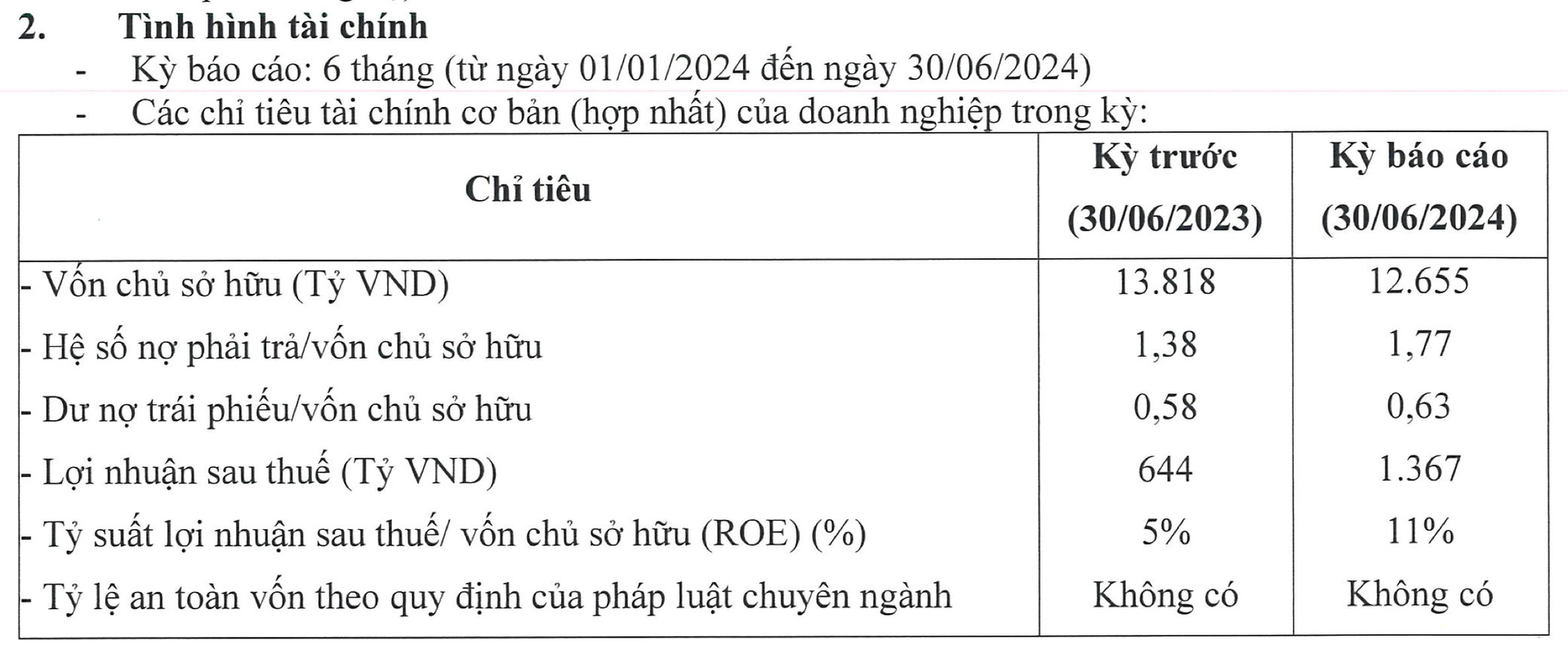

Phu My Hung Development Corporation has released its business results for the first half of 2024. Notably, the company reported a post-tax profit of 1,367 billion VND, more than doubling its profit from the same period last year.

As of June 30, 2024, Phu My Hung’s owner’s equity stood at nearly 12,655 billion VND, a decrease compared to the previous year. Its liabilities amounted to 22,399 billion VND, with bond debt reaching nearly 8,000 billion VND. Thus, its total assets exceeded 35,000 billion VND.

Currently, Phu My Hung has 3 lots of bonds issued in the domestic market and 3 lots issued internationally.

Out of the 3 lots of domestically issued bonds, with a total value of 2,000 billion VND, the interest rates range from 7.15% to 8.8% per annum, and they will all mature in 2026. On the other hand, the 3 lots of internationally issued bonds have a total value of 305 million USD.

Phu My Hung Development Corporation was established in December 2008 and is the investor of the Phu My Hung urban area project in District 7, Ho Chi Minh City.

Phu My Hung has a charter capital of 954 billion VND. Of this, foreign capital accounts for 70% (contributed in foreign currency) and is held by Phu My Hung Asia Holdings Corporation, a company based in Cayman Island and a subsidiary of the Taiwanese CT&D Group.

The remaining capital is contributed by Tan Thuan Industrial Promotion Company Limited (IPC) in the form of land use rights.

IPC is a state-owned enterprise wholly owned by the Ho Chi Minh City People’s Committee, currently under the leadership of Mr. Lam Hoai Anh, who serves as its Director and legal representative.

The Profitable Flamingo: How the Resort Chain Soared to Success in 2024

Flamingo Holdings has just released its financial report for the first half of 2024, and the results are impressive. The company has seen significant growth in both revenue and profit, surpassing expectations and setting a strong precedent for the remainder of the year. With a strong performance across the board, Flamingo Holdings is poised for continued success and a bright future ahead.

“Dragonfruit’s American Dream: How Vietnamese Pitahaya Receives its US ‘Visa’, Sending Export Giant’s Stocks Soaring.”

Investors who purchase this stock on or before September 10th will not be entitled to the 10% stock dividend.