The annual General Meeting of Son La Sugarcane for the 2023-2024 term was held on the morning of September 5, with some shareholders proposing to increase the dividend ratio for the term from 100% to 200-250% in cash.

Following the vote, the meeting agreed to increase the dividend to VND 20,000/share, the highest amount since its listing on HNX in 2012. The company currently has nearly 9.8 million circulating shares and is estimated to spend nearly VND 196 billion on dividend payment.

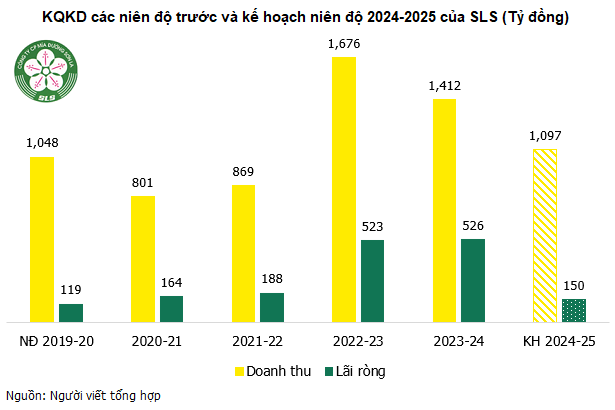

Son La Sugarcane’s huge dividend is thanks to a record net profit of over VND 526 billion in the 2023-2024 term, surpassing the profit plan by 284% as assigned by the General Meeting of Shareholders. The corresponding EPS reached VND 53,754.

This is not the first time SLS has increased its dividend ratio. In the 2022-2023 term, the company adjusted its dividend from VND 10,000/share as initially planned to VND 15,000/share, equivalent to nearly VND 147 billion (paid in mid-November 2023).

Since its listing on HNX in 2012, Son La Sugarcane has never forgotten to pay dividends to shareholders, with a rate of over 50% in cash. In the last three terms, the company has paid dividends of over 100%.

|

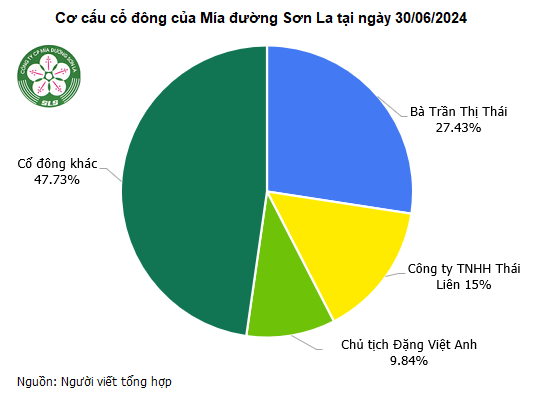

The biggest beneficiary is a group of shareholders related to Mr. Dang Viet Anh – Chairman of the Board of Directors of SLS, currently owning 52.27% of the capital. In particular, Mrs. Tran Thi Thai – Mr. Dang Viet Anh’s mother, owns 27.43% of the capital; Thai Lien Company owns 15% of the capital, and Mr. Dang Viet Anh owns 9.84%.

Thai Lien Company is a legal entity represented by Ms. Tran Thi Lien, Mrs. Thai’s sister, under the law.

For the 2024-2025 business plan (July 1, 2024 – June 30, 2025), Son La Sugarcane set a cautious target with expected revenue of VND 1,097 billion and net profit of VND 150 billion, down 22% and 71%, respectively, compared to the previous term.

SLS’s leaders said that in 2024, the company faced many difficulties when the world and domestic economies had not fully recovered, causing reduced purchasing power. In addition, climate change, drought, heat, and flooding in Son La severely affected the development of sugarcane area and yield.

Moreover, fierce competition from other crops has pushed the company’s sugarcane growing areas further away from the factory to particularly difficult areas. Smuggling and commercial fraud in sugar remain uncontrolled, causing sugar prices to drop and consumption to face many difficulties.

In the stock market, SLS’s market price has recently accelerated and is currently trading around VND 208,000/share, surging more than 22% in a quarter to a peak since its listing.

| SLS price chart since the beginning of 2024 |

The Manh

“The Power of Persuasion: Unlocking Shareholder Value with a Record-Breaking Dividend”

The price-to-earnings ratio (P/E) of this business is an incredibly low 3.5. This indicates a potential bargain for investors, as it’s a metric that showcases the company’s current share price relative to its earnings. A low P/E ratio can often signify an undervalued company, and this particular ratio is far below the industry average, presenting an intriguing opportunity for those seeking to invest.