Illustration

Brent Crude Oil Hits Near 3-Year Low

Brent crude oil prices closed at their lowest since December 2021, after OPEC+ lowered its demand forecasts for this year and 2025, overshadowing supply concerns caused by Tropical Storm Francine.

On September 10th, Brent crude oil fell by 2.65 USD or 3.69% to 69.19 USD per barrel, while WTI crude oil decreased by 2.69 USD or 4.31%, closing at 65.75 USD per barrel.

Both oil benchmarks dropped by over 3 USD per barrel during the session, following a 1% gain in the previous session. WTI crude oil fell more than 5% to its lowest since May 2023.

In its monthly report, the Organization of the Petroleum Exporting Countries (OPEC) stated that global oil demand is expected to rise by 2.03 million barrels per day (bpd) in 2024, down from the previous forecast of a 2.11 million bpd increase.

OPEC also trimmed its global demand growth estimate for 2025 to 1.74 million bpd from 1.78 million bpd. Oil prices declined due to weakened global demand prospects and expected oil oversupply.

Meanwhile, the U.S. Energy Information Administration (EIA) stated that global oil demand is expected to reach a record high this year, and production growth will be lower than previously forecast. Global oil demand is projected to increase by an average of about 103.1 million barrels per day this year, up 200,000 bpd from the previous forecast of 102.9 million bpd.

However, oil prices remained under pressure after the EIA’s forecast due to concerns about China, as the country’s August 2024 export growth was the fastest in nearly 1.5 years, while imports disappointed due to weak domestic demand.

U.S. Natural Gas Prices Rise by 3%

Natural gas prices in the U.S. increased by 3% as energy producers cut output ahead of a storm expected to hit Louisiana.

October 2024 natural gas futures on the New York Mercantile Exchange rose by 6.2 U.S. cents, or 2.9%, to settle at 2.232 USD per mmBTU.

Gold Prices Surge Past $2,500 per Ounce

Gold prices surged past $2,500 per ounce as market participants awaited U.S. inflation data to provide further clues on the Federal Reserve’s rate cut decision next week.

Spot gold on the LBMA rose by 0.3% to $2,512.38 per ounce. Gold futures for December 2024 on the New York Mercantile Exchange climbed by 0.4% to $2,543.10 per ounce.

Year-to-date, gold prices have climbed by 21% and reached a record high of $2,531.60 per ounce on August 20, 2024. Low-interest rates reduce the opportunity cost of holding gold bullion.

The U.S. Consumer Price Index (CPI) for August 2024 is expected to rise by 0.2% from the previous year, remaining unchanged from the previous month.

Copper Prices Fall, Nickel Hits 6-Week Low, Zinc at Near 4-Week Low

Copper prices declined amid concerns about the health of China’s economy and metal demand following the release of economic data.

Three-month copper on the London Metal Exchange fell by 0.9% to $9,012 per ton, after rising by 1.1% in the previous session.

Asian traders anticipated that copper prices could drop to $8,450 per ton.

On the London Metal Exchange, nickel fell by 1.1% to $15,735 per ton, its lowest since mid-July—zinc fell by 1% to $2,703.50 per ton after touching its lowest since early August.

Iron Ore Prices Dip, Steel Rebars Climb

Iron ore prices on the Dalian Commodity Exchange slipped due to weakened demand prospects in China, overshadowing reduced supply and expectations of further stimulus measures from the top consumer.

The January 2025 iron ore contract on the Dalian Commodity Exchange fell by 0.07% to 675 CNY ($94.79) per ton.

The October 2024 iron ore contract on the Singapore Exchange fell by 1.17% to $90.70 per ton.

China’s iron ore imports in August 2024 decreased by 1.38% from July and by 4.73% from the previous year due to lower steel prices and weak demand prospects.

On the Shanghai Futures Exchange, steel rebar prices rose by 2.08%, hot-rolled coil by 0.87%, and steel wire by 0.36%, while stainless steel fell by 1.45%.

According to Mysteel, a consulting company, demand for steel in China remained weak in the previous week amid concerns about the country’s economy and its relationship with the U.S., even though September is usually a peak season for steel consumption.

On the Shanghai Futures Exchange, hot-rolled coil prices rose by 1.75%, steel wire and rebar by 1.6%, while stainless steel fell by 0.4%.

Rubber Prices in Japan Hit 1-Week High

Rubber prices in Japan rose for the third consecutive session to a 1-week high, supported by wet weather in some producing areas of China and Thailand, along with positive economic data from China.

The February 2025 rubber contract on the Osaka Stock Exchange (OSE) climbed by 3.9 JPY, or 1.09%, to 360.5 JPY (2.52 USD) per kg.

On the Shanghai Futures Exchange, the January 2025 rubber contract advanced by 175 CNY, or 1.05%, to 16,780 CNY (2,357.24 USD) per ton.

October 2024 rubber contract on the Singapore Exchange fell by 0.3% to 183 U.S. cents per kg.

Coffee Prices Extend Gains

Robusta coffee for November 2024 delivery on the London International Financial Futures and Options Exchange (LIFFE) rose by $6, or 0.1%, to $4,897 per ton.

December 2024 arabica coffee on the ICE climbed by 0.7% to $2,472 per lb.

