Boats and fish cages of Tan An residents, Quang Yen town, were severely damaged. (Photo: Van Duc/VNA)

|

On the evening of September 11, the Chairman of the Quang Ninh People’s Committee hosted a meeting with financial organizations to discuss credit support solutions for customers affected by Storm No. 3 (Yagi).

Mr. Cao Tuong Huy, Chairman of the Quang Ninh People’s Committee, emphasized the need for credit institutions and banks in the province to apply existing policies flexibly, rather than rigidly. He also suggested that they propose specific policies to higher authorities, treating Storm No. 3 as a disaster. These policies should include debt restructuring, maintaining current debt groups, considering debt waivers or reductions, and providing new loans to affected customers, regardless of collateral. He further stressed the importance of studying debt and risk management in accordance with regulations.

The provincial Department of Agriculture and Rural Development, the State Bank’s Quang Ninh branch, and related departments are to advise the provincial People’s Committee on issuing guidance to help residents with procedures for debt suspension, rescheduling, and restructuring, as well as new loans. The province of Quang Ninh will provide separate support policies for those affected by Storm No. 3 in all fields.

Storm No. 3 caused significant damage to the infrastructure of most agencies, units, businesses, and residents in Quang Ninh province, especially in the areas directly hit by the storm, such as Ha Long city, Uong Bi city, and Quang Yen town.

According to a report by the State Bank of Vietnam’s Quang Ninh branch, as of September 10, 2024, a total of 11,058 customers, with a total outstanding debt of VND 10,654 billion (accounting for 5.6% of the province’s total outstanding debt), were severely affected by the aftermath of Storm No. 3.

Fish cages at Ben Giang, Tan An, Quang Yen were damaged and destroyed. (Photo: Van Duc/VNA)

|

Some customers in the field of aquaculture suffered severe losses, with their fish cages being washed away.

The breakdown of affected customers by industry includes 6,270 customers with VND 1,463 billion in debt in the field of agriculture, forestry, and fisheries; 533 customers with VND 5,243 billion in debt in the field of industry and construction; and 4,255 customers with VND 3,984 billion in debt in the field of trade and services.

To stabilize banking activities and support customers in overcoming difficulties and resuming production and business operations, the State Bank’s Quang Ninh branch has directed credit institutions in the area to implement solutions to assist customers in dealing with the consequences of Storm No. 3.

Specifically, credit institutions and their branches in the area are requested to restructure debts and maintain debt groups for affected borrowers, consider interest waivers or reductions for affected customers, and provide new loans to help them restore production and business activities in accordance with current regulations. At the same time, they should handle debts and manage risks in accordance with existing regulations for severely affected customers who have lost their repayment ability.

Mr. Nguyen Duc Hien, Director of the State Bank’s Quang Ninh branch, requested that the People’s Committee direct local authorities, departments, and sectors to coordinate with the Quang Ninh banking sector in confirming the damage suffered by customers in cases where debt rescheduling, restructuring, or write-offs are necessary.

Mr. Ho Quang Huy, Chairman of the People’s Committee of Mong Cai city, requested that banks support customers affected by Storm No. 3 by rescheduling their debts and reducing interest rates on existing loans. He also suggested providing new loans without collateral to help individuals and businesses resume production and business activities.

Mr. Tran Duc Thang, Chairman of the People’s Committee of Quang Yen town, where nearly 2,000 customers with about VND 400 billion in debt were affected, proposed that for the group of aquaculture farmers, households should be provided with new loans to restart production, focusing on purchasing seedlings and restoring fish cages. He also suggested reducing interest rates for both old and new loans. For the group of crop farmers, he proposed debt write-offs.

Representatives of banks in Quang Ninh province agreed with the proposals made by the local authorities. Some bank branches in the area have reduced interest rates within the permitted range. However, when the reduction exceeds the allowed limit, the bank branches need to obtain approval from higher authorities.

Earlier, on the morning of September 11, a working group from the State Bank of Vietnam, led by Mr. Dao Minh Tu, Permanent Deputy Governor, worked with the banking sectors of Quang Ninh and Hai Phong provinces to grasp the banking situation and implement solutions to support customers affected by Storm No. 3 (YAGI). The State Bank has taken note of the proposals and will soon have credit policies in place to provide timely support.

According to initial statistics from Quang Ninh province, as of September 11, 2,805 households were flooded, 19,582 houses were damaged, 21 water transport vehicles, 28 tourist boats, and 41 fishing vessels of various types sank or drifted, more than 1,000 oyster cages were lost or washed away, 2,637 aquaculture facilities were damaged, 17,000 square meters of aquaculture structures were damaged, 912 hectares of rice were knocked down or flooded, and 45,489 hectares of forest were affected. Many of these affected individuals and entities are current borrowers from credit institutions in the area.

Van Duc

“A City’s Generous Support: Ho Chi Minh City Donates 120 Billion VND to Aid Fellow Citizens Affected by Storm No. 3”

On September 10, the Vietnam Fatherland Front Central Committee launched a donation drive to support communities affected by the devastating Storm No. 3.

A Northern Province Offers to Give Away VND 100 Billion in Storm Recovery Aid to Other Struggling Regions

Prime Minister Pham Minh Chinh has directed aid worth VND 100 billion to the province to overcome the aftermath of storms. However, the provincial leaders wished to pass this on to the northern mountainous localities that are facing difficulties due to floods, landslides, and other natural calamities.

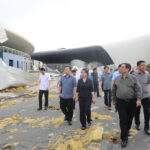

Prime Minister Visits, Encourages Citizens and Directs Recovery Efforts in the Wake of Typhoon No. 3 in Quang Ninh.

On the afternoon of September 8, Prime Minister Pham Minh Chinh inspected the damage and directed the implementation of urgent measures to overcome the consequences of Storm No. 3 in Quang Ninh province. The province bore the brunt of the storm, with the strongest winds and, as of the morning of September 8, the most extensive damage.

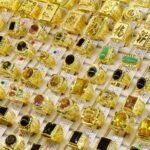

Gold Prices Today, 9/8: SJC Gold Bars Retreat From Peak, Gold Rings Remain Sky-High.

Today, gold prices have dipped for SJC gold bars, while gold rings continue to soar at lofty heights.