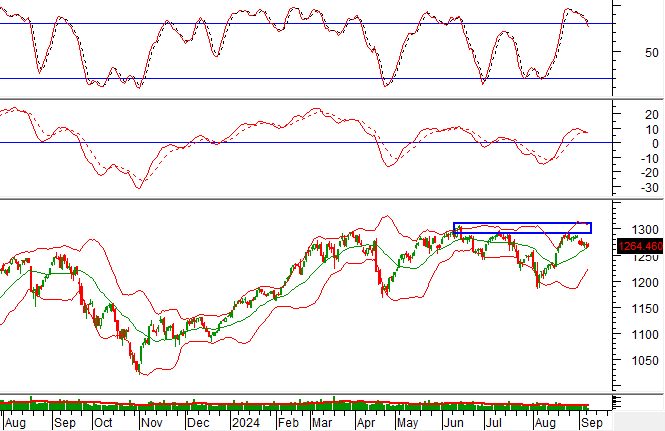

Technical Signals for the VN-Index

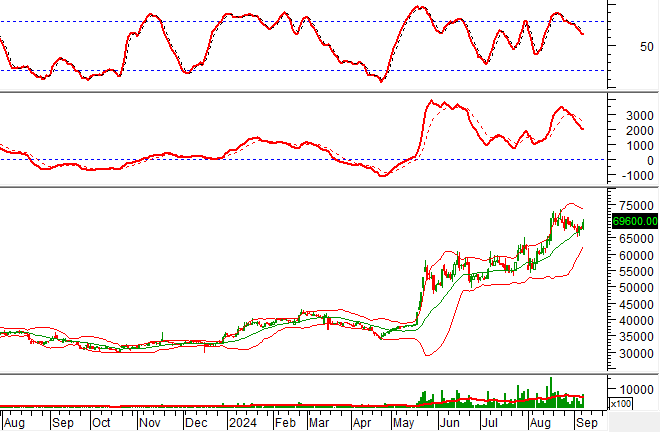

During the trading session on the morning of September 10, 2024, the VN-Index witnessed a decline, accompanied by a slight increase in trading volume. This indicates a lack of optimism among investors.

At present, the VN-Index is testing the Middle line of the Bollinger Bands, while the Stochastic Oscillator indicator continues to show a sell signal and has fallen out of the overbought zone. If the index falls below this support level, the risk of a downward adjustment is likely to increase in the upcoming sessions.

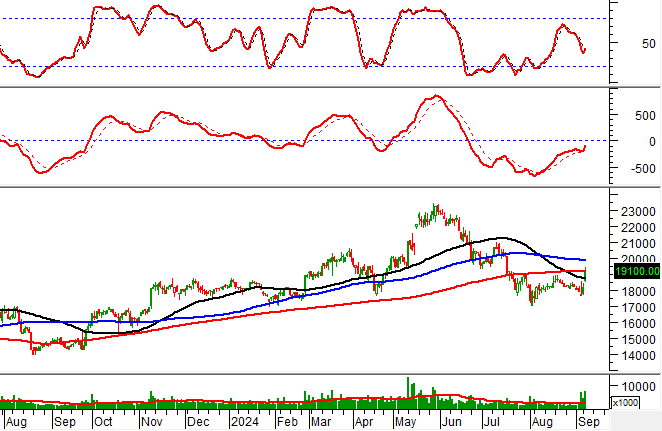

Technical Signals for the HNX-Index

On September 10, 2024, the HNX-Index also experienced a decline and formed a High Wave Candle pattern, while the trading volume slightly decreased. This reflects investors’ hesitation.

Additionally, the HNX-Index failed to retest the 38.2% Fibonacci Projection level (corresponding to the 233-237 point region) as the MACD indicator continues to diverge from the Signal line after previously giving a sell signal. This suggests that the short-term outlook remains pessimistic.

BAF – BAF Vietnam Agricultural Joint Stock Company

On the morning of September 10, 2024, BAF witnessed a strong surge and formed a Rising Window candlestick pattern, accompanied by above-average trading volume. This indicates active participation from investors.

Furthermore, the stock price is testing the group of SMA 50 and SMA 100 day moving averages, while the Stochastic indicator has provided a buy signal again. If the stock price successfully breaks above this resistance zone, an optimistic mid-term scenario is likely to unfold in the upcoming period.

NTP – NTP Plastic Joint Stock Company

During the morning session of September 10, 2024, NTP witnessed an increase in its stock price, along with a trading volume that surpassed the 20-session average, indicating a positive sentiment among investors.

Additionally, the stock price is testing the Middle line of the Bollinger Bands, and the MACD indicator is narrowing the gap with the Signal line after previously giving a sell signal. If a buy signal reappears in the upcoming sessions, the short-term upward trend is likely to resume.

Technical Analysis Team, Vietstock Consulting Department

The Most ‘Expensive’ Stock on the Stock Exchange Takes a Negative Turn

Today’s trading session (September 9) was relatively dull, with the value of stocks traded on the HoSE through matching orders hovering around VND 10 trillion, hitting a three-week low. Large-cap stocks were painted in red, and the market lacked driving force. The negative trend also continued for VNZ, the most expensive stock on the exchange, as shares of VNG Corporation continued to be heavily sold off.

The Stock Market is Primed for a New Uptrend; VN-Index Eyes 1,350 Points by Late 2024

According to Agriseco, the second half of this year will be pivotal for the new growth cycle leading up to 2025. With potential market upgrades on the horizon, this period is crucial for attracting foreign investment and setting the stage for a prosperous future.

The Rise of Vietnam’s Stock Market: 1.4 Million New Accounts Since January

As of the end of August, individual investors held over 8.6 million securities accounts, equivalent to approximately 8.6% of the population. This significant proportion of investors showcases a thriving personal investment landscape, with individuals taking an active interest in their financial future.