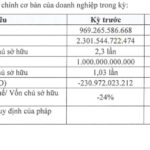

Despite incurring a loss of over VND 129 billion in the first half of the year, Tan Lien Phat Tan Cang managed to record a post-tax profit of more than VND 20 billion for the full year 2023.

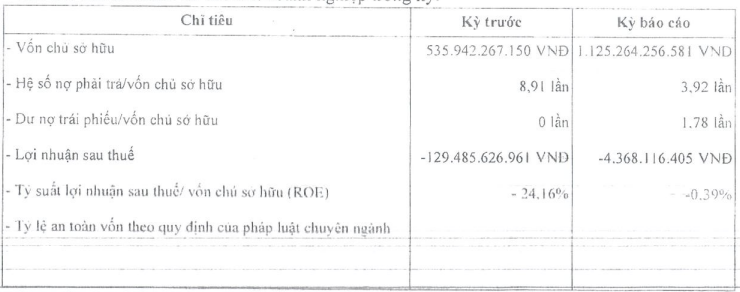

As of June 30, 2024, the Company’s total assets exceeded VND 5,500 billion, up over 4% from the previous year. Conversely, its liabilities decreased by nearly 8%, to over VND 4,400 billion, despite a bond debt balance of VND 2,000 billion (compared to zero bond debt as of June 30, 2023).

|

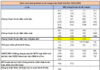

Tan Lien Phat Tan Cang’s Business Results for the First Half of 2024

Source: HNX

|

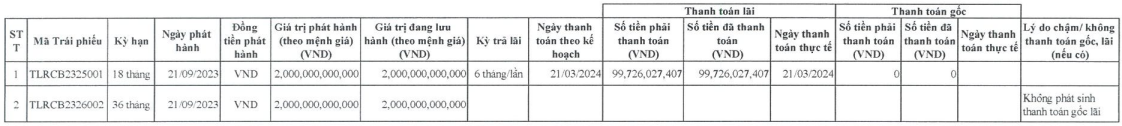

Tan Lien Phat Tan Cang currently has two bond issues in circulation, with codes TLRCB2325001 and TLRCB2326002, and a total issuance value of VND 4,000 billion (VND 2,000 billion each), both issued on September 21, 2023, with an interest rate of 10% per annum. The bonds are secured by the Company’s movable assets and contractual rights arising from a business cooperation agreement.

The TLRCB2325001 bond has a tenor of 18 months, maturing on March 21, 2025, with interest payments made every six months. The TLRCB2326002 bond has a tenor of 36 months, maturing on September 21, 2026, with annual interest payments.

During the first half of 2024, Tan Lien Phat Tan Cang made interest payments of nearly VND 100 billion on the TLRCB2325001 bond (on March 21, 2024).

|

Tan Lien Phat Tan Cang’s Bond Principal and Interest Payments for the First Half of 2024

Source: HNX

|

Established in 2002, Tan Lien Phat Tan Cang has been directed by Ms. Tran Thi Thu Hien, who has served as its Director and legal representative for many years. Previously, the Company’s primary business was in transport-related support services, and its head office was located on the 14th floor of the Lim Building, 9-10 Ton Duc Thang, Ben Nghe Ward, District 1, Ho Chi Minh City. Today, the Company’s primary business is in real estate, and its head office has relocated to 28 Nguyen Quy Khanh, Ward 5, An Phu, Thu Duc City, Ho Chi Minh City.

In addition to Tan Lien Phat Tan Cang, Ms. Tran Thi Thu Hien is also associated with other companies, including Phong Tuan Phat Investment Joint Stock Company, Mi Lan Limited Liability Company, and Masterise Lumiere Office Service Joint Stock Company.

In the past, Tan Lien Phat Tan Cang has entered into secured transactions with banks, pledging assets such as its nearly VND 680 billion capital contribution to Continental Pacific Joint Stock Company; its right to claim debts and all revenues arising from a business cooperation agreement for the Tan Cang Saigon Complex project in Ward 22, Binh Thanh District, Ho Chi Minh City; and 1,288 apartments (in towers L26, L26M, L27, and L27M) and 1,198 apartments (in towers T30 and U38) in the Masteri Water Point high-rise apartment project in Gia Lam urban area, Gia Lam District, Hanoi…

“Eurowindow Holdings Reports Six-Month Profit Quadruples, Liabilities Exceed Equity”

Eurowindow Holding, a member of the prestigious Eurowindow Group, has announced impressive financial results for the first half of 2024. The company reported a remarkable after-tax profit of 96.6 billion VND, more than quadrupling its earnings from the same period last year. This achievement is even more impressive considering Eurowindow Holding’s payable debt, which has increased to over 8.8 trillion VND, surpassing its owner’s equity by 1.1 times.