The minutes of the Board of Directors’ meeting on August 30, 2024, revealed that all three members agreed to temporarily cease RCD’s business operations from September 10, 2024, to September 9, 2025.

“To address the existing issues and potentially move towards dissolving the company to preserve shareholders’ capital,” the company stated in an unusual information disclosure sent to the Hanoi Stock Exchange (HNX). The Board authorized the legal representative, General Director Tran Xuan Chuong, to carry out the necessary procedures as per the law.

By September 6, 2024, the Business Registration Office under the Ho Chi Minh City Department of Planning and Investment had confirmed that RCD and all its branches, representative offices, and business locations had registered to temporarily suspend their activities during the specified period.

This is not the first time RCD has registered for a temporary business suspension. The company previously halted operations from May 15, 2023, to April 30, 2024, to mitigate further losses and restructure and reorganize its business operations. The leadership had also decided to cease activities in previous years due to the lack of new projects and the complex and unpredictable pandemic situation to minimize losses.

In late August, RCD announced the relocation of its office from 236 Nam Ky Khoi Nghia, Vo Thi Sau Ward, District 3, Ho Chi Minh City, to a new address, 235/46 on the same street.

Before the decision to temporarily cease operations, major shareholder Nguyen Duy Anh sold over 1.6 million RCD shares (equivalent to a 33.75% stake) on August 16, 2024. The transaction value for the agreement on that day was nearly VND 2.8 billion, equivalent to VND 1,700 per share, lower than the closing price of VND 2,100 per share. During this time, two individuals, Ms. Trinh Thi Hong Hanh and Mr. Tran Xuan Luc, increased their holdings to 22.44% and 22.38%, respectively, after purchasing 1 million shares and 436,700 shares.

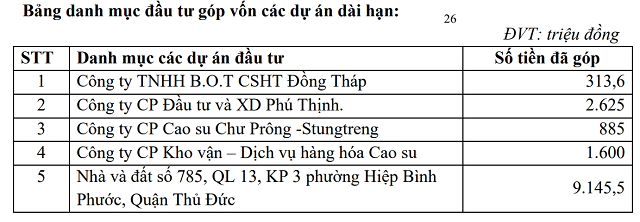

RCD also recently held its 2024 Extraordinary General Meeting of Shareholders on August 17, 2024. In addition to approving the aforementioned directions, RCD shareholders agreed to the proposal of General Director Tran Xuan Chuong to authorize the Board of Directors to decide on the business plan (including price and selling price) for the house at 785 National Highway 13, Ward 3, Hiep Binh Phuoc Ward, Thu Duc City, Ho Chi Minh City. This property is owned by the company and has an area of over 310 square meters. RCD’s investment in the house and land at this address is about VND 9.1 billion.

In 2023, RCD ceased operations in a series of fields, including construction contracting, consulting, surveying, and financial investment, resulting in performance that did not meet the set plan. Accordingly, revenue from sales of goods and services reached only VND 540 million. Financial revenue was over VND 142 million, resulting in a meager after-tax profit of VND 4.6 million.

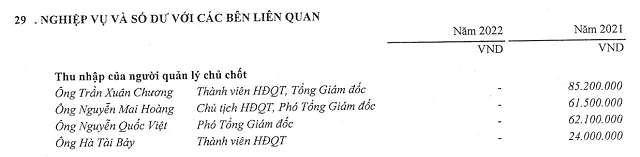

“The company has tried to resolve social insurance policies and minimum wage issues, reduce working hours, and create favorable conditions for employees to find suitable jobs with stable incomes,” RCD stated in the resolution. Given the challenging business conditions, the company’s leaders also waived their 2022 incomes.

Source: RCD

|

As of the end of 2023, RCD’s equity was nearly VND 56 billion. This included VND 53 billion in charter capital, VND 7.3 billion in capital surplus, VND 2 billion in development investment fund, VND 8.7 billion in undistributed profits, and VND 15.4 billion in treasury shares.

Total assets amounted to approximately VND 95 billion, with short-term receivables of over VND 83 billion. The company’s total liabilities at the end of the period were VND 38 billion. Long-term investments in projects totaled nearly VND 16 billion, and investments in securities reached VND 629 million. The company also repaid capital contributions to shareholders of the District 9 project, amounting to about VND 11.5 billion. The 2023 financial statements were not audited due to the company’s discontinuous operations.

“In general, the company’s business operations in 2023 faced many difficulties, and the business situation remained unfavorable, completely stagnant, and had been temporarily suspended since May 1, 2023,” according to the report of the BKS Company, which also recommended that RCD’s leaders implement policies to recover receivables and advances and comply with regulations on accounting to preserve shareholders’ capital.

Source: RCD

|

A Wise Move by the Major Shareholder?

RCD was once a member of the Vietnam Rubber Industry Group Joint Stock Company (HOSE: GVR). Established in 1993 as the Basic Rubber Construction Technical Enterprise, it was equitized in 2004 and listed on UPCoM in 2015. The company undertakes construction contracts for projects such as factories, office buildings, public welfare facilities, and transportation infrastructure for rubber companies under GVR and infrastructure projects in industrial parks. RCD was also the investor in the 9.54-hectare residential project in Trang Bom District, Dong Nai Province.

About ten years ago, RCD’s revenue ranged from VND 100-200 billion. The record was VND 896 billion in 2016, mainly from real estate business. Dividends were also very high, at VND 5,000 per share in 2017 and 2019.

In 2014, GVR owned 25.5% of RCD’s capital, Mr. Nguyen Mai Hoang held 7.79%, and Mr. Tran Xuan Luc held 11.74%. Two years later, GVR divested entirely, making way for the appearance of Mr. Nguyen Duy Anh and Mr. Pham Van Khuong. By the end of 2022, these two individuals held 30.88% and 24.84%, respectively.

GVR sold almost all of its RCD shares in April 2016 at around VND 10,500 per share, quite early compared to the peak of around VND 30,000 per share in early 2017. Nonetheless, the move by the rubber industry giant was reasonable before RCD’s market price continuously declined due to lost revenue streams, now reaching only VND 2,300 per share. The Chairman of the Board of Directors and Vice General Director of RCD, Mr. Nguyen Mai Hoang, also divested almost entirely in May 2017 when the share price fell to the VND 15,000 range.

| RCD’s revenue during 2012-2022 |

| RCD share price movement since 2017 |

The Electric Car Distributor’s Plight: A Record Loss in Vietnam

“Wuling’s Mini EV is now in Vietnam, distributed by TMT Motor. However, the company has hit a rough patch in the first half of 2024, with losses amounting to nearly 100 billion VND. With short-term debts exceeding short-term assets by 120.7 billion VND, the auditing firm has expressed doubts about TMT Motor’s ability to continue operating.”