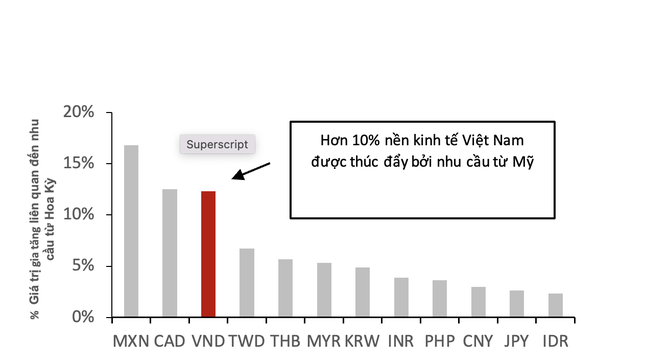

Michael Kokalari, Director of Macroeconomic Analysis and Market Research at VinaCapital, noted that Vietnam is one of the three countries in the world with the closest economic ties to the US. Strong US consumption is driving the recovery of Vietnam’s exports, manufacturing, and GDP growth.

According to Mr. Kokalari, this close link answers many questions that VinaCapital has recently received on this topic, especially as the US presidential election draws near and the US economy slows down, possibly leading the Fed to cut interest rates in September.

In short, the result of the US presidential election will not significantly impact Vietnam, regardless of which party wins in November, as the policies of the Democratic and Republican parties have more similarities than differences.

Regarding the slowing US economy, US consumption has continued to recover well this year, despite the Fed’s record interest rate hikes, due to the “K-shaped” economic dynamics in the US. This recovery disproportionately benefits Vietnam because, according to OECD analysis of “input-output linkages between countries,” US economic developments affect Vietnam more than any other country in the world, except for Canada and Mexico.

Strong demand for “Made in Vietnam” products from US consumers has boosted Vietnam’s export recovery to the US, from a 21% decline in the first seven months of 2023 to a 24% increase in the same period this year, driving manufacturing up by 10%.

Manufacturing accounts for a quarter of Vietnam’s economy, so the recovery in manufacturing is likely to lift Vietnam’s GDP growth from 5.1% in 2023 to 6.5% this year.

Vietnam is ramping up infrastructure investment.

According to VinaCapital, the Vietnamese economy is being supported by the “K-shaped” economic dynamics in the US this year. While the Fed has raised interest rates in the US to curb inflation, instead of cooling the US economy, higher interest rates have stimulated increased spending from wealthy US consumers, represented by the upper part of the “K” in the “K-shaped” economy. These consumers are now earning higher investment incomes from their savings and are spending this “surprise income” on various products, including those “Made in Vietnam.”

“We believe that US consumer demand for ‘Made in Vietnam’ products will slow down but not decline sharply in early 2025. We are optimistic that the recovery in Vietnam’s real estate sector and infrastructure investment will help boost GDP growth,” said Michael Kokalari.

Additionally, Vietnam recently raised its GDP growth target for this year from 6.5% to 7%, demonstrating the government’s determination to maintain strong economic growth. The two main levers that the government can use to accelerate GDP growth in the short term are increasing the number of approvals for new real estate projects in Vietnam and ramping up infrastructure investment.

The Vice Prime Minister Meets with Leading Hong Kong Conglomerates.

On the afternoon of September 10, immediately upon arriving in Hong Kong, China, to attend the 9th Belt and Road Summit at the invitation of the Chief Executive of the Hong Kong Special Administrative Region, Mr. John Lee, Vietnam’s Permanent Deputy Prime Minister, Mr. Nguyen Hoa Binh, met with leaders of several of Hong Kong’s foremost business groups, which have significant cooperative investments in Vietnam.

The Storm’s Wake: Businesses Battered by Yagi’s Fury

Super Typhoon Yagi, the most powerful storm to hit Asia in 2024 so far, wreaked havoc on Vietnam’s infrastructure and industrial facilities.

Request to Halt Operations on Vulnerable Bridges Amid High Water Levels

The collapse of the Phong Chau Bridge in Phu Tho has prompted the Vietnam Road Administration to take immediate action. They have mandated a temporary cessation of traffic on bridges deemed unsafe due to natural disasters, high water levels, strong currents, or structural weakness. This proactive measure ensures the safety of commuters and highlights the administration’s commitment to maintaining a robust and secure transportation network across Vietnam.

[Infographic] Flood Levels in the Northern Regions Over the Next 24 Hours

There is a high risk of flooding in the low-lying areas along the river banks in the provinces of Lang Son, Cao Bang, Lao Cai, Yen Bai, Phu Tho, Bac Giang, Bac Kan, Thai Nguyen, Hoa Binh, Ninh Binh, and Thanh Hoa. In addition, the threat of flash floods and landslides looms over the mountainous regions of Northern Vietnam and Thanh Hoa province.

Master the Derivatives Stock Market and Earn Real Money with DNSE’s Online Competition

The rapid development of Vietnam’s derivatives market has presented savvy investors with a plethora of exciting opportunities to boost their income by keeping pace with global trends.

![[Infographic] Flood Levels in the Northern Regions Over the Next 24 Hours](https://xe.today/wp-content/uploads/2024/09/lu-kv-mien-150x150.jpg)