Oil rig in the ocean with a beautiful sunset backdrop

US Crude Oil Prices Rise by Over $2 per Barrel

Oil prices climbed over 2%, driven by concerns of prolonged production disruptions at US offshore oil fields as Hurricane Francine passed through on its way to making landfall in Louisiana.

On September 11th, Brent crude oil settled at $70.61 per barrel, up $1.42 or 2.05%, while WTI crude oil rose $1.56 or 2.37% to $67.31 per barrel. In the previous session, both oil benchmarks had declined, with Brent falling below $70 per barrel – its lowest since December 2021 – and US WTI crude dropping to its lowest since May 2023, after OPEC downwardly revised its 2024 global oil demand growth forecast for the second time.

The market was also pressured by concerns that Hurricane Francine would disrupt production in the US, the world’s largest producer.

Meanwhile, oil prices rose despite a build in US crude inventories for the week ending September 6, 2024. Inventories rose by 833,000 barrels to 419.1 million barrels, according to the EIA, slightly lower than the 987,000-barrel increase expected by analysts.

US Natural Gas Prices Climb 2%

Natural gas prices in the US rose 2% as energy producers continued to curb output ahead of the anticipated landfall of the hurricane along the Louisiana coast.

October 2024 natural gas futures on the New York Mercantile Exchange climbed 3.8 US cents, or 1.7%, to $2.27 per mmBTU.

Gold Prices Dip

Gold prices slipped as the US dollar and Treasury yields strengthened following US inflation data, which caused investors to temper their expectations for an interest rate cut by the Federal Reserve next week.

Spot gold on the LBMA fell 0.1% to $2,513.19 an ounce, while gold futures for December 2024 delivery on the New York Mercantile Exchange were unchanged at $2,542.40 an ounce.

US consumer prices rose slightly in August 2024, but underlying inflation remained muted, suggesting that the Fed may not need to cut rates by half a percentage point next week.

Nickel and Copper Prices Advance

Nickel prices rose after top producer Russia proposed banning exports of metals used in battery production to retaliate against Western sanctions related to the Ukraine conflict.

Three-month nickel on the London Metal Exchange climbed 2.6% to $16,145 a ton after Russian President Vladimir Putin indicated that Moscow would consider restricting exports of uranium, titanium, and nickel.

Russia is the world’s largest producer of refined nickel and a key supplier to China and Europe.

Meanwhile, three-month copper on the LME gained 0.9% to $9,105 a ton.

Iron Ore and Steel Prices Rally

Iron ore prices on the Dalian Commodity Exchange rose due to increasing exports and decreasing supply in China, overshadowing concerns about weakening demand prospects in the top consumer and a faltering global economy.

January 2025 iron ore futures on the Dalian exchange climbed 1.09% to 694 CNY ($97.56) per ton, while October 2024 iron ore futures on the Singapore Exchange rose 2.52% to $92.90 per ton.

On the Shanghai Futures Exchange, steel rebar climbed 1.6%, hot-rolled coil added 1.37%, steel wire gained 1%, and stainless steel inched up 0.15%.

Rubber Prices in Japan Break Three-Day Winning Streak

Rubber prices in Japan snapped a three-day winning streak, pressured by a stronger yen and mixed trade data from China, which clouded the demand outlook from the world’s top consumer.

February 2025 rubber futures on the Osaka Exchange fell 7.8 JPY, or 2.16%, to 352.7 JPY ($2.50) per kg. Meanwhile, January 2025 rubber futures on the Shanghai Futures Exchange dropped 100 CNY, or 0.59%, to 16,745 CNY ($2,354.01) per ton.

October 2024 rubber futures on the Singapore Exchange, however, bucked the trend and rose 0.4% to 182.9 US cents per kg.

Robusta Coffee Prices Hit Near 16-Year High

Robusta coffee prices climbed to their highest level in nearly 16 years during the August 30, 2024 session, driven by tight supplies.

November 2024 robusta coffee futures on the London ICE rose $111, or 2.3%, to $5,008 per ton. Exports of robusta coffee from Brazil, the world’s third-largest exporter, rose 31% in August 2024.

In contrast, robusta coffee exports from Vietnam, the world’s largest producer, fell 12.1% in the first eight months of 2024 compared to the same period last year.

Meanwhile, December 2024 arabica coffee futures on the ICE fell 0.2% to $2,466.50 per lb.

Sugar Prices Sweeten

October 2024 raw sugar futures on the ICE rose 0.36 US cent, or 1.4%, to 18.73 US cents per lb, rebounding from a 1.9% drop in the previous session.

October 2024 white sugar futures on the London market climbed 2% to $529.10 per ton.

Wheat Prices Reach One-Week High, Soybeans and Corn Advance

US wheat prices climbed to a one-week high, supported by expectations of potentially lower exports from the Black Sea region.

On the Chicago Board of Trade, December 2024 wheat futures rose 5 US cents to $5.79-1/4 per bushel after touching $5.82-1/4, the highest since September 4, 2024. November 2024 soybean futures added 3-1/4 US cents to $10-1/2 per bushel, while December 2024 corn gained 1/2 US cent to $4.04-3/4 per bushel.

