|

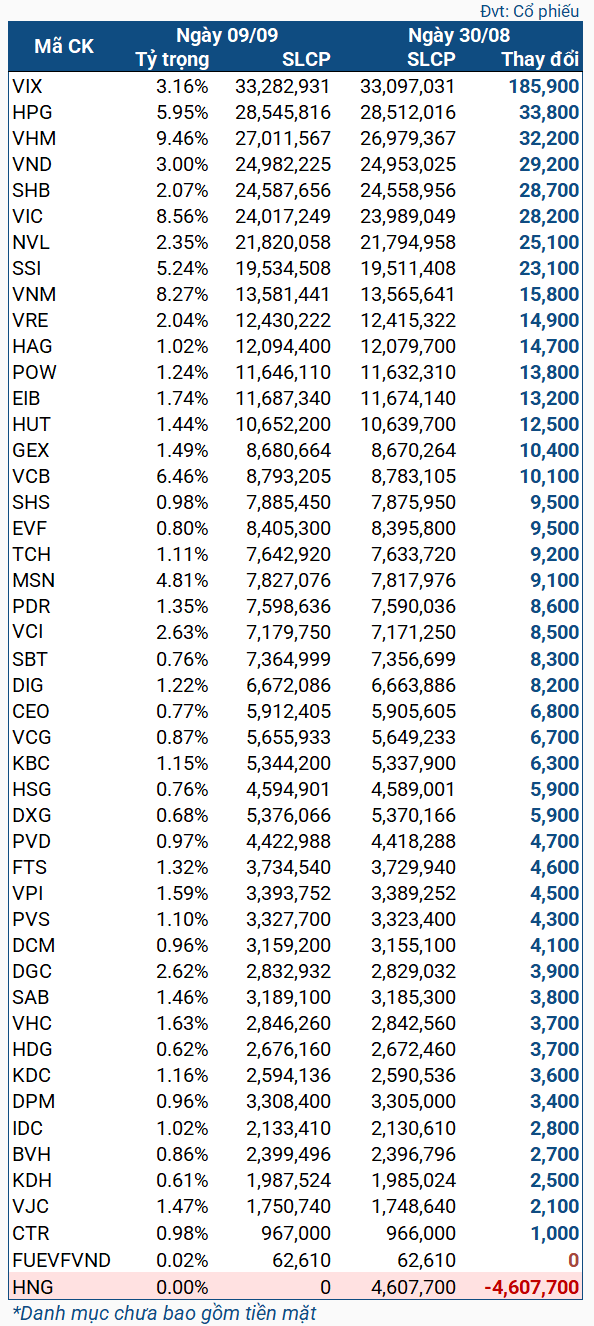

VNM ETF Stock Changes from 08/30 to 09/09/2024

|

During this period, the VNM ETF fund purchased almost all the stocks in its portfolio. The largest purchase was of VIX with 185,900 shares, far surpassing the next two stocks, HPG and VNM (both purchased over 30,000 shares). VND, SHB, and VIC were also bought with a net purchase of over 28,000 shares.

On the other hand, the fund sold all its holdings of HNG stocks, selling over 4.6 million shares.

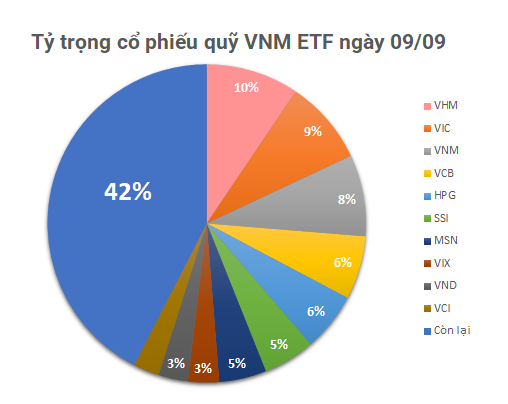

As of September 9th, the net asset value of VNM ETF was nearly $498 million, a decrease from the $502 million recorded on August 30th. The entire portfolio consists of Vietnamese stocks, allocated across 45 stock codes and one fund certificate. The top weights go to VHM (9.46%), VIC (8.56%), VNM (8.27%), VCB (6.46%), and HPG (5.95%).

“DRH Holdings Stock (DRH) Plunges as Chairman Phan Tan Dat Faces Crisis”

After trading was suspended by HoSE, Chairman Phan Tan Dat’s DHR shares plummeted to the floor price, with a record-high trading volume.