As per the published financial reports, for the first half of 2024, Flamingo Group recorded a remarkable revenue of VND 2,006 billion, equivalent to 202% compared to the same period in 2023. This significant increase in revenue is attributed to the handover of the Flamingo Ibiza Hai Tien City project and the contributions from two resort areas: Flamingo Cat Ba Resorts and Flamingo Dai Lai Resort.

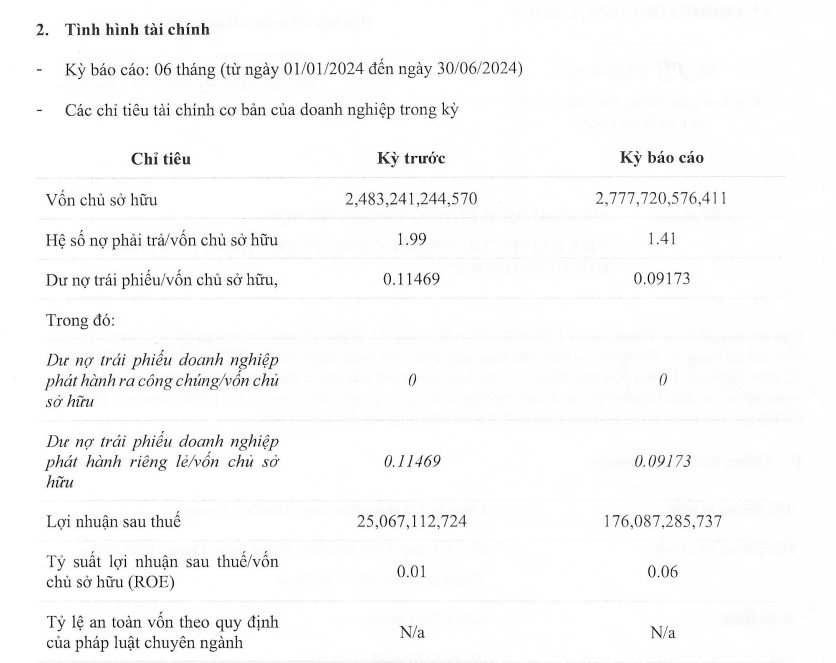

The Group’s profit before tax for the first six months of 2024 reached VND 205 billion, a fivefold increase from the same period in 2023, which was VND 42 billion. As a result, the profit after tax amounted to VND 176 billion, seven times higher than the VND 25 billion recorded in the first half of 2023.

As of June 30, 2024, Flamingo Group’s total assets amounted to VND 6,691 billion, a decrease of approximately VND 600 billion from the beginning of the year. This change is due to a VND 800 billion reduction in short-term assets, mainly from the decrease in inventory and the handover of real estate in the Flamingo Ibiza Hai Tien City project. Meanwhile, long-term assets increased by nearly VND 200 billion.

As of June 30, 2024, the Group’s payables decreased by VND 780 billion, mainly due to the handover of real estate at the Flamingo Ibiza Hai Tien City project. The company’s bond balance as of June 30, 2024, was VND 254.8 billion. It is worth mentioning that during the first six months of 2024, Flamingo Holdings repurchased VND 30 billion of bonds ahead of schedule.

Flamingo Golden Hill Ha Nam, set to launch in Q4 2024, promises to be a stunning addition to the group’s portfolio.

The first half of 2024 witnessed a robust operational phase for Flamingo Holdings’ projects. On January 28, the Group inaugurated the Golden Hill Center at Flamingo Golden Hill Ha Nam. Just three months later, on April 27, the Tan Trao Destination Centre at Flamingo Heritage Tan Trao City was unveiled. And on May 4, Flamingo Ibiza Hai Tien City officially commenced its operations.

Flamingo also successfully hosted the Lala Town street festival, attracting tens of thousands of attendees across four provinces. This event left a lasting impression on three new destination cities: Flamingo Heritage Tan Trao City, Flamingo Golden Hill Ha Nam, and Flamingo Ibiza Hai Tien City. The Lala Town brand will present lucrative business opportunities and boost purchasing power and ideal rental prospects for Flamingo real estate owners.

The last two quarters of the year are anticipated to witness very positive developments in the Group’s business operations, with the expected launch of two cities, Flamingo Golden Hill Ha Nam and Flamingo Heritage Tan Trao City, in the fourth quarter.

“The Power of Persuasion: Unlocking Shareholder Value with a Record-Breaking Dividend”

The price-to-earnings ratio (P/E) of this business is an incredibly low 3.5. This indicates a potential bargain for investors, as it’s a metric that showcases the company’s current share price relative to its earnings. A low P/E ratio can often signify an undervalued company, and this particular ratio is far below the industry average, presenting an intriguing opportunity for those seeking to invest.