Illustrative image

To meet the demands of animal husbandry, Vietnam has consistently imported large quantities of corn in recent years.

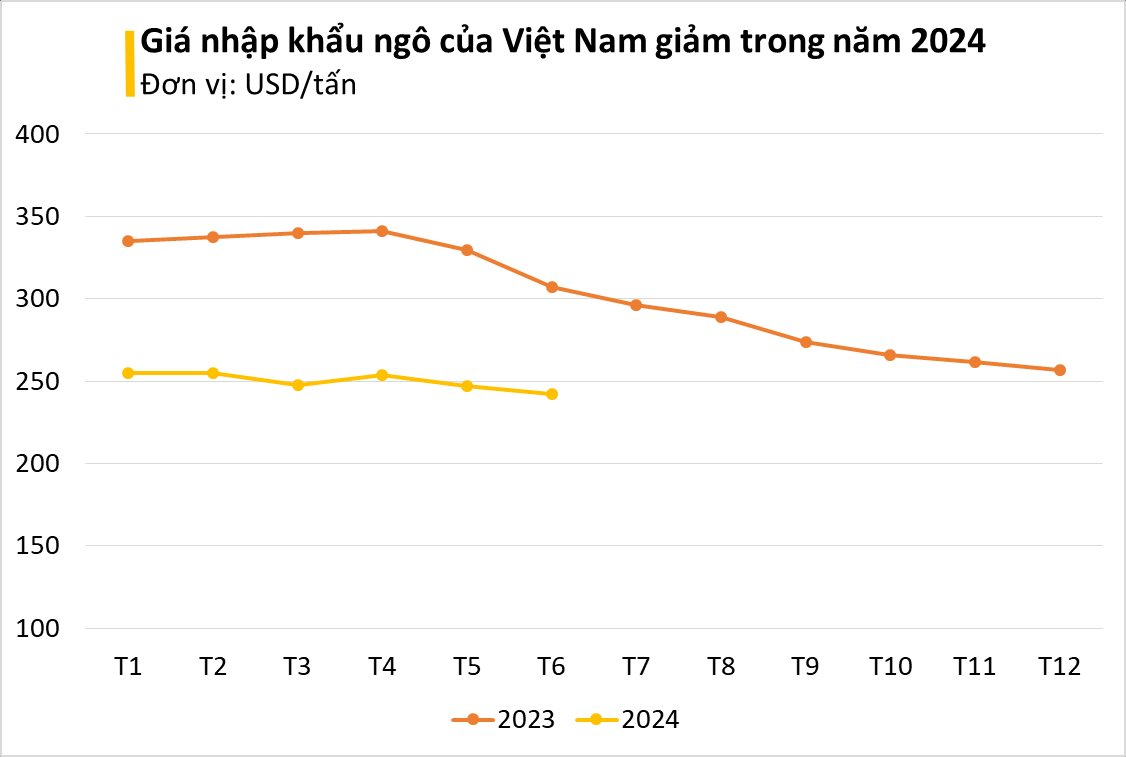

According to preliminary statistics from the General Department of Customs, Vietnam’s import of various types of corn in the first seven months of 2024 exceeded 5.74 million tons, valued at over $1.43 billion. While the volume and value increased, the average import price decreased by 24.1% compared to the same period in 2023.

Particularly in July 2024, the import volume and value surged by 36.4% and 35.3%, respectively, compared to the previous month, and a significant increase of 49.4% in volume and 21.2% in value was observed compared to July 2023.

