The VN-Index remained in the red throughout the trading session, with the HoSE recording a decline in over 280 stocks, including the main pillars of the VN30 basket.

Net inflows into the stock market continued to decline.

Of the VN30 basket, 23/30 stocks fell, leaving only HPG, GAS, and SSB in the green. However, their efforts were not enough to counter the pressure from the VN30 group, particularly the impact of VHM and VIC.

Vingroup’s stocks VIC and VHM both fell by over 2%, while VRE remained unchanged. Stocks in the real estate sector also turned red. Bank stocks could not escape the market’s downward trend. Construction, chemicals, securities, and technology stocks all fell in unison.

As the market adjusted, VNZ, the most expensive stock on the exchange, continued to face strong selling pressure, closing near the floor price of 392,500 VND per unit.

The stock price fell by as much as 68,900 VND per unit during the day, while liquidity surged to 27,930 billion VND. Prior to this, VNZ’s trading volume was only a few hundred shares per session.

Currently, VNZ is at its lowest point in the past year. During the same period last year, in September, the stock price had surpassed the 1 million VND per unit mark. After just two sessions of strong adjustments, the company’s market capitalization has evaporated by more than 3,500 billion VND, falling to 11,278 billion VND.

At the close of trading, the VN-Index fell 6.23 points (0.49%) to 1,267.73 points. The HNX-Index decreased by 1.19 points (0.51%) to 233.46 points, while the UPCoM-Index dropped by 0.37 points (0.4%) to 93 points.

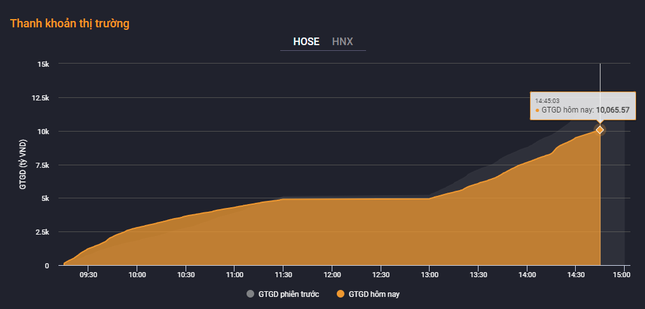

Liquidity also weakened, with the HoSE’s matching value falling to 10,065 billion VND, a 16% decrease from the previous session and the lowest in three weeks. Foreign investors returned to net selling, offloading 470 billion VND worth of shares, mainly in FPT, MSN, HPG, and VPB.

The Rise of Vietnam’s Stock Market: 1.4 Million New Accounts Since January

As of the end of August, individual investors held over 8.6 million securities accounts, equivalent to approximately 8.6% of the population. This significant proportion of investors showcases a thriving personal investment landscape, with individuals taking an active interest in their financial future.