Sacombank staff received an average of 372.6 million VND per person in 2023. Illustration photo, source: Sacombank

The report “Income of General Director, Chairman of the Board of Directors and Independent Members of the Board of Directors at Public Companies in Vietnam in 2023” conducted by FiinGroup, FiinRatings, and VNIDA has just been announced. It shows that the income of the Chairman of the Board of Directors of Sacombank is leading the banking industry in 2023 with an income of 8.6 billion VND, far exceeding the average income of the Chairmen of the Board of Directors of banks of 4.1 billion VND and the second highest in the market, only after the income of the Chairman of the Board of Directors of PNJ (8.8 billion VND).

At Sacombank, Mr. Duong Cong Minh has been holding the position of Chairman of the Board of Directors since June 2017 up to now.

With the income in 2023, the amount that Sacombank Chairman Duong Cong Minh earned in 2023 is significantly higher compared to the income of the chairmen of state-owned banks.

Specifically, according to statistics based on the audited financial statements for the year 2023, in the “Big 4” group of banks, Mr. Phan Duc Tu – Chairman of BIDV – received a salary of more than 2.48 billion VND in 2023. Similarly, the salary of the Chairman of VietinBank is also at the same level of 2.48 billion VND.

Mr. Pham Quang Dung – former Chairman of Vietcombank received a salary of 1.63 billion VND in 2023. Also in 2023, Mr. Ngo Chi Dung – Chairman of VPBank – received a salary of 3.36 billion VND.

At MBBank, Mr. Luu Trung Thai was appointed in April 2023. The financial report reveals that Mr. Thai received a salary of more than 1.98 billion VND last year.

