CTCP Cơ khí Phổ Yên (Fomeco), listed as FBC on the UPCoM exchange, has announced its plans to distribute a hefty cash dividend for the year 2023.

Fomeco intends to distribute a dividend of 200%, or VND 20,000 per share, with the record date set for September 27, 2024. The payout, estimated at VND 74 billion, will commence on November 7, 2024, for the company’s 3.7 million outstanding shares.

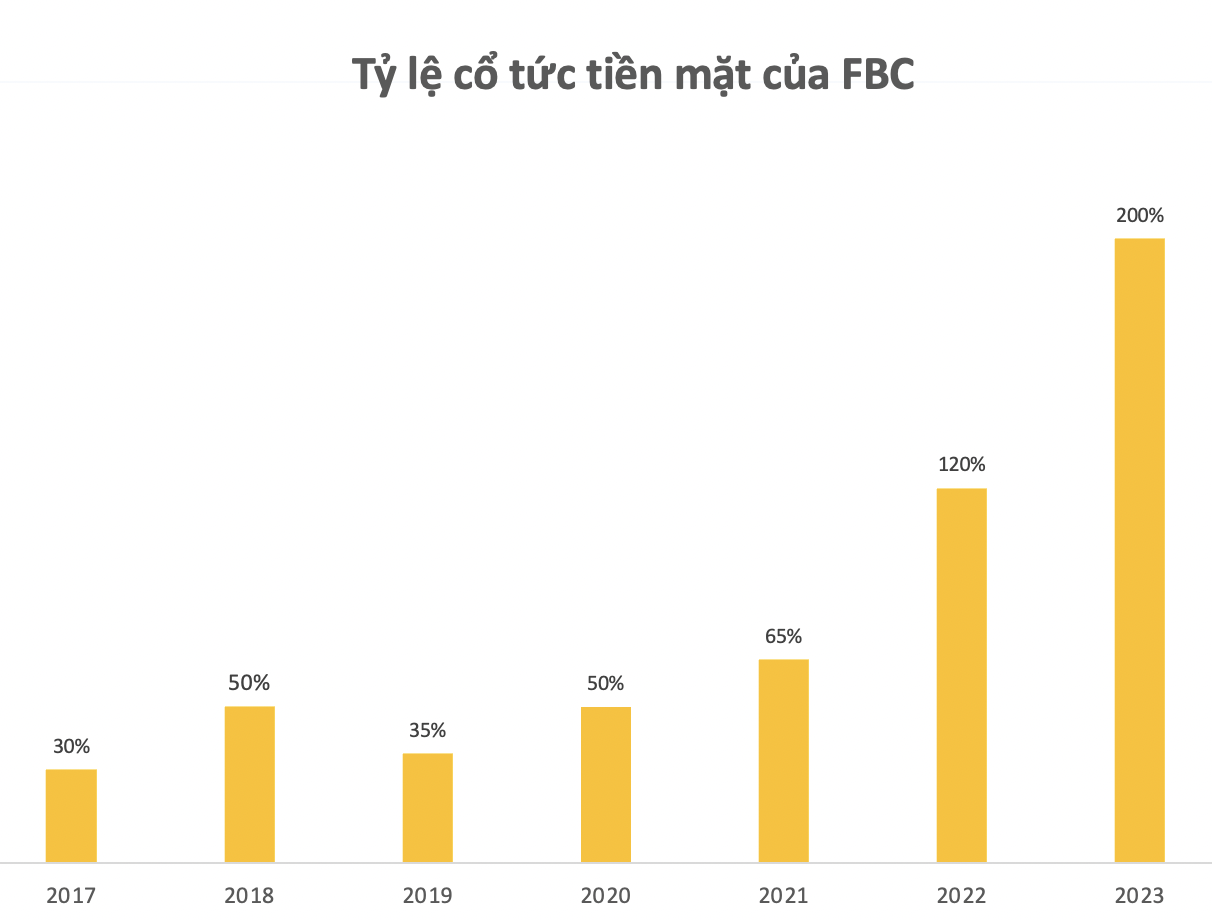

Trading at VND 3,700 per share on the UPCoM, FBC’s announced dividend far surpasses its market price, offering a yield of over 540%. Since its listing in 2017, Fomeco has consistently rewarded shareholders with substantial cash dividends ranging from 30% to 65% annually, with an extraordinary payout of 120% in 2022. The 2023 dividend, however, sets a new record in the company’s history.

This generous dividend policy follows Fomeco’s impressive financial performance in the previous year. Despite a 20% decline in revenue to VND 1,049 billion, the company posted a record-high profit, increasing by 10% to nearly VND 73 billion.

Established in 1974 and transformed into a joint-stock company in 2003, Fomeco specializes in manufacturing and supplying a range of mechanical products. Their portfolio includes bearings, motorcycle and automobile parts, conveyor rollers, construction equipment, and various other mechanical components.

With a charter capital of VND 37 billion, Fomeco is majority-owned by the Vietnam Engine and Agricultural Machinery Corporation (VEAM), which holds a 51% stake. VEAM is a prominent player in the Vietnamese automotive industry, with strategic partnerships in joint ventures such as Toyota Vietnam (VEAM holding 20%), Honda Vietnam (VEAM holding 30%), Ford Vietnam (25% through its subsidiary, VEAM DISOCO), Mekong Auto, Kumba, and VEAM Korea.

Over the years, FBC has established itself as a trusted supplier to industry giants like Honda Vietnam, Yamaha, Suzuki, Hanwa, Nippo, Piaggio, and Panasonic, among others.

“The Power of Persuasion: Unlocking Shareholder Value with a Record-Breaking Dividend”

The price-to-earnings ratio (P/E) of this business is an incredibly low 3.5. This indicates a potential bargain for investors, as it’s a metric that showcases the company’s current share price relative to its earnings. A low P/E ratio can often signify an undervalued company, and this particular ratio is far below the industry average, presenting an intriguing opportunity for those seeking to invest.