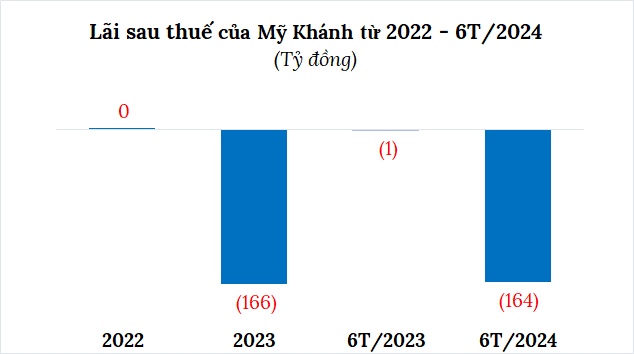

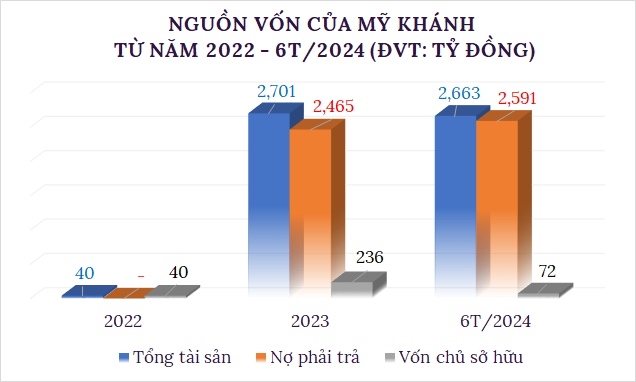

Investment and Development Company My Khanh announced financial indicators for the first half of 2024 with a loss of over VND 164 billion. In 2023, the company suffered a loss of VND 166 billion, in contrast to a meager profit of VND 8 million in 2022.

Source: Consolidated

|

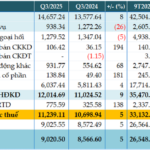

As of June 30, 2024, My Khanh’s equity capital decreased by 73%, leaving just over VND 72 billion. The debt-to-equity ratio surged from 10.43 to 35.91, translating to outstanding debts of VND 2,590 billion. Of this, bond debt stood at approximately VND 2,245 billion.

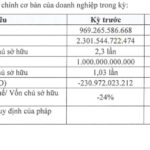

My Khanh Investment and Development Joint Stock Company was established in 2021 with an initial charter capital of VND 600 million. The company was founded by Mr. Tran Hai Nam, holding 67%, and Mr. Pham Thanh Tung, with a 33% stake. In mid-2022, the company raised its capital to VND 40 billion, with the founding shareholders withdrawing and Ms. Huynh Thi Linh Chi owning 67% and Mr. Le Nguyen Hong Diep holding 33%. By mid-2023, the company had increased its capital to VND 400 billion, and the ownership structure changed again, with Investment Consulting Services Company VT holding 96.7% and Mr. Pham Bao Trung owning 3.3%. Mr. Tran Kien serves as the Director and legal representative.

Source: Consolidated

|

According to HNX, My Khanh has VND 2,245 billion of bonds (code: MKHCH2329001) in circulation. These bonds were issued on June 30, 2023, with a term of 6 years and a maturity date of June 30, 2029. The interest rate is 14% per annum.

The collateral for the bonds is all asset rights arising from the project in Area A-2 of the Residential and Resettlement Area in Nam Rach Chiec, An Phu Ward, District 2, Ho Chi Minh City (now An Phu Ward, Thu Duc City, Ho Chi Minh City). The project covers an area of over 14.8 hectares.

The Residential and Resettlement Area in Nam Rach Chiec spans approximately 60.2 hectares. It includes a resettlement area for the Thu Thiem New Urban Area project, covering about 30 hectares, with the People’s Committee of District 2 as the investor. The remaining 30 hectares are allocated for a residential area developed by the Keppel Land – Tien Phuoc Group Joint Venture (now Nam Rach Chiec Company Limited) with 1,844 apartments.

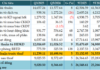

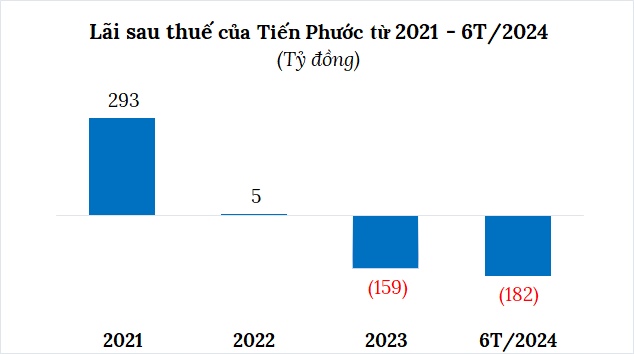

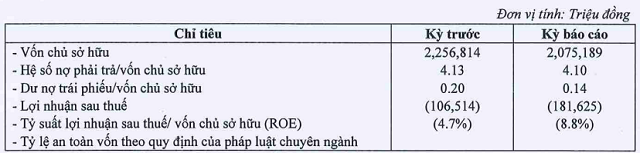

In the first half of 2024, Tien Phuoc Group posted an after-tax loss of VND 182 billion. As of June 2024, the company’s equity capital stood at VND 2,075 billion, an 8% decrease compared to the previous year. Its debt exceeded VND 8,500 billion, a 9% reduction, of which bond debt amounted to VND 290 billion.

Source: Consolidated

|

Source: Tien Phuoc Group

|

* [Famous real estate project owner in Ho Chi Minh City suffers losses and debts exceeding VND 8,500 billion]

* [Palm City project owner faces losses after Keppel Land’s withdrawal]

* [Thanh Tu]

“Eurowindow Holdings Reports Six-Month Profit Quadruples, Liabilities Exceed Equity”

Eurowindow Holding, a member of the prestigious Eurowindow Group, has announced impressive financial results for the first half of 2024. The company reported a remarkable after-tax profit of 96.6 billion VND, more than quadrupling its earnings from the same period last year. This achievement is even more impressive considering Eurowindow Holding’s payable debt, which has increased to over 8.8 trillion VND, surpassing its owner’s equity by 1.1 times.