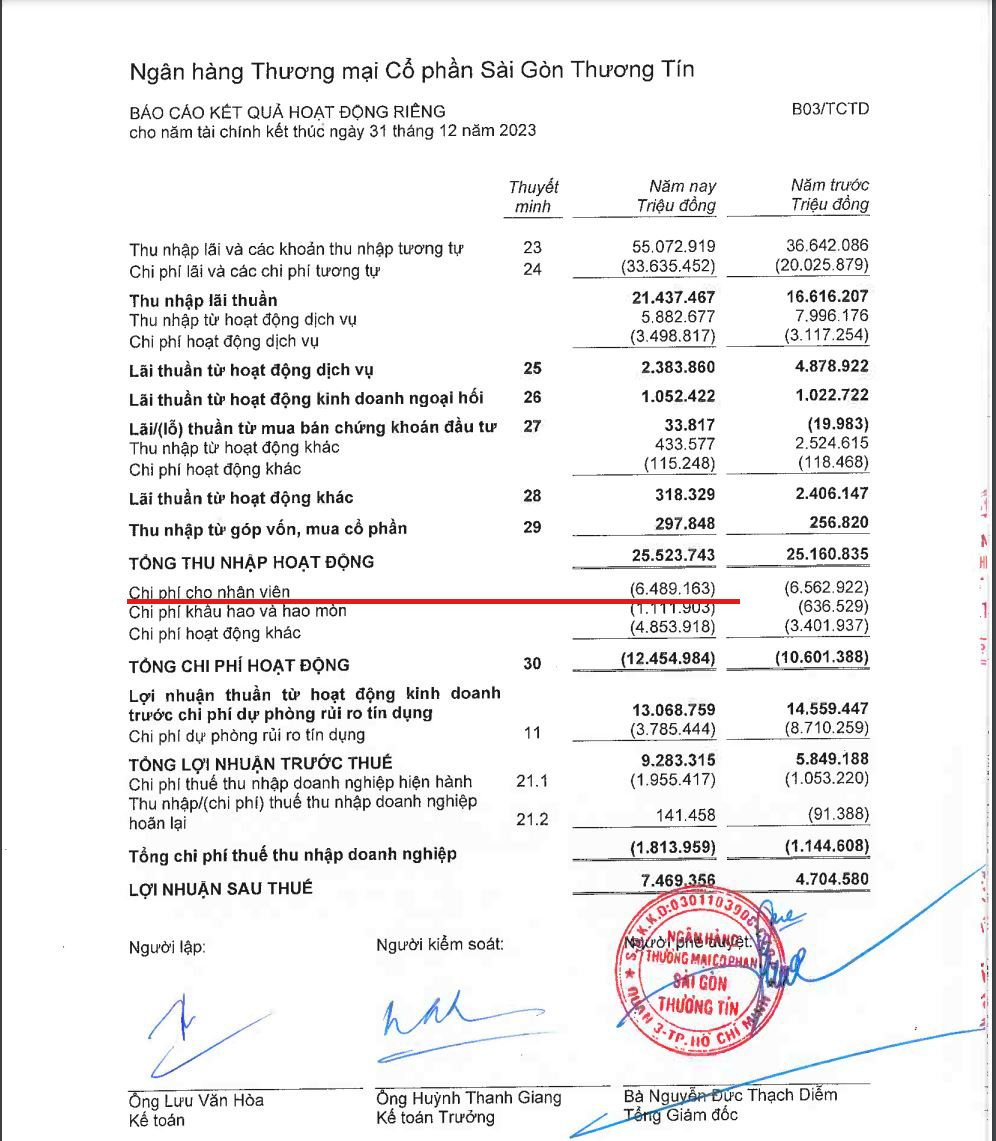

While the Chairman of the Board of Directors has an income of 8.6 billion VND, the highest in the banking industry, according to calculations based on Sacombank’s audited separate financial statements for the year 2023, in 2023, the bank’s officers and employees were paid an average of 372.6 million VND.

Source: Sacombank’s 2023 Audited Financial Statements

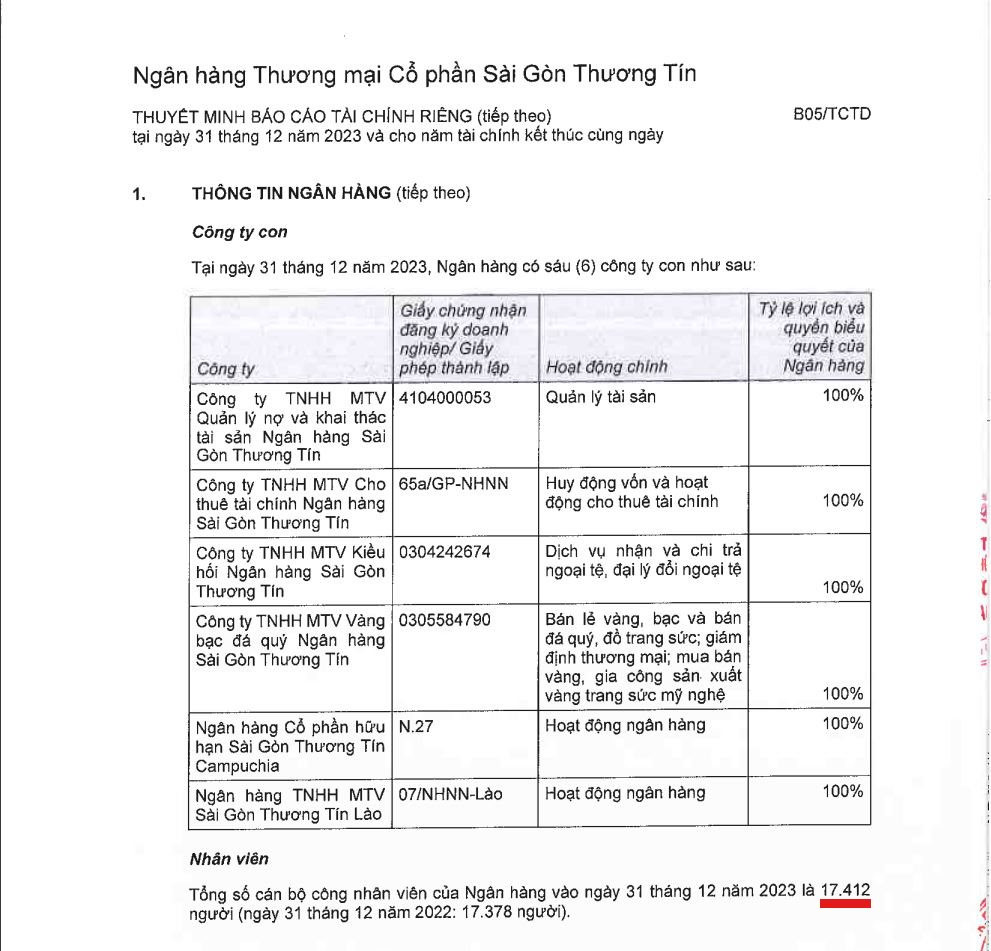

Specifically, according to the 2023 audited financial statements, as of December 31, 2023, Sacombank had 17,412 officers, employees, and workers.

