In the international market, the DXY index dropped by 0.54 points over the week, falling to 101.19.

The USD took a tumble in the global markets following the release of mixed US jobs data.

According to the report from the US Bureau of Labor Statistics (BLS), non-farm payrolls increased by 142,000 in August, falling short of economists’ predictions of 161,000. Meanwhile, the unemployment rate dipped slightly to 4.2%, in line with expectations.

The data indicates that the US economy generated slightly fewer jobs than anticipated in August, reflecting a slowing labor market, and paving the way for a Fed rate cut later this month.

Prior to the report’s release, markets were certain that the Fed would initiate a rate cut at the upcoming September 17-18 meeting. The only question was by how much. However, after the jobs report, the odds of a 50-basis-point cut increased, according to the CME Group.

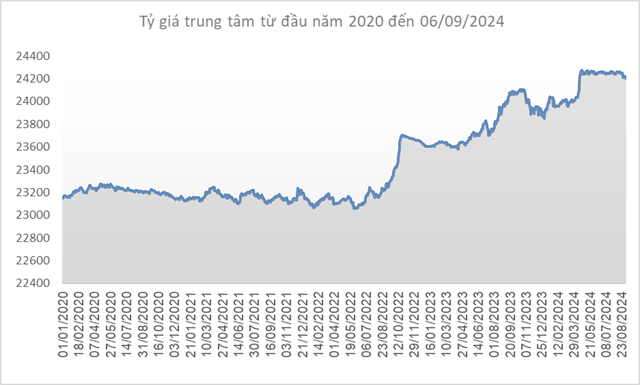

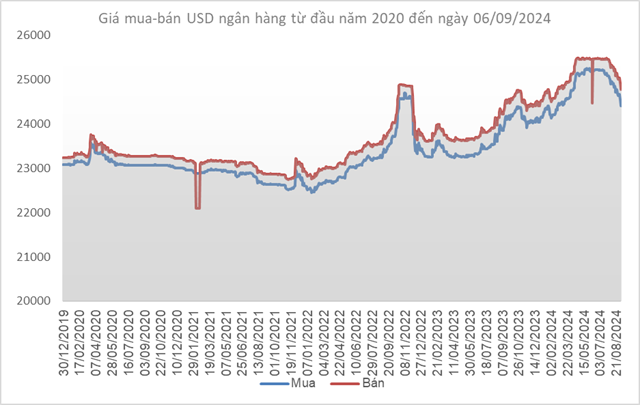

Source: SBV

|

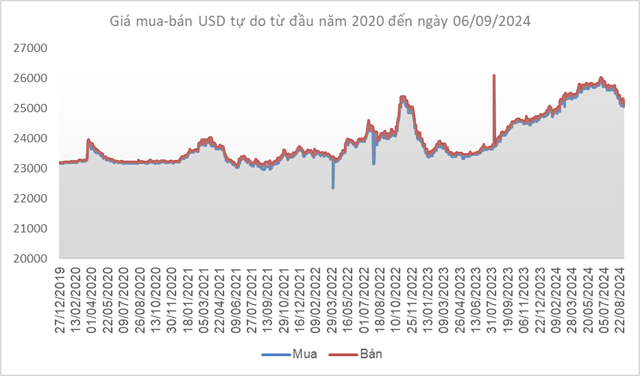

Domestically, the Vietnamese dong’s central exchange rate against the USD decreased by 19 VND/USD compared to the previous week (August 30), settling at 24,202 VND/USD on September 6, 2024.

The State Bank of Vietnam (SBV) kept the immediate buying rate unchanged at 23,400 VND/USD. Notably, after nearly five months of fixing the immediate selling rate at 25,450 VND/USD, the central bank started adjusting the selling rate in line with the movements of the central exchange rate from August 30 onwards. On September 6, the immediate selling rate stood at 25,362 VND/USD, a decrease of 23 VND/USD compared to August 30.

Source: VCB

|

Vietcombank’s quoted exchange rate stood at 24,400-24,770 VND/USD (buying – selling), a decrease of 260 VND/USD on both sides. This marks the sixth consecutive week of declining USD bank rates, with a total decrease of 691 VND/USD on both buying and selling sides.

Source: VietstockFinance

|

The Golden Outlook: A Critical Perspective on Short-Term Price Predictions

The September meeting of the US Federal Reserve is fast approaching, and the gold market is in a flutter. Speculations are rife about the extent of interest rate cuts, causing a stir in the market.