Samsung has been nurturing the dream of creating a safe digital wallet for its users for over a decade. In 2013, Samsung took the first step by partnering with VISA and MasterCard to make mobile payments a reality, while the industry was still skeptical about the utility of NFC (Near Field Communication) technology. Just two years later, at the Mobile World Congress in Barcelona in 2015, Samsung Pay for payment processing and Samsung Pass for biometrics were introduced.

A safe digital wallet has been Samsung’s dream for over a decade.

Samsung’s journey began with understanding users’ desires for a secure payment method. Over the next decade, they continuously enhanced the features and security of their wallet. In 2022, Samsung Pay and Samsung Pass merged to become Samsung Wallet. While simplifying the number of apps and operations, Samsung Wallet exponentially increased the security layers by combining physical storage safety and digital data protection.

Safer than physical card storage

Samsung Wallet offers a rich digital life with trusted partners and developers.

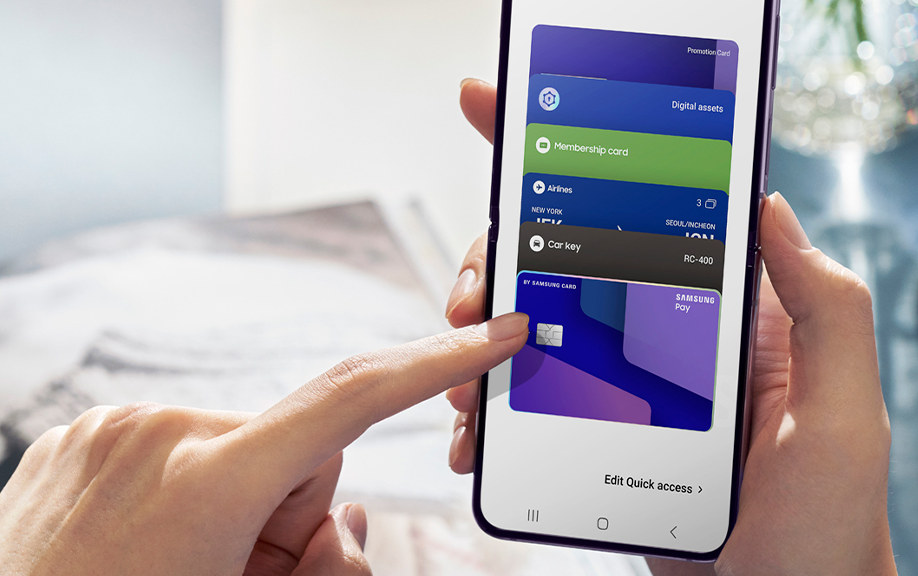

Through collaborations with trusted partners and developers, Samsung Wallet consistently adds features that enrich the digital 4.0 lifestyle. Users experience a sense of relief as they add cards to their digital wallet, eliminating the worries of losing important physical cards or forgetting their wallet at home.

Starting with payment and credit cards, Samsung Wallet then delved into the smaller yet essential needs of modern life. It integrated supermarket loyalty cards, gift cards, discount coupons, and more. Instead of carrying a bulky physical wallet, users can now effortlessly tap their digital wallet to make contactless payments anywhere, anytime with NFC, as well as make online payments with just a few quick steps.

Samsung Wallet also continuously expands its storage capabilities to include travel and entertainment services. This compact app, occupying a modest space on the massive screens of the Galaxy Z Fold6 or Galaxy Z Flip6, efficiently stores movie tickets, tourist attraction tickets, gym membership cards, boarding passes, and more, allowing users to bid farewell to the hassle of paper tickets.

Beyond just a payment service, Samsung Wallet now integrates with SmartThings, enabling the storage of digital home and car keys. Samsung’s collaboration with BMW optimizes the journey of unlocking and starting the car seamlessly with the phone, even allowing users to turn on the air conditioning when they are near the vehicle, offering a luxurious experience to car owners.

“By combining Samsung’s advanced technology with our partners’ diverse services, we aim to make payment more convenient and digital life easier than ever through a unified and unique platform,” emphasized a Samsung representative.

Samsung Wallet offers instant and secure storage of multiple cards.

On the Galaxy Z Fold6 and Galaxy Z Flip6, Samsung Wallet simplifies the process of storing multiple cards instantly and securely. Users can simply tap the back of their phone on a contactless card, and the wallet will quickly capture the information without the need for camera scanning or manual data entry.

Additionally, Samsung Wallet optimizes four different access methods to cater to users’ frequent needs, offering quicker access than fumbling through pockets for a physical wallet, plastic cards, paper tickets, or keys. Users can access their wallet with just one swipe from the bottom when the screen is off, on the standby screen, lock screen, or by double-tapping the power button.

Robust security for digital payment data

Security is Samsung’s top priority when it comes to digital wallets, as any payment vulnerabilities can result in financial losses for users. Therefore, Samsung Wallet continuously fortifies its data protection and safeguards users’ digital lives.

The first layer of security that users directly experience is the biometric identification and authentication service provided by Samsung Pass, which includes fingerprint and iris recognition. Each transaction is secured with a single touch, eliminating the hassle of remembering multiple passwords for financial applications.

The second layer is the Samsung Knox multi-layered defense platform, integrated directly into the smartphone chip, which employs data encryption to safeguard cards and sensitive personal information from threats and malware. The effectiveness of Knox is attested by various international standards, including CC from NIAP (USA), FIPS 140-2 from NIST (USA), STIGs from DISA (USA), and the 2023 CES Innovation Award from CTA (USA).

Samsung Knox provides robust multi-layered defense for data protection.

In conjunction with Samsung Knox, some critical data in Samsung Wallet is stored in an isolated environment, embedded in the Secure Element, to fortify protection against hackers.

With the recently launched Galaxy Z Fold6 and Galaxy Z Flip6, Samsung Wallet reinforces its commitment to optimizing security for its users. These devices will be among the first to receive the latest Samsung Knox updates and will benefit from continuous security updates for the next seven years.

With a host of innovations in storage and security, Samsung Wallet promises to be the go-to comprehensive solution for digital users.