Source: Sacombank’s 2023 Audited Financial Statements

Thus, with the “Staff costs” at about 6,489 billion VND reflected in the separate business results report, on average, in 2023, each officer and employee of Sacombank will be paid according to the book amount of more than 372.6 million VND.

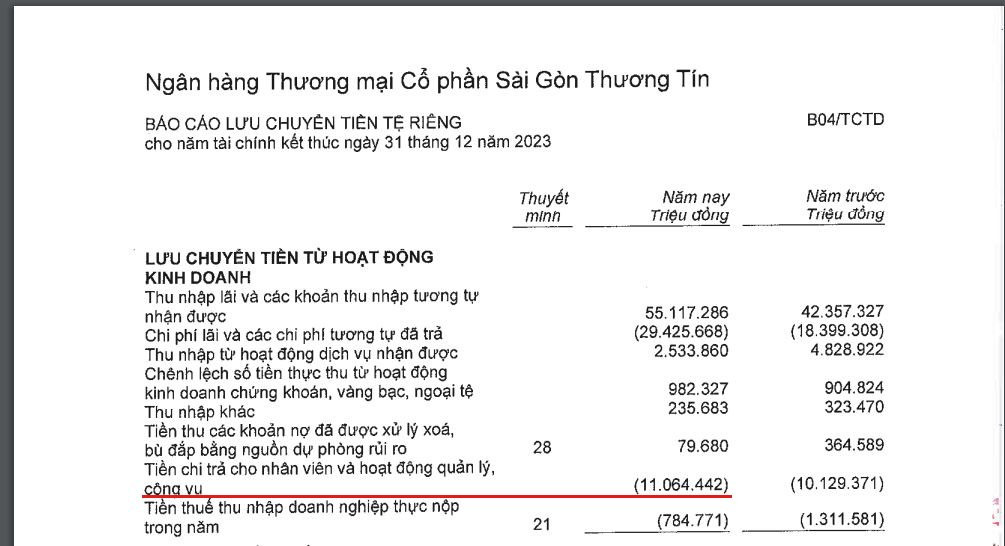

Meanwhile, in the separate audited 2023 cash flow statement, Sacombank announced the item “Cash paid to employees and management, public affairs” in 2023 at more than 11,064 billion VND.

Source: Sacombank’s 2023 Audited Financial Statements

In terms of the bank’s overall operations, according to data published by Sacombank at the AGM held on May 26, 2024, in 2023, Sacombank’s pre-tax profit reached 9,595 billion VND, up 51.4%; ROA and ROE ratios reached 1.22% and 18.3%, respectively, up 0.31% and 4.47%, much higher than in 2022; total assets reached 674,390 billion VND, up 13.9%, of which profitable assets increased by 14.3%, accounting for 89.6%; charter capital was 18,852 billion VND.

Sacombank’s total mobilized capital in 2023 reached 578,029 billion VND, up 11.3%, of which 90.8% came from the 1st market, accounting for 3.9% of the industry’s deposits; total credit outstanding reached 482,731 billion VND, up 10%, accounting for 3.5% market share; total bad debt decreased by 0.16%, the ratio of non-performing loans was 2.1%, up 1.18% compared to the beginning of the year in the context of increasing credit risk and declining customer repayment ability.

In 2024, Sacombank sets a target for financial indicators to grow by 10%. Specifically, pre-tax profit reaches 10,600 billion VND, total assets increase to 724,100 billion VND, total mobilized capital reaches 636,600 billion VND, total credit outstanding reaches 535,800 billion VND, bad debt is controlled below 2%, and the limits and ratios ensure safe operation in compliance with SBV regulations.

Sure, I can assist with that.

The President of Laos Welcomed by Vietnamese Counterpart, Mr. Tô Lâm

On the morning of September 10, a grand welcoming ceremony was held at the Presidential Palace for General Secretary and President of Laos, Thongloun Sisoulith, his wife, and the high-level delegation from the Lao People’s Democratic Republic. The event was conducted with the highest protocol afforded to a visiting head of state.