Crude oil tanker in the Black Sea. Photo: Reuters.

Brent crude oil futures stabilized at their lowest level since December 2021 on September 10, after OPEC lowered its demand forecast for this year and 2025.

Brent crude futures fell $2.65, or 3.69%, to $69.19 a barrel. WTI oil fell $2.96 a barrel, or 4.31%, to $65.75.

Both oils fell more than $3 a barrel in the session after rising about 1% on September 9. WTI oil fell to its lowest level since May 2023.

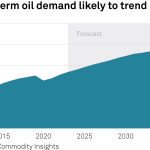

On September 10, the Organization of the Petroleum Exporting Countries (OPEC) said world oil demand would rise by 2.03 million barrels per day (bpd) this year, down from its previous forecast of 2.11 million bpd. Until last month, OPEC had kept its forecast at 2.11 million bpd since it was first released in July 2023.

OPEC also cut its estimate of global demand growth in 2025 to 1.74 million bpd from 1.78 million bpd. Oil prices fell on weak global demand and concerns about oversupply.

Oil price movement in the past year. Source: Trading Economics.

In a separate forecast, the US Energy Information Administration (EIA) said global oil demand would rise to a record high this year, while output growth would be lower than expected.

EIA said global oil demand would average 103.1 million barrels per day this year, up about 200,000 bpd from its previous forecast of 102.9 million bpd.

However, oil prices fell sharply after the EIA forecast, reflecting market concerns, especially from China.

Data released on September 10 showed that China’s exports in August rose to their highest level in 18 months, but imports disappointed due to weak domestic demand.

Meanwhile, Asian refinery profit margins fell to their lowest seasonal level since 2020 last week as gasoline and diesel supplies increased.

“There has been almost no growth in oil demand in advanced economies this year. Fiscal stimulus in China has not boosted the construction sector; that’s a big reason why diesel demand in China is falling,” said Clay Seigle, oil market analyst.