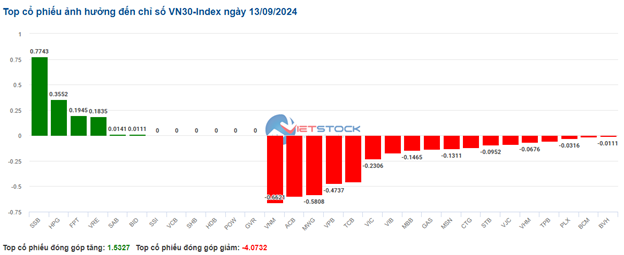

The breadth of stocks in the VN30 basket continues to favor sellers, with most stocks trading lower. Notable decliners include VNM, ACB, MWG, and VPB, which are negatively impacting the VN30-Index by subtracting 0.66, 0.6, 0.58, and 0.47 points, respectively, from the overall index.

On a more positive note, SSB, HPG, FPT, and VRE have managed to stay in the green, providing some support to the overall index and curbing further losses.

Source: VietstockFinance

|

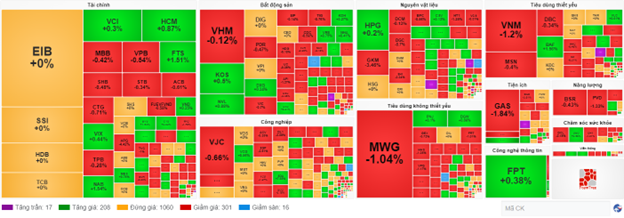

Overall, sector performance has been highly mixed. The utilities sector is facing the strongest selling pressure, with a decline of 0.67%. This pressure is concentrated in large-cap stocks such as GAS, which opened in the red and is currently down 1.58%, POW (-0.39%), NT2 (-0.75%), and QTP (-0.71%).

The industrial sector is also witnessing a lackluster performance, with a decline of 0.31%. Within this sector, VJC is down 0.38%, HUT has fallen by 0.61%, and GMD is trading 0.52% lower. However, a few stocks in this sector are bucking the downtrend, including VCG, which is up 0.56%, HAH (+0.77%), and SAC, which has gained an impressive 3.57%.

On a more positive note, the materials sector is leading the group of sectors that are holding steady, with a modest recovery of 0.13%. Specifically, HPG is up 0.2%, HSG has gained 0.5%, CSV is 0.25% higher, and DPM has ticked up 0.14%. Nonetheless, some stocks in this sector are still in the red, including GKM, which is down 3.46%, DGC (-0.62%), NKG (-0.24%), and GVR, which is down slightly by 0.14%.

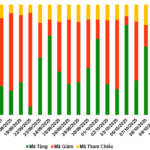

Compared to the opening, the number of stocks trading at reference prices remains above 1,000, and sellers continue to hold the upper hand. There are 301 declining stocks versus 208 advancing stocks.

Source: VietstockFinance

|

Open: VN-Index Choppy

The market opened slightly in the red, indicating investors’ cautious sentiment. The major indices are trading mixed, fluctuating around the reference levels.

The European Central Bank (ECB) lowered its key interest rate by 0.25 percentage points on September 12, marking the second rate cut this year. As a result, the ECB’s benchmark rate now stands at 3.5%, down from 3.75% previously.

This decision comes amid challenges facing the European economy. Economic growth in the Eurozone remains subdued, while inflation is trending downward, approaching the ECB’s target of 2%.

As of 9:30 am, the materials sector is leading the gains, with a strong showing from the start of the session. Notable performers include HPG, up 0.6%, POM (+7.69%), HSG (+0.25%), VLB (+1.81%), DCM (+0.4%), and KQS, which has surged 6.67%.

The energy sector is also witnessing a positive session, with several stocks making notable gains. For instance, BSR is up 0.43%, PVD has gained 0.38%, and PVB is 0.71% higher.

Prime Minister Postpones Meeting with Chairmen and CEOs of Vingroup, Sungroup, Masan Group, FPT, Hoa Phat, THACO, and T&T on September 12th.

The Prime Minister is keen to host a conference focused on collaborating with private corporations to address challenges in business operations and stimulate economic growth. The aim is to create a platform to discuss strategies for unblocking major projects, fostering a stable macroeconomic environment, and promoting a thriving business landscape.

The Hottest Real Estate Area in Thai Binh, Identified as the City’s Key Satellite Town

The southern area of Thai Binh city presents an opportune setting for a vibrant and modern satellite city. With a host of ongoing projects and a ring road that interconnects with neighboring commercial hubs, this area is poised to become a dynamic urban center.

The Four Real Estate Segments that Weather the Storm and Why

According to Savills Vietnam, the real estate market continues to be buoyed in certain sectors, including industrial, retail, office, and residential properties.