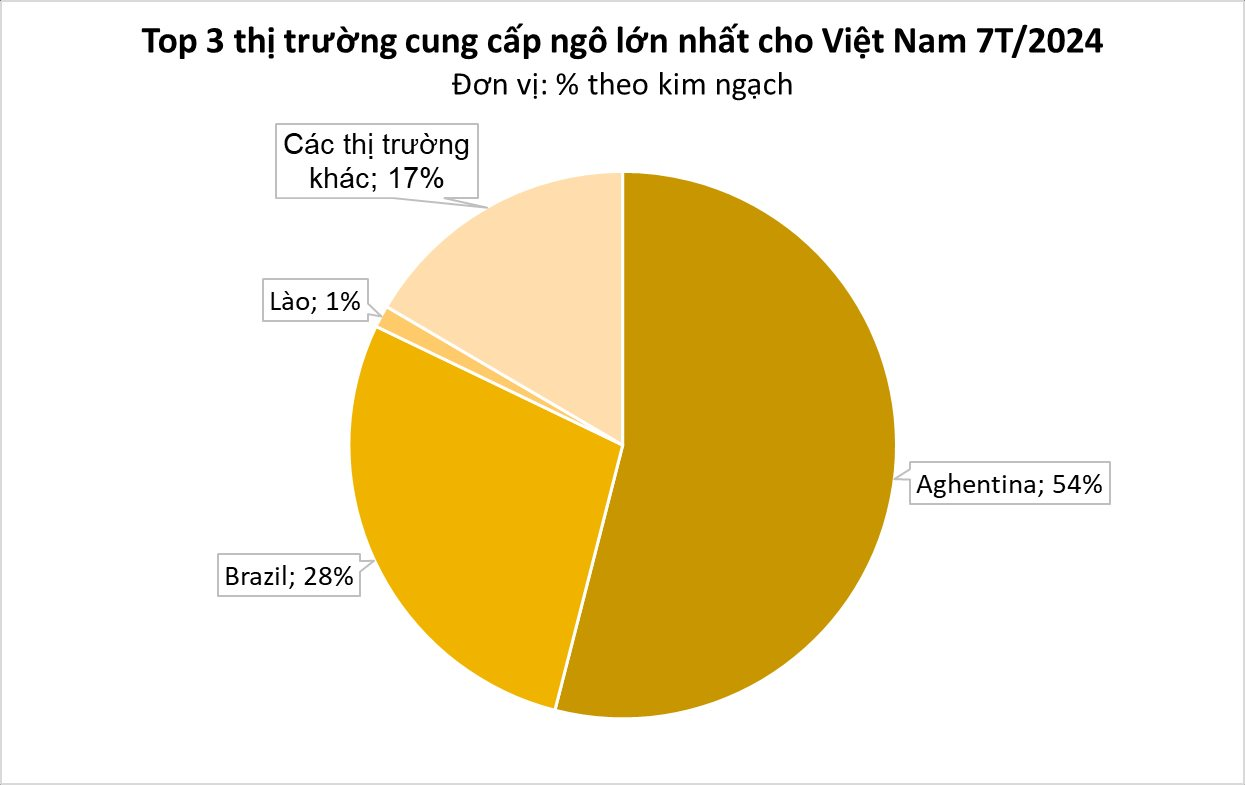

Argentina was Vietnam’s primary trading partner in corn imports, with nearly 3.19 million tons, equivalent to over $772.29 million. This marked a 130% increase in volume and a 71% surge in value compared to the same period last year. The South American nation accounted for 55.5% of the total import volume and 54% of the total import value of corn in Vietnam.

The second-largest market was Brazil, contributing 28% to both the volume and value of Vietnam’s corn imports. While the import volume from Brazil increased by 14%, the import value decreased by 12%, and the price dropped by 23% compared to the first seven months of 2023.

Laos was the third-largest market, with 74,589 tons, equivalent to $18.64 million, accounting for 1.3% of Vietnam’s total corn import volume and value.

Corn is a crucial feed ingredient in livestock and poultry farming. It typically constitutes 25-40% of the diet of these animals, depending on their growth stage and physiological state. The production of corn is closely linked to animal husbandry, and countries with higher corn yields tend to have more developed livestock industries.

According to Statista, Vietnam is among the top 30 corn-producing countries globally. However, it is also one of the largest corn importers, ranking behind China, Europe, Mexico, Japan, South Korea, and Egypt.

Vietnam used to boast a massive corn production capacity. As per USDA reports, the country’s corn output began rising in the 1980s but started declining from 2015/2016, leading to a sharp increase in corn imports.

The large-scale corn imports not only strain the trade balance but also pose challenges to Vietnam’s food security and sustainable agricultural production. The primary reason for the increased imports is that domestic corn production fails to keep pace with the rising demand, particularly from the livestock and animal feed industries.

Currently, corn is also considered a vital raw material for producing ethanol, especially in India. India’s efforts to produce more ethanol from corn have transformed the country from a net exporter to a net importer for the first time in decades, impacting local poultry producers and disrupting global supply chains.

The enormous demand has prompted the South Asian nation to boost imports and curb exports. Traditional export markets like Vietnam, Bangladesh, Nepal, and Malaysia, which relied on Indian corn due to its convenient supply, now have to source it from South America and the United States.

India was among the top three corn suppliers to Vietnam in 2023. However, Vietnam has recently reduced its corn imports from India due to the high prices offered by the South Asian country.

The Feed Import Industry: A $2.65 Billion Dollar Deficit

As per the Ministry of Agriculture and Rural Development, between January and August 2024, exports of animal feed and raw materials reached $0.67 billion. However, imports of the same group during this period stood at a much higher $3.32 billion. This trade deficit of $2.65 billion highlights a significant gap in the industry.

“Sustainable Swine Farming: Transforming the Industry with Large-Scale, Eco-Friendly Practices.”

The smallholder pig farming sector is undergoing a transformation, with production from backyard farms declining to 35-40% while professional farms and larger operations now account for 60-65% of the market share. However, the small and medium-sized farming sector, including household farms and medium-sized farms, still lags in terms of professionalism, and production costs remain high.

The Largest Ostrich Farm in Vietnam: Dominating the Domestic Market with an 80% Share of Ostrich Chick Supply and a Consistent Annual Revenue of 7-9 Trillion VND.

With a diverse portfolio, our company’s operations span a range of industries, including tobacco, travel services, fashion textiles and leather goods, paper and packaging, animal husbandry, international trade and investment, and real estate.