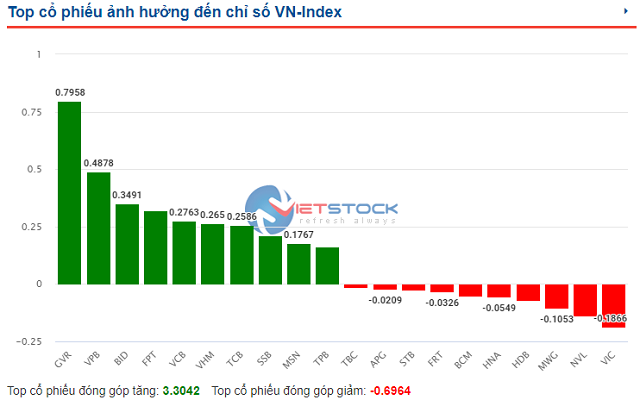

A number of large-cap stocks contributed positively to the VN-Index’s gain, led by VCB with nearly 1.1 points, followed by GVR with almost 0.7 points, and FPT with nearly 0.4 points. The top 10 performing stocks contributed a total of 3.4 points to the index’s increase.

In terms of sector performance, entertainment and media stocks continued to lead the market with a strong 10.61% gain, driven by VNZ‘s 15% surge. The telecom and transportation sectors also recorded impressive gains, both rising over 1%. On the downside, the semiconductor industry witnessed the sharpest decline of 5.13%, dragged down by VBH‘s fall.

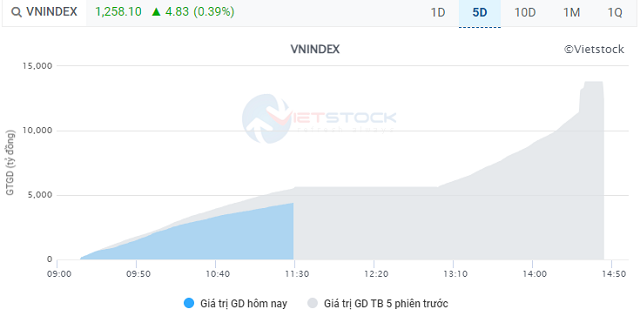

Market liquidity remained subdued at approximately 5.7 trillion VND, lower than the previous day’s average and the 5-day average.

|

Market liquidity declined during the morning session on September 12th

Source: VietstockFinance

|

Foreign investors net sold nearly 214 billion VND, focusing their sales on VPB (38 billion VND), VCI (33 billion VND), MWG (24 billion VND), and HPG (23 billion VND). On the buying side, DCM, FPT, CTG, and VHM attracted some interest, but it wasn’t enough to offset the selling pressure.

10:40 am: Market maintains its upward trajectory amid fluctuations

The market opened on a positive note and continued to fluctuate throughout the morning session. As of 10:30 am, the VN-Index had gained 5.59 points to reach 1,258.86, while the HNX and UPCoM indices rose 1.16 points and 0.34 points to close at 232.61 and 92.66, respectively.

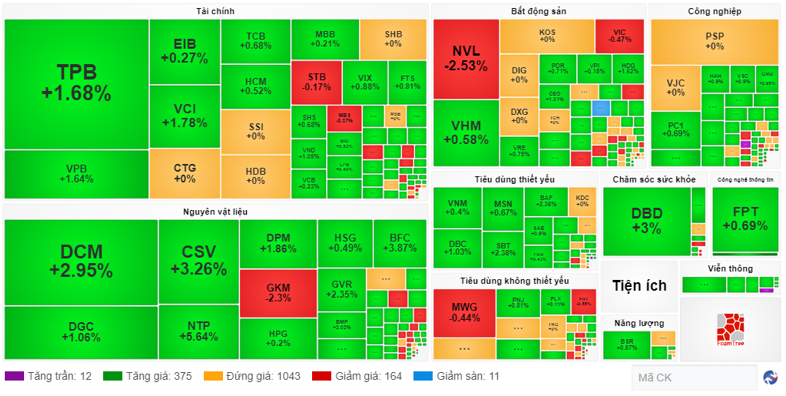

Market breadth was positive, with 387 stocks advancing (including 12 stocks that hit the ceiling price) and only 175 declining (including 11 at the floor price). The remaining 1,043 stocks remained unchanged.

Source: VietstockFinance

|

Total trading volume across the three exchanges stood at 3,774 billion VND, slightly lower than the previous day’s volume. Stocks from the financial and real estate sectors, which hold a significant weight in the market, mostly witnessed positive momentum. Notable gainers in the financial sector included TPB (up 1.68%), VPB (up 1.64%), and VCI (up 1.78%). Real estate stocks also mostly traded in the green, albeit with modest gains.

Additionally, the materials sector attracted strong buying interest, with notable gainers including NTP (up 5.64%), CSV (up 3.26%), BFC (up 3.87%), DCM (up 2.95%), GVR (up 2.35%), and DPM (up 1.86%).

Among these stocks, GVR made the largest contribution to the VN-Index’s gains, adding nearly 0.8 points. It was followed by VPB and BID, which contributed nearly 0.5 points and almost 0.4 points, respectively.

Source: VietstockFinance

|

Foreign investors net sold approximately 97 billion VND, with the selling pressure distributed across several stocks, including VPB (nearly 25 billion VND), NVL (over 18 billion VND), MWG (nearly 16 billion VND), VCI (almost 15 billion VND), and HDB (close to 13 billion VND). On the buying side, foreign investors concentrated their purchases on DCM (nearly 22 billion VND), CTG (over 16 billion VND), and TPB (around 14 billion VND).

Market Open: Modest recovery, VNZ continues its upward surge

After a series of sharp declines, the VN-Index rebounded at the start of the September 12 trading session, climbing 5.09 points to 1,258.36. The HNX and UPCoM indices also turned green, rising 1.05 points and 0.12 points to 232.5 and 92.44, respectively.

U.S. stock markets had also bounced back in a volatile session as investors weighed the latest inflation data and its potential impact on the Fed’s policy moves. Tech stocks led the recovery from intraday lows.

In the Vietnamese market, most sectors started the day in positive territory, with media and entertainment leading the gains, surging 10.54%. VNZ stood out with another 15% jump. The food retail and telecom sectors also rose over 1%.

Source: VietstockFinance

|

Only two sectors witnessed minor declines: household goods and personal items, and specialized services and trade. However, the losses in these sectors were negligible, with the indices barely moving from the reference point.

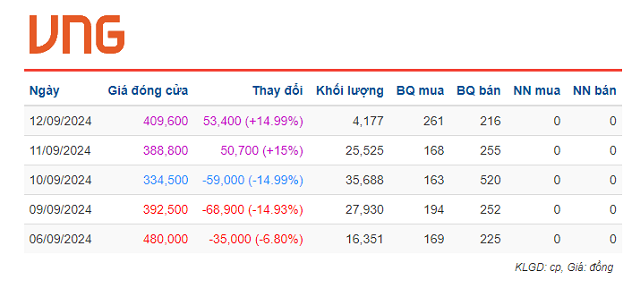

The Most ‘Expensive’ Stock on the Stock Exchange Takes a Negative Turn

Today’s trading session (September 9) was relatively dull, with the value of stocks traded on the HoSE through matching orders hovering around VND 10 trillion, hitting a three-week low. Large-cap stocks were painted in red, and the market lacked driving force. The negative trend also continued for VNZ, the most expensive stock on the exchange, as shares of VNG Corporation continued to be heavily sold off.