PVI Insurance Corporation has recently reported approximately 240 loss reports (excluding motor and personal insurance) following the landfall of Storm No. 3 in Northern Vietnam. A company representative stated that the estimated compensation amount exceeds VND 400 billion.

“We are actively coordinating with relevant parties to handle losses as quickly as possible, minimizing procedures to ensure our customers’ benefits,” the company stated.

Storm No. 3 caused significant damage to several provinces and cities in Northern Vietnam, uprooting numerous trees and even toppling some onto cars and motorcycles owned by residents.

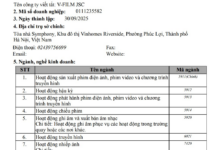

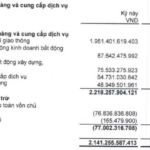

PVI Insurance is a wholly-owned subsidiary of PVI Joint Stock Company. In terms of financial performance, the company’s audited financial statements for the first half of 2024 showed a pre-tax accounting profit of VND 783 billion, an increase of VND 90 billion compared to the same period in 2023. After-tax profit was VND 659 billion, a rise of over VND 60 billion compared to the VND 595 billion recorded in the first half of last year.

As of June 30, 2024, PVI’s total assets amounted to VND 31,236 billion, an increase of nearly VND 4,300 billion from the beginning of the year. The company’s payables stood at over VND 22,518 billion, a significant increase from the figure of over VND 18,843 billion at the beginning of the year. This comprised mainly of short-term debt totaling more than VND 22,392 billion, compared to over VND 18,697 billion at the start of the year. Long-term debt, on the other hand, was slightly higher at over VND 126 billion, up from VND 146 billion in the previous year.

PVI’s equity capital reached VND 8,718 billion, an increase of nearly VND 700 billion from the beginning of the year. The company also had over VND 1,745 billion in undistributed post-tax profits and more than VND 3,716 billion in share capital surplus.

Additionally, PVI Insurance has received approval from the Ministry of Finance to increase its charter capital from VND 3,500 billion to VND 3,900 billion. This is the second time the company has raised its charter capital within the last five months. Previously, on March 29, the company also received a business license to increase its charter capital from VND 3,300 billion to VND 3,500 billion.

Alongside PVI Insurance, several other insurance companies are also handling compensation claims from customers, including Bao Minh, MIC, PTI, and PJICO.

Prior to this, on September 9, the Department of Management and Supervision of Insurance (Ministry of Finance) sent a document to the Vietnam Insurance Association and insurance businesses, requesting a report on the damage and compensation related to Storm Yagi (Storm No. 3). Specifically, the department requested insurance companies to actively coordinate with agencies, organizations, and individuals to determine losses regarding human life and property of insured organizations and individuals.

Notably, insurance companies were instructed to make advance payments and promptly compensate the insured and beneficiaries in full and on time, in accordance with the contract and legal provisions.

“Bank Assesses Storm Damage to Restructure Debt and Reduce Loan Interest for Customers”

The banking sector is actively collating and updating information regarding the extent of damage incurred by their clients. While there has been no official announcement regarding specific relief measures for affected customers, such as repayment extensions, waivers, or reduced interest rates, banks are working to assess the situation and formulate appropriate support strategies.

The Perfect Headline:

“Financial Relief for Quang Ninh: Exploring Credit Support for Customers Affected by Storm No. 3”

The Chairman of the People’s Committee of Mong Cai City has requested that banks defer debt and reduce interest rates on existing loans. In addition, they are encouraging new unsecured loans to provide much-needed financial support to local businesses and citizens. This initiative aims to stimulate economic growth in the area by enabling easier access to capital for reinvestment and business operations.

The Storm Yagi Claims: Insurance Payouts Before September 12th

The Insurance Supervisory Authority (Ministry of Finance) has requested that insurance companies submit a report on damage and insurance claim settlements by September 12th.