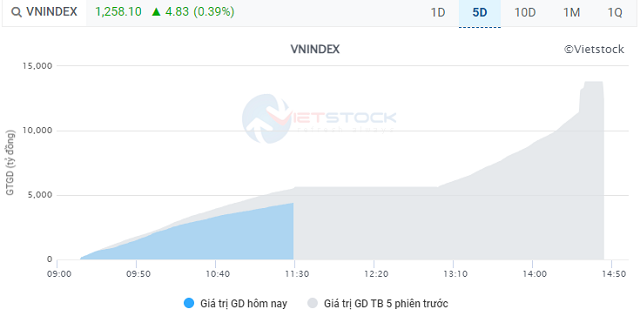

Morning session: Mild recovery but liquidity dropped

VN-Index maintained its green status throughout the morning session and ended with a gain of 4.83 points to 1,258.10 points. A similar scenario was seen on HNX and UPCoM, which rose 0.74 points to 232.2 and 0.23 points to 92.55, respectively. However, liquidity weakened compared to the previous session and the 5-session average.

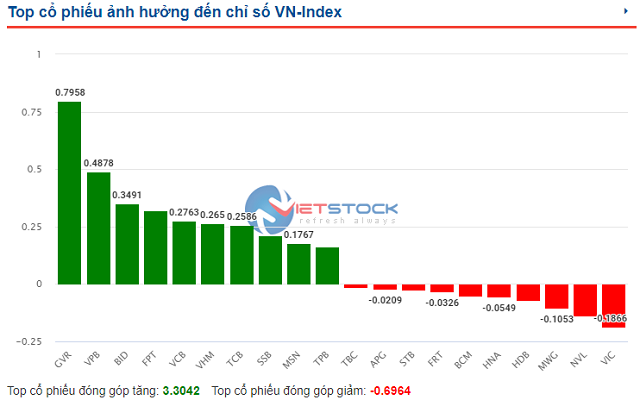

Many pillar stocks made positive contributions to VN-Index’s gain, led by VCB with nearly 1.1 points, GVR with nearly 0.7 points, FPT with nearly 0.4 points,…, and the top 10 stocks brought about 3.4 points in total.

In terms of sectors, media and entertainment stocks remained the top gainers with a rise of 10.61%, driven by VNZ surging 15%. The market also witnessed 2 other sectors climbing over 1% – telecommunications and transportation. On the losing side, semiconductors dropped the most with 5.13% due to selling pressure from VBH falling to the floor price.

The market liquidity was only about VND5.7 trillion, lower than that of the previous session and the 5-session average.

|

Market liquidity dropped in the morning session of 12/09

Source: VietstockFinance

|

Foreign investors net sold nearly VND214 billion, focusing on VPB with over VND38 billion, VCI with nearly VND33 billion, MWG with over VND24 billion, HPG with over VND23 billion, and many other stocks with net selling value decreasing evenly. On the buying side, DCM, FPT, CTG, and VHM received attention but were not strong enough to balance the selling force.

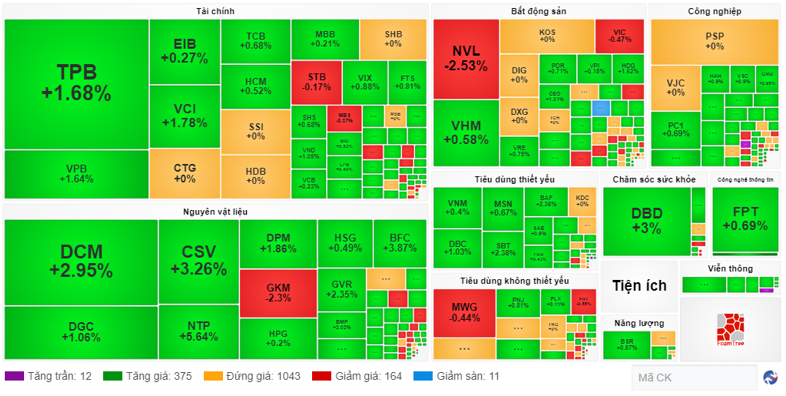

10:40: Continuous fluctuations to maintain the green status

The market started the morning session smoothly and then entered a continuous fluctuation phase but generally maintained its green status. As of 10:30, VN-Index rose 5.59 points to 1,258.86, HNX increased 1.16 points to 232.61, and UPCoM climbed 0.34 points to 92.66.

The market breadth had 387 gainers, including 12 stocks hitting the ceiling price, while there were 175 losers, including 11 stocks falling to the floor price, and the remaining 1,043 stocks were stagnant.

Source: VietstockFinance

|

The liquidity of the 3 exchanges was VND3,774 billion, slightly lower than that of the previous session. Many stocks in the large-cap sectors, such as finance and real estate, mostly witnessed positive movements. Financial stocks advanced well, such as TPB rising 1.68%, VPB climbing 1.64%, VCI increasing by 1.78%,…, and real estate stocks mostly inched higher.

In addition, the materials sector also attracted money with NTP surging 5.64%, CSV rising 3.26%, BFC climbing 3.87%, DCM increasing by 2.95%, GVR advancing 2.35%, DPM rising 1.86%,…

Among the above stocks, GVR also took the lead in terms of point contribution to VN-Index, with nearly 0.8 points. Following were VPB with nearly 0.5 points and BID with nearly 0.4 points.

Source: VietstockFinance

|

Foreign investors were net sellers of nearly VND97 billion, with the selling pressure decreasing evenly in VPB with nearly VND25 billion, NVL with over VND18 billion, MWG with nearly VND16 billion, VCI with nearly VND15 billion, HDB with nearly VND13 billion,…, while net buying was mostly focused on DCM with nearly VND22 billion, CTG with over VND16 billion, and TPB with nearly VND14 billion.

Opening: Mild recovery, VNZ continued to surge

After a series of sharp declines, VN-Index started the trading session on 12/09 with a gain of 5.09 points to 1,258.36 points, while the green also appeared on HNX and UPCoM, rising 1.05 points to 232.5 and 0.12 points to 92.44, respectively.

Previously, US stocks advanced in a volatile session as investors weighed what the latest US inflation data meant for the Fed’s policy. Tech stocks led the rebound from intraday lows.

In the Vietnamese market, most industry groups were in positive territory in the early morning session, with media and entertainment taking the lead with a gain of 10.54%, in which VNZ continued to surge 15%. Following were food and staples retailing and telecommunications, both climbing over 1%.

Source: VietstockFinance

|

Only 2 sectors declined – household and personal products, and diversified services and commerce, but both dropped slightly, almost at the reference level.