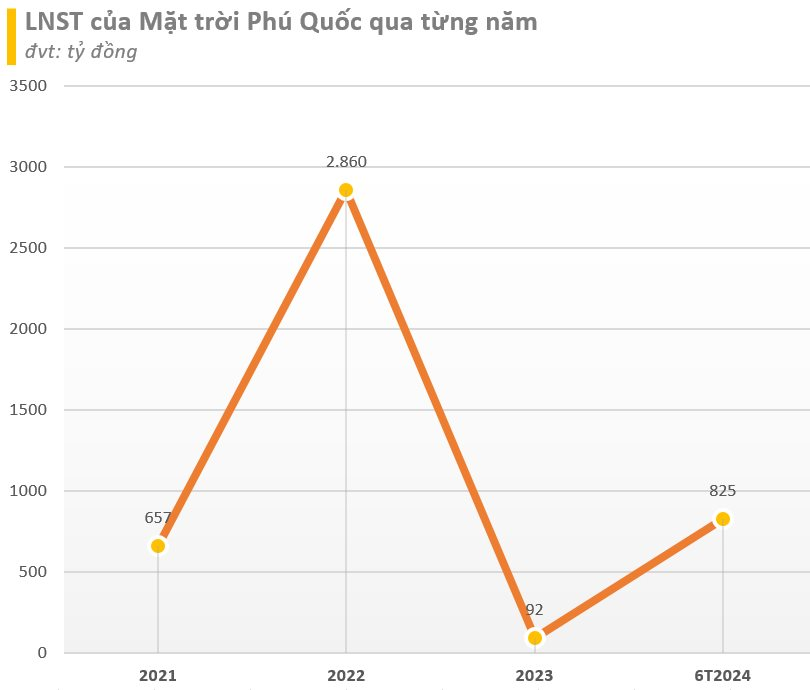

According to information from HNX, Sun World Hon Thom Phu Quoc recorded a profit after tax of over VND 825 billion in the first half of 2024. This figure is a significant improvement compared to the loss of over VND 318 billion in the same period last year, surpassing the full-year profit of 2023.

By the end of June, the company’s equity reached nearly VND 10,095 billion. Total liabilities increased slightly to around VND 57,100 billion. Of this, bond debt accounted for a low proportion, at just over VND 2,000 billion. Thus, the total assets of this enterprise stood at VND 67,200 billion (USD 2.6 billion).

In the first half of the year, the company paid over VND 145 billion in interest on bond lots. At the same time, Sun World Hon Thom Phu Quoc also repaid more than VND 202 billion in bond principal.

Sun World Hon Thom Phu Quoc is the unit directly operating, exploiting, and managing investments in the Hon Thom Cable Car and Sea Entertainment Complex project in Phu Quoc, also known as Sun World Hon Thom Nature Park. The project has been in operation since 2018, featuring the world’s longest three-wire cable car system, spanning nearly 7,900 meters.

The sea entertainment area on Hon Thom island includes items such as the Exotica theme park, Aquatopia water park, restaurants, and sea activities (canoeing, scuba diving, kayaking, jet skiing, and floating houses). Tickets to Sun World Hon Thom Nature Park are currently priced at VND 650,000 for adults and VND 500,000 for children. The ticket includes a two-way cable car ride, access to the theme park, and the water park.

In December 2023, the company launched several entertainment projects in Sunset Town, including the iconic Kiss Bridge, a night market by the sea, and the nightly show, Kiss of the Sea, which have attracted many visitors.

“The Power of Persuasion: Unlocking Shareholder Value with a Record-Breaking Dividend”

The price-to-earnings ratio (P/E) of this business is an incredibly low 3.5. This indicates a potential bargain for investors, as it’s a metric that showcases the company’s current share price relative to its earnings. A low P/E ratio can often signify an undervalued company, and this particular ratio is far below the industry average, presenting an intriguing opportunity for those seeking to invest.

The $40 Billion Bond Burden: Is Saigon Capital Thriving or Just Surviving?

Despite a notable improvement in financial performance compared to the previous year, Saigon Capital’s net profit for the first half of the year remains modest in comparison to the company’s total capital of nearly VND 5,000 billion.