The stock market continued its downward trend in the week following the 02/09 holiday break, with the VN-Index falling by almost 1% to 1,274 points and the HNX-Index dropping by 1.2% to 234.65 points.

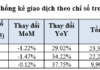

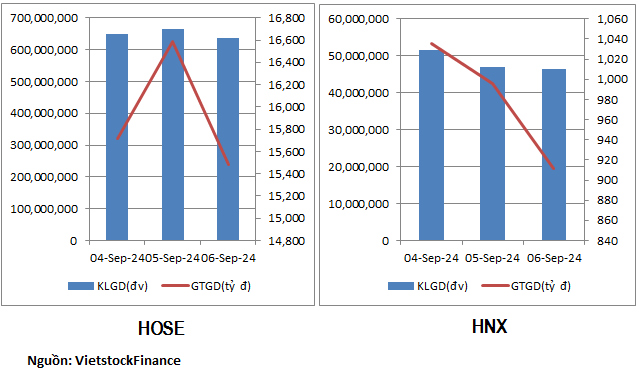

Trading liquidity remained lackluster as volumes declined on both exchanges. On the HOSE exchange, transaction values rose slightly by over 1%, reaching nearly VND 16,000 billion per session, while trading volume decreased by 3.2% to 650 million units per session, indicating a preference for large-cap stocks.

Meanwhile, liquidity on the HNX exchange weakened, with an 8% and 6% drop in trading volume and value, respectively, to 48.3 million units and VND 981 billion per session.

|

Market Liquidity Overview for Week of 04 – 06/09

|

The flow of capital was uncertain in the past trading week, with no standout sector attracting funds. Instead, a few individual stocks stood out.

Two certificates, E1VFVN30 and FUEVFVND, were among the top gainers in liquidity, with trading volumes increasing by 400% and nearly 150%, respectively.

In terms of liquidity increase, DSE ranked second on the HOSE exchange, with an average trading volume increase of over 250% to 460,000 units per session. The share price also rose by 6.6%.

On the HNX exchange, TTH recorded a 238% increase in trading volume, leading the pack in liquidity growth. The share price rose by nearly 3.6%, reaching VND 2,900 per share.

CMS ranked second on the HNX exchange, with a 145% increase in trading volume to over 400,000 units per session. The share price, however, plummeted by 20% during the week following news of the prosecution of a “pump-and-dump” scheme involving this stock.

Oil and gas stocks attracted significant interest last week. PVS, PVB, and PVC all witnessed increased trading activity on the HNX exchange.

On the other hand, the real estate sector continued to experience capital outflows. On both exchanges, numerous real estate stocks fell into the category of significant declines in liquidity. TDC, VPH, FIR, LDG, BCM, HQC, SCR, IDJ, VC7, DTD, TIG, CEO, and AVV were among the names that saw substantial decreases in trading volume compared to the previous week, with TDC experiencing a 70% drop.

While most of these liquidity-drained real estate stocks witnessed price declines, the decreases were not significant.

|

Top 20 Stocks with Highest Liquidity Increase/Decrease on HOSE Exchange

|

|

Top 20 Stocks with Highest Liquidity Increase/Decrease on HNX Exchange

|

The lists of stocks with the highest increases and decreases in liquidity are based on average trading volumes of over 100,000 units per session.

The Stock Brokers’ View: VN-Index Faces Deeper Correction Risk

The VN-Index is showing signs of weakness as it fails to hold the support level of the 20-day moving average. This could indicate a potential shift in market sentiment and a possible downward trend in the coming days. With the index struggling to maintain its footing, investors are advised to proceed with caution and keep a close eye on their positions. A break below this key technical level could trigger further selling pressure and result in a more pronounced correction. Vigilance and a strategic approach are crucial in navigating this uncertain period.

The Ultimate Guide to Stock Market Success: Navigating the Dynamic Range of 1,260 – 1,280 Points

The VN-Index formed a bearish candlestick pattern, a “shooting star,” as it touched the 20-day moving average. This indicates a potential shift in market sentiment, with bottom-fishers taking a more proactive approach and providing consistent support to the index.