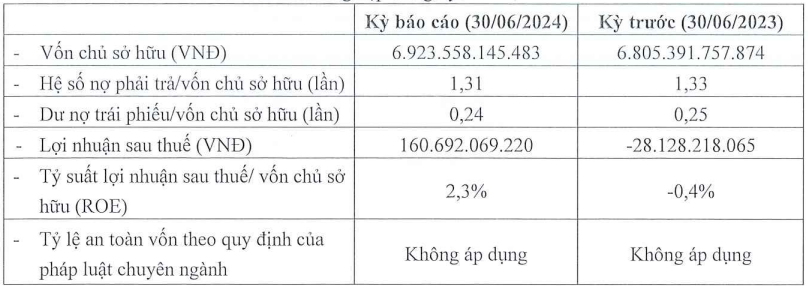

As of June 30, 2024, Dia Oc No Va’s total assets were recorded at approximately VND 16 trillion, almost unchanged from a year earlier. Payable debt remained relatively flat at nearly VND 9.1 trillion, of which bond debt accounted for nearly VND 1.7 trillion.

In the first half of this year, the company posted a post-tax profit of nearly VND 161 billion. In 2023, the company incurred a loss of nearly VND 71 billion, while in 2022, it recorded a profit of VND 554 billion.

|

Dia Oc No Va’s Business Results for the First Half of 2024

|

Dia Oc No Va currently has five bond issues outstanding, totaling VND 1,673 billion. They were all issued in 2020 with a coupon rate of 10% per annum. These include: NVJCH2025001 (VND 23 billion), NVJCH2023003 (VND 245 billion), NVJCH2024004 (VND 610 billion), NVJCH2025005 (VND 460 billion), and NVJCH2026006 (VND 335 billion).

The NVJCH2025001 and NVJCH2023003 bonds will mature in 2025, while the NVJCH2024004 and NVJCH2026006 bonds will mature in 2026. The NVJCH2025005 bond has the latest maturity, coming due in 2027.

The company disclosed that it had paid more than VND 99 billion in interest on these five bond issues; however, the payments were made after the scheduled dates.

According to the schedule, Dia Oc No Va was supposed to make interest payments of nearly VND 637 million on March 23, 2024, and nearly VND 632 million on June 23 for the NVJCH2025001 bond. However, the company only made the first payment on March 25 and the second payment on June 24.

The four bond issues NVJCH2023003, NVJCH2024004, NVJCH2025005, and NVJCH2026006 had a combined interest payment due date of February 28, 2024, totaling over VND 97.7 billion. However, the company only fulfilled this obligation to bondholders on March 8.

Dia Oc No Va has a chartered capital of nearly VND 5.6 trillion and is a subsidiary of Novaland Group (HOSE: NVL), which owns 99.99% of the company.

Dia Oc No Va is the developer of two projects in Ho Chi Minh City: Sunrise City in District 7, spanning over 5 hectares, with Phase 3 delivered in Q4 2015; and Golf Park Residence in Thu Duc, covering over 2.5 hectares, handed over in Q4 2016.

Additionally, the company is one of the five investors in the large-scale project, Aqua City Phoenix Island, in Dong Nai province, spanning over 249 hectares.

The $40 Billion Bond Burden: Is Saigon Capital Thriving or Just Surviving?

Despite a notable improvement in financial performance compared to the previous year, Saigon Capital’s net profit for the first half of the year remains modest in comparison to the company’s total capital of nearly VND 5,000 billion.