Sugar Prices Continue to Fall

Raw sugar for October 2024 delivery on ICE fell by 0.36 U.S. cents, or 1.9%, to 18.47 U.S. cents per lb, after touching a 2-week low of 18.43 U.S. cents per lb.

On the London market, white sugar for October 2024 delivery fell by 1.5% to $518.60 per ton.

Soybean Prices Hit 1-Week Low, Corn Falls, Wheat Rises

Soybean prices on the Chicago Board of Trade fell to a 1-week low as better-than-expected yield estimates for the U.S. soybean crop boosted production prospects and eased concerns about dry weather.

On the Chicago Board of Trade, November 2024 soybean futures fell by 20-3/4 cents to $9.97-1/4 per bushel after dipping to $9.95-3/4, the lowest since September 3, 2024. December 2024 corn futures fell by 3 cents to $4.04-1/4 per bushel, while December 2024 wheat futures rose by 5-3/4 cents to $5.74-1/4 per bushel.

Palm Oil Prices Extend Losses

Palm oil prices in Malaysia declined after data showed that stocks in the world’s second-largest producer rose more than expected in August 2024.

The November 2024 palm oil contract on the Bursa Malaysia Derivatives Exchange fell by 12 ringgit, or 0.31%, to 3,883 ringgit ($894.70) per ton.

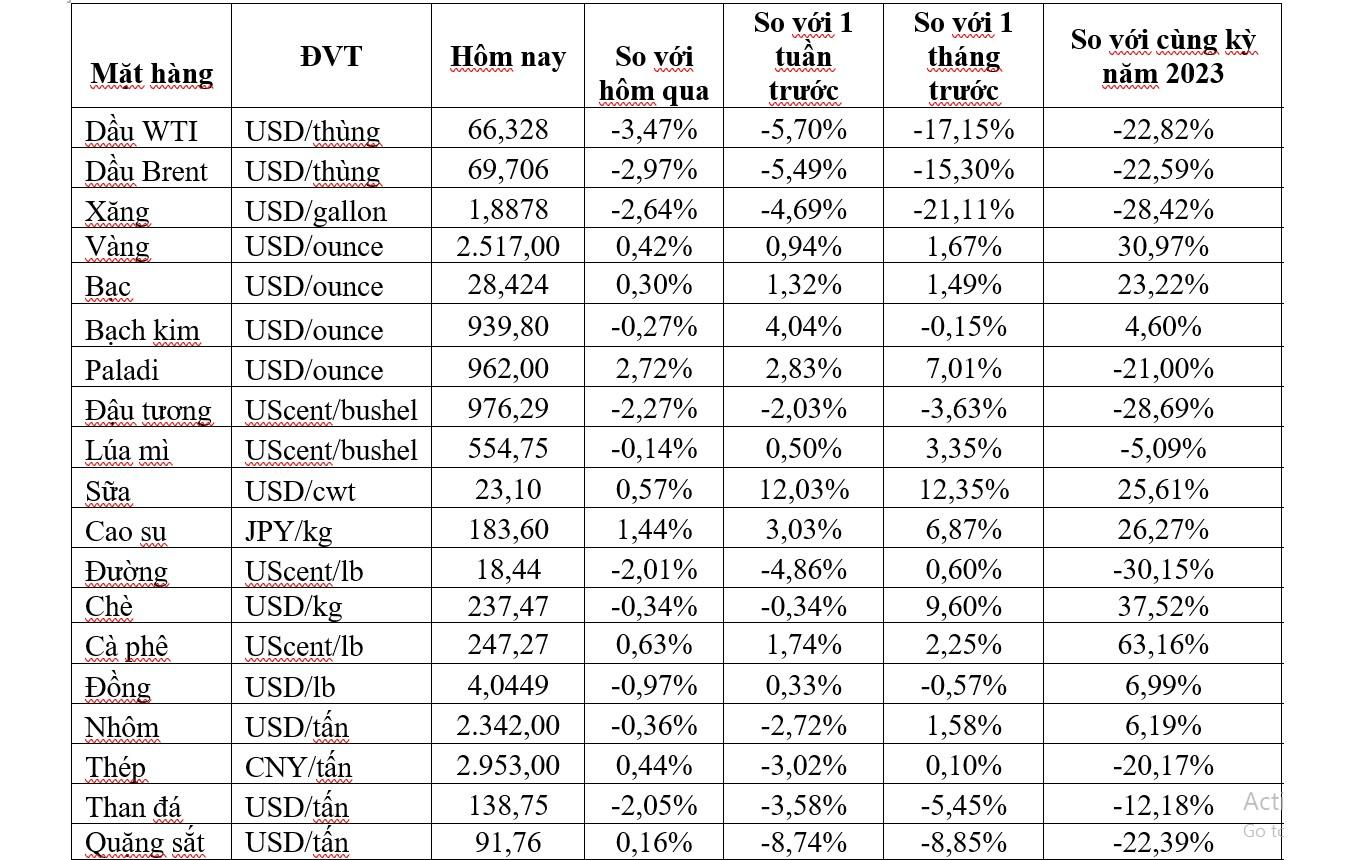

Prices of Key Commodities on September 11th

Unveiling a Special Change Before the iPhone 16 Launch: A Feature Many Vietnamese Will Love

Before the iPhone 16’s grand unveiling, a particular change was revealed that many Vietnamese consumers will undoubtedly appreciate.