Palm Oil Prices Climb

Palm oil prices in Malaysia advanced after data showed that stocks in August 2024 were lower than expected in the world’s second-largest producer.

November 2024 palm oil futures on the Bursa Malaysia Exchange rose 16 ringgit, or 0.41%, to 3,901 ringgit per ton.

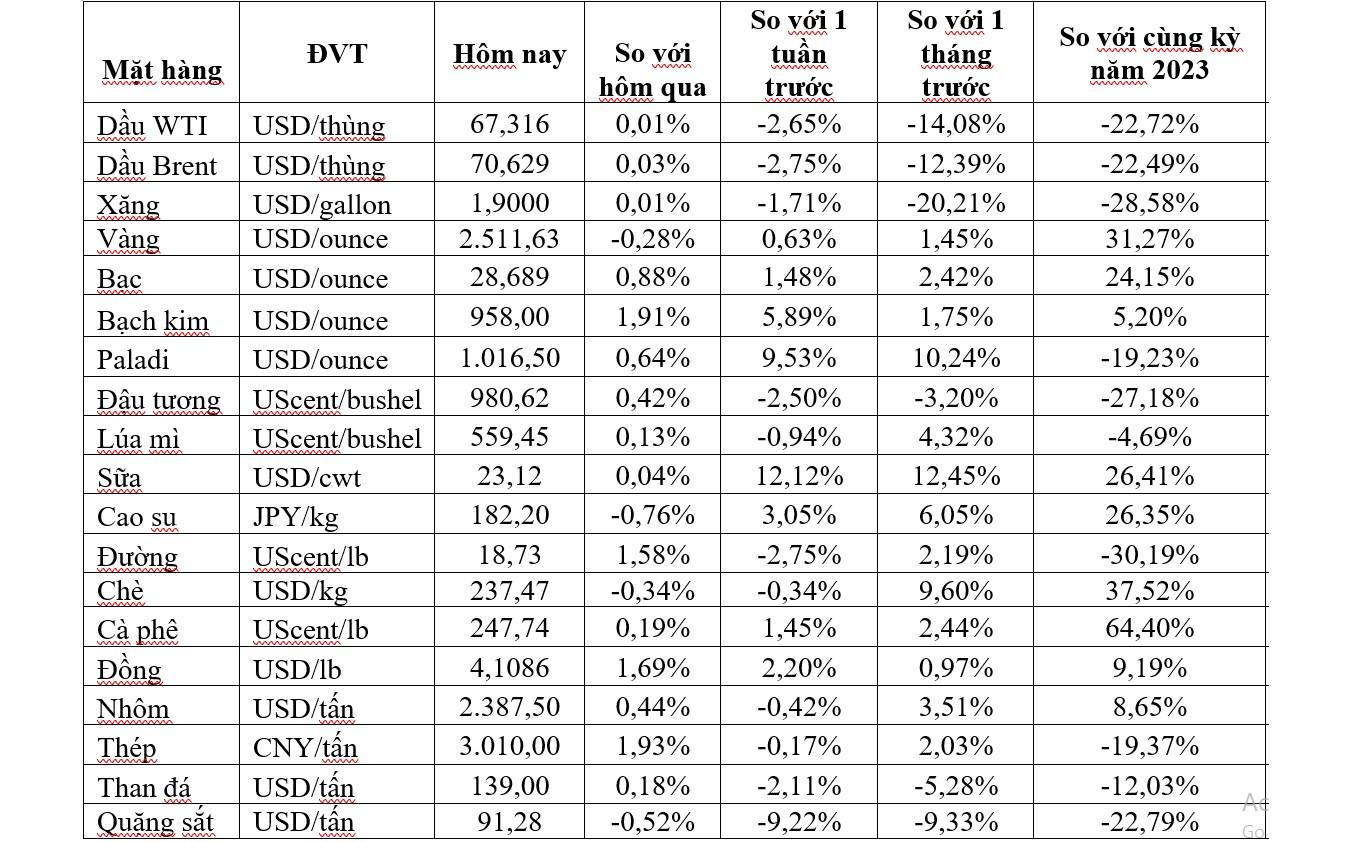

Prices of Key Commodities on September 12 Morning

Assorted commodities including oil, natural gas, gold, nickel, copper, iron ore, rubber, coffee, sugar, wheat, and palm oil

The Market on 9/11: Brent Crude Oil Plummets to Near 3-Year Low, Gold Surges Past $2,500 per Ounce

As of the market close on September 10th, Brent crude oil prices hit a near three-year low, nickel plunged to a six-week low, and zinc tumbled to a near four-week low. Meanwhile, gold rallied, surpassing the $2,500 per ounce mark.

Unveiling a Special Change Before the iPhone 16 Launch: A Feature Many Vietnamese Will Love

Before the iPhone 16’s grand unveiling, a particular change was revealed that many Vietnamese consumers will undoubtedly